Key Points

- Railgun Crypto is a privacy-focused protocol on Ethereum, using ZK cryptography for anonymous DeFi transactions.

- It seems likely that Railgun is gaining popularity, with over $3 billion in shielded volume and recent high-profile endorsements.

- Vitalik Buterin’s recent transfers, like $1.8 million in ETH, suggest strong support, but privacy in crypto remains a debated topic.

- The evidence leans toward Railgun being a leader in on-chain privacy, backed by the Ethereum Foundation’s stake in RAIL tokens.

Railgun is not just another cryptocurrency; it’s a protocol designed to enhance privacy within decentralized finance (DeFi). Built directly on the Ethereum blockchain, it leverages Zero-Knowledge (ZK) cryptography, specifically zk-SNARKs, to enable private transactions. This means users can shield their ERC-20 tokens or NFTs into private addresses, ensuring their balances, transactions, and interactions with DeFi apps remain anonymous. For example, you can trade on decentralized exchanges (DEXs), lend on platforms, or add liquidity without anyone tracing those actions back to you.

Unlike other privacy solutions that might require layer-2 solutions or bridges, Railgun operates on Ethereum’s mainnet, eliminating security risks associated with additional infrastructure. It’s also highly composable, working across multiple blockchains like Ethereum, Polygon, BSC, and Arbitrum, making it a versatile tool for privacy-conscious users. The RAIL token serves as the governance token for the Railgun DAO, giving stakers economic rights and privileges over the system.

Growing Adoption and Usage Metrics

Railgun’s adoption is backed by impressive numbers. According to its official communications, the protocol has processed approximately $3 billion in shielded volume since its launch in January 2022, with recent months showing record-breaking activity

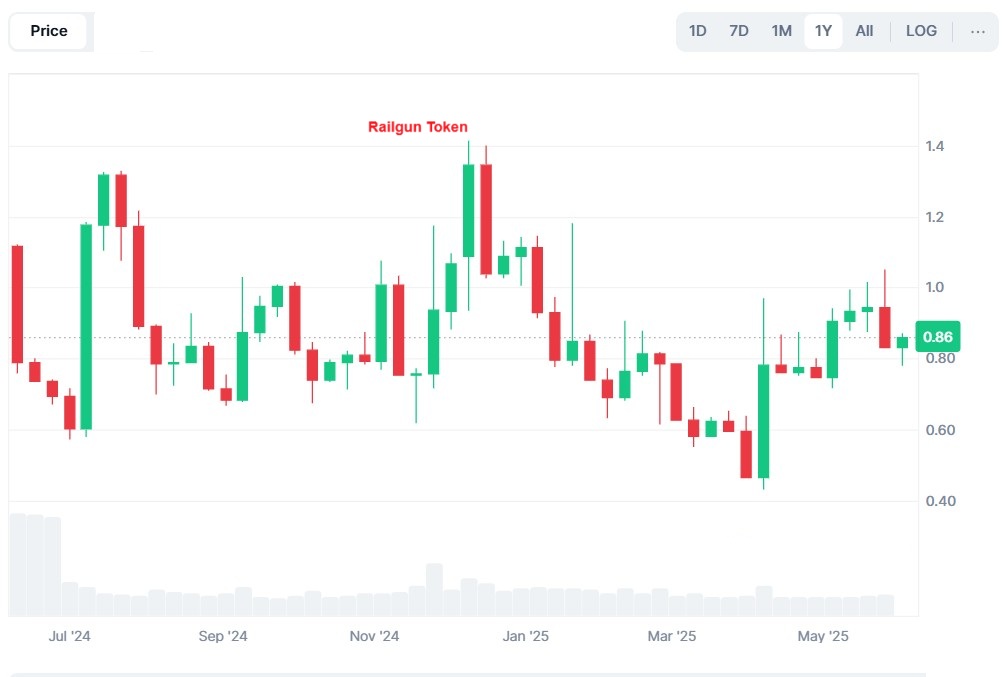

The market has also responded positively, with RAIL seeing a 3% price uptick to $0.85 and increased trading volume as shown in the chart below. This indicates that Railgun’s growth is not just technical but also market-driven, with users and investors recognizing its value.

Expert Opinions and Community Sentiment

Crypto influencers and analysts are taking notice of Railgun’s rise. Recently Vitalik Buterin moved ethereum to railgum projects. A crypto influencer mentioned

“This is a major reputation win for Railgun—Vitalik’s move isn’t just about money, it’s a public stamp of confidence in on-chain privacy. Expect the privacy narrative on Ethereum to heat up, with devs, funds, and users all eyeing Railgun and its tech as a next-gen privacy leader”.

This sentiment highlights Railgun’s potential to shape the future of privacy in crypto.

However, privacy protocols like Railgun are not without controversy. There were rumors linking Railgun to illicit activities, such as those associated with North Korea’s Lazarus group. However, Ryan Adams from BanklessHQ addressed this in an X post, clarifying about the rumors and said,

“Correction on something we said on @BanklessHQ about Railgun… It sounds like North Korea has discovered Railgun…and it seems that Lazarus group has discovered… Wait, no, that’s not true. Railgun is not associated with any illicit activities, and its technology is designed to prevent such misuse”.

This clarification is crucial for maintaining trust and dispelling misconceptions, especially in a space where privacy and security are often debated.

Technical Details and Security

Railgun’s technology is built on well-established libraries and has been audited by reputable firms like ABDK, ensuring its security.

Market Performance and Token Economics

The RAIL token, with a circulating supply of 58 million out of a total supply of 57.5 million, has a market cap of around $45.73 million, according to recent data as shown below.

However, the recent price uptick following Buterin’s transfers suggests market confidence. Staking RAIL offers governance rights and rewards from protocol fees, incentivizing participation in the ecosystem. The uptick can be tracked in the chart below. It also states movement of trend with simple moving average.

Comparative Analysis Linked To Privacy in Crypto

To put Railgun in context, it competes with other privacy protocols like Tornado Cash, which has faced regulatory challenges. Railgun’s advantage lies in its on-chain, mainnet approach, avoiding the security risks of layer-2 solutions. Its ability to handle high 6-7 figure transactions daily thus, positions it as a robust solution for both retail and institutional users seeking privacy .

Potential Risks and Future Outlook

While Railgun is gaining traction, privacy in crypto remains a sensitive topic. Regulatory pressures could impact its adoption, and the protocol must continue to balance privacy with compliance to avoid scrutiny. However, with support from Buterin, the Ethereum Foundation, and a growing user base, it seems likely that Railgun will continue to lead the charge in on-chain privacy. For users, it offers a promising tool to protect financial freedom, especially as DeFi grows and privacy becomes non-negotiable.

In The End,

Railgun Crypto is more than just a privacy coin; it’s a movement toward securing financial privacy in the digital age. With its innovative technology, recent endorsements from Vitalik Buterin and the Ethereum Foundation, and impressive adoption metrics like $3 billion in shielded volume, Railgun is poised to shape the future of DeFi. As privacy concerns grow, Railgun stands out as a leader, offering a secure, user-friendly solution that’s capturing the attention of the crypto community.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.