The crypto markets are on fire, and both seasoned traders and curious newcomers are hunting for the next big breakout. As of August 14, 2025, five tokens are showing strong potential for significant gains, ranging from Ethereum’s solid institutional support to the exciting unpredictability of meme coins like Maxi Doge.

Bitcoin has surged past $124,000, and the total crypto market cap has exceeded $4 trillion. This setting creates the perfect environment for these five tokens to stand out. As selective investments target strong projects, which tokens will take the lead? Today, Ethereum, Little Pepe, Solana, XRP, Chainlink, and Gala are the ones to watch a mix of innovation, utility, and sheer audacity that could make headlines before the day is out.

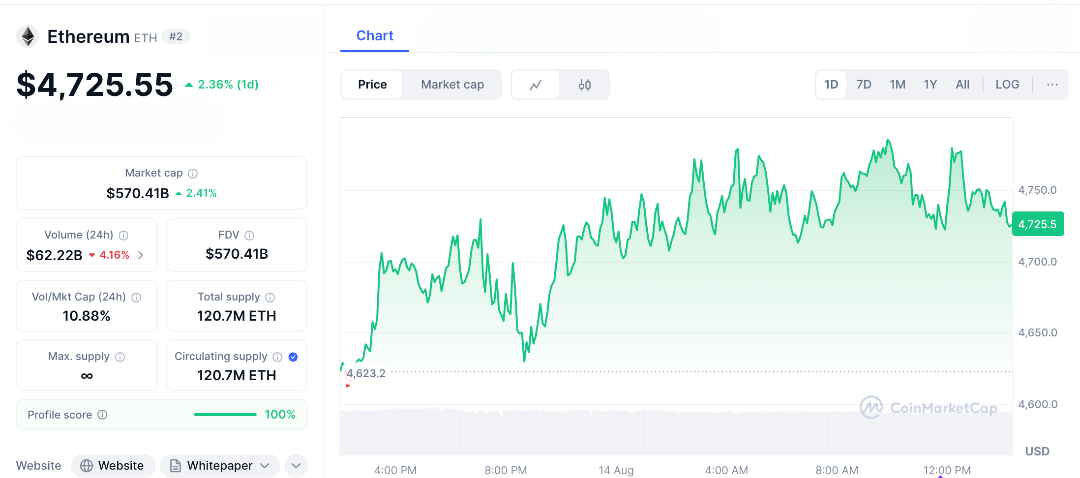

Ethereum: The Institutional Powerhouse

Ethereum continues to dominate as the heavyweight of crypto, a must-have for any serious portfolio. Trading around $4,725 after pushing toward all-time highs, ETH is riding a wave of $20 billion in ETF inflows, attracting pensions, funds, and institutional players seeking exposure to its Layer-2 ecosystem.

Recent upgrades have cut fees dramatically, making DeFi and tokenized asset transactions smoother than ever. The Total Value Locked (TVL) has reached $200 billion, indicating strong real-world use. Analysts predict that Ethereum could reach $8,000 by the end of the year if adoption continues to grow, especially for uses like supply chain tracking and business applications. Ethereum’s strength comes from solid fundamentals and real growth. With Bitcoin’s current momentum helping the market, ETH could see a 50% increase if the rally continues.

Little Pepe: Meme Magic Unleashed

Enter Little Pepe (LILPEPE) crypto’s wild card, where meme hype meets high-risk, high-reward potential. Currently trading at $0.0020 in stage 11 of its presale, the project has already raised $19 million and sold 98% of its tokens, showing just how hot this community-driven frenzy is.

Built on Ethereum, LIL PEPE thrives on viral hype and retail excitement, with initial listings expected around $0.003, offering 60% short-term upside. Long-term believers whisper of 60x to 600x gains by 2030, fueled by meme mania and presale fever. For traders chasing explosive potential, LIL PEPE embodies pure FOMO energy, rewarding early adopters if retail hype ignites in today’s selective alt rally.

Solana: The Speed Demon of DeFi

Solana (SOL) isn’t just riding the altseason wave it’s powering it. Sitting at $202 after a steady climb, Solana delivers blazing-fast transactions and deep liquidity, making it a magnet for traders chasing volatility.

Its network processes millions of transactions daily, luring developers and projects away from congested chains. Beyond speed, Solana’s growing footprint in gaming and AI partnerships is fueling real-world adoption. In this warming crypto phase, if altcoin capital rotations pick up, SOL could see a 20% surge in a single day, transforming quiet momentum into a full-blown breakout.

Gala: Web3 Gaming’s Power Play

Gala (GALA) is positioning itself as the catalyst of Web3 gaming, where hype meets tangible utility. Trading at $0.018 with a 4.2% daily bump, Gala’s upcoming game launches and tokenomics revamp this month have ignited fresh momentum.

Its immersive, trans-media gaming ecosystems are pulling in both crypto traders and traditional gamers looking for the next big play-to-earn hit. In a market hungry for real-world use cases, Gala’s event-driven setup is a swing trader’s dream. If its catalysts land as planned, GALA could rocket 30% in a day, riding the selective rally straight into breakout territory.

Chainlink: The Oracle That Moves Markets

Chainlink (LINK) remains the undisputed oracle backbone of DeFi, quietly powering a $93 billion TVL ecosystem while positioning itself at the heart of real-world asset (RWA) integration. Trading at $23.41, LINK blends reliable liquidity with the kind of volatility swing traders love, making it a go-to for infrastructure-focused plays.

With fresh integrations expanding its reach across foundational protocols, Chainlink is riding the broader alt revival. If selective capital rotation favours infrastructure today, a 15% breakout is on the table, cementing LINK’s role as the steady bet in a sea of speculation.

The Crypto Market’s Next Big Opportunities

Reflecting on crypto’s journey from small beginnings to trillion-dollar empires, this selective warm-up feels like the start of something big. Ethereum’s strength, Little Pepe’s excitement, Solana’s liquidity, Gala’s growth, and Chainlink’s demand showcase the variety driving potential gains.

However, crypto is always unpredictable. It’s essential to diversify investments, stake for returns, and monitor money flows to manage risks. If these five tokens take off, they could redefine profits in 2025. In the ongoing crypto story, today’s selective rise might lead to tomorrow’s big winners. The opportunity is here, take it!

FAQs

1. Why is Ethereum a top crypto pick today?

Ethereum’s crypto surge, at $4,737 with $20B ETF inflows and $200B TVL, makes it a momentum play with a $7,500 year-end target.

2. What drives Little Pepe’s crypto potential?

Little Pepe’s $0.0020 presale, with $19M raised and 60% listing upside, fuels its high-risk, explosive crypto potential in meme mania.

3. How does Solana fit the crypto rally?

Solana’s $202 price and high liquidity, driven by gaming and AI integrations, make it a volatility-driven crypto swing trade leader.

4. Why could Gala’s crypto price explode?

Gala’s $0.0188 price rides Web3 gaming catalysts and tokenomics revamps, positioning it for news-driven crypto momentum.

5. What makes Chainlink a crypto standout?

Chainlink’s $24.19 price and $93B TVL in DeFi oracles offer steady crypto swing setups, with potential 15% gains today.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.