XRP has tendency to take over the blockchain news cycle.

XRP, as we may all know, is a cryptocurrency created by Ripple Labs in 2012, designed to make cross-border payments faster and cheaper. Unlike Bitcoin, which is all about peer-to-peer transactions, or Ethereum, which focuses on smart contracts, XRP is built for financial institutions. It acts as a bridge currency, allowing banks and payment providers to settle international transactions in seconds (~3-5 seconds) for a fraction of a cent (around $0.0002 per transaction). XRP runs on the XRP Ledger (XRPL), a decentralized blockchain that’s open-source and maintained by over 150 independent validators. Ripple Labs partners with banks like Santander and SBI Holdings to integrate XRP into their payment systems, aiming to replace slower, costlier systems like SWIFT. With a fixed supply of 100 billion tokens (58.6 billion in circulation as of May ’25), XRP’s value hinges on its adoption in global finance.

Institutional Interest Takes Off

Fast forward to May 2025, and XRP is stealing the spotlight yet again. On May 19, the Chicago Mercantile Exchange (CME) launched the first regulated XRP futures in the U.S., offering contract sizes of 2,500 and 50,000 XRP. These futures are cash-settled, meaning traders can speculate on XRP’s price without holding the actual tokens – a big draw for institutional investors. The launch generated $19 million in first-day trading volume, outpacing Solana’s futures debut, showing serious market interest. With $5.5 billion in open interest for XRP futures, institutional players are clearly paying attention.

But that’s not it. There’s buzz about a spot XRP ETF. Firms like Grayscale, Bitwise, and Canary Capital have filed applications, and the SEC is reviewing them. It is noted that Grayscale’s Digital Large Cap Fund Index ETF, which includes XRP, is set to launch on July 2, potentially becoming the first U.S. spot XRP ETF product. If approved, this could lock up significant amounts of XRP, driving demand and pushing prices higher. Analysts are optimistic: Standard Chartered predicts XRP could hit $5.50 by December 2025, while some stretch targets even suggest $15 if bullish momentum continues.

Potential XRP Price Surge? Where’s XRP at Now?

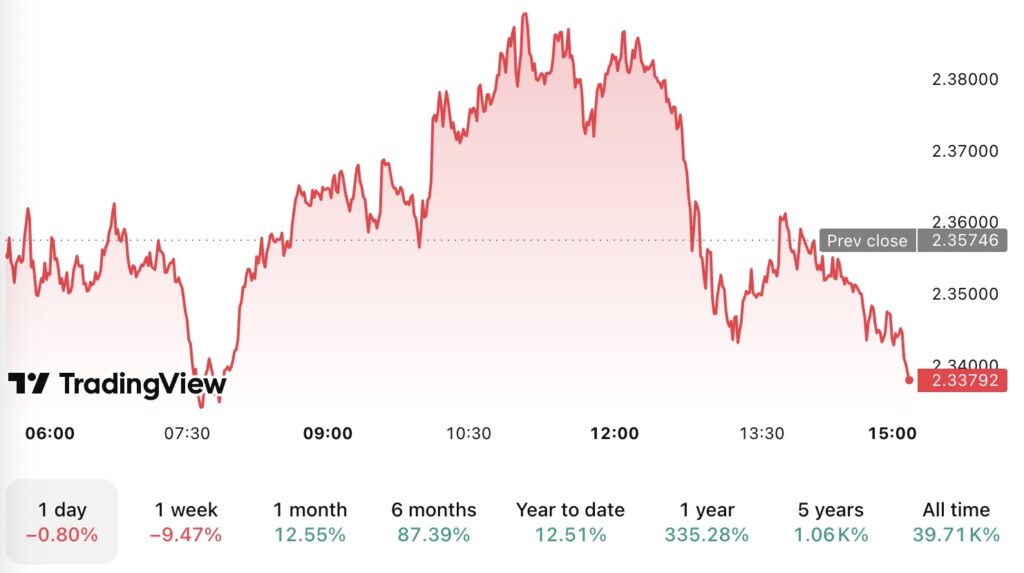

As of May 21, 2025, XRP is trading at ~$2.33, down 0.7% in the last 24 hours from $2.35. Despite the dip, its 24-hour trading volume is a hefty $3 billion, signaling strong market activity. XRP is up 12.5% year-to-date, but it’s still 42% below its all-time high of $3 from January 2025. A pullback to $2.00 or $1.63 is possible if momentum fades, but the futures launch and ETF speculation are fueling bullish sentiment.

Source: Trading View

What’s Driving This Boom?

Several factors are propelling XRP’s institutional surge:

- Regulatory Clarity: The SEC’s March 2025 decision to drop its appeal removes a major overhang, boosting investor confidence. While Ripple still faces fines for institutional sales, the retail market is clear to engage with XRP.

- CME Futures: The regulated futures give institutions a safe way to bet on XRP’s price, increasing liquidity and market stability.

- ETF Hype: A spot XRP ETF could bring in billions in institutional capital, similar to Bitcoin and Ethereum ETFs in 2024. The CME futures launch strengthens the case for ETF approval.

- Ripple’s Expansion: Ripple’s new partnerships with Zand Bank and Mamo in the UAE, following a Dubai Financial Services Authority license in March 2025, are expanding XRP’s use in cross-border payments.

Ripple Payments momentum is building in the UAE. 🇦🇪 https://t.co/gFiwxXWfM5

Following our DFSA license, Zand Bank and @MamoPay are now live on Ripple Payments—bringing always-on, blockchain-powered cross-border payments to one of the world’s top remittance hubs.

— Ripple (@Ripple) May 19, 2025

But as always, it’s not all sunshine and rainbows. XRP has its share of hurdles! Market volatility is a big one, with millions (upwards of $10M) in long positions (where traders buy XRP expecting its price to rise, often using borrowed funds to boost gains) being liquidated around mid-May 2025, a sign of how fast market sentiment can flip. Overbought conditions, with the Relative Strength Index (RSI) at 51.1, hint at a possible price dip, especially if profit-taking kicks in. There’s also uncertainty around ETF approvals. If the SEC slows down, those hopes could be dashed. Ripple’s $125 million fine for institutional sales, upheld in court, might scare off some investors, and competition from stablecoins like USDT and USDC which offer cross-border perks without the price swings, adds another layer of challenge

Looking ahead, XRP has some exciting catalysts. The APEX summit in June 2025 could showcase new partnerships, further boosting adoption. If a spot XRP ETF gets approved by late 2025, analysts predict a price surge to $5 or higher, driven by institutional inflows. Long-term, if Ripple captures a chunk of the $7.5 trillion daily remittance market, XRP could hit $20 by 2030. However, a bearish scenario where adoption lags could see XRP drop to $1.60.

Its best to be cautiously optimistic about XRP. The CME futures and potential ETF approval are big wins, and Ripple’s real-world utility in payments gives XRP an edge over many speculative cryptos. At $2.33, it’s a solid entry point for long-term investors, especially if it breaks above $3 toward $3.40. But I’d keep an eye on support levels at $2.00 and $1.63 and a pullback isn’t off the table. If you’re risk-averse, wait for ETF confirmation and if you’re a believer in XRP’s payment revolution, now might be a good time to hop in. Whichever way, remember the volatility factor and don’t invest a major chunk of your portfolio and use your discretion while formulating any investment strategy.

FAQs: XRP Basics and Key Points

What Is the CME?

The Chicago Mercantile Exchange (CME) is one of the world’s largest derivatives marketplaces. It launched XRP futures on May 19, 2025, allowing traders to speculate on XRP’s price without owning the tokens. These futures are regulated by the CFTC, making them a safe bet for institutional investors, and they generated $19 million in trading volume on day one.

What Does Institutional Adoption Mean?

Institutional adoption refers to large financial entities, like banks, hedge funds, and asset managers, using or investing in a cryptocurrency. For XRP, this means firms integrating it into payment systems (like Ripple’s partnerships with Zand Bank) or trading its futures on platforms like the CME. It signals mainstream acceptance and can drive price growth through increased demand and liquidity.

What’s an XRP ETF?

An XRP Exchange-Traded Fund (ETF) is a financial product that tracks XRP’s price and trades on stock exchanges. A spot XRP ETF would hold actual XRP, creating direct demand, while a futures ETF (like ProShares’ April 2025 launch) bets on price movements without holding tokens. Grayscale’s spot XRP ETF, potentially launching July 2, 2025, could lock up XRP and push prices higher.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.