In the fast-moving world of crypto, stablecoins have become a much-needed anchor helping to connect the wild swings of digital assets with the more stable world of traditional finance. Tether today is leading the way by far, with a massive market cap of $158 billion. That’s around 62% of the entire stablecoin market, which totals $253.655 billion, according to data from DefiLlama and CoinMarketCap.

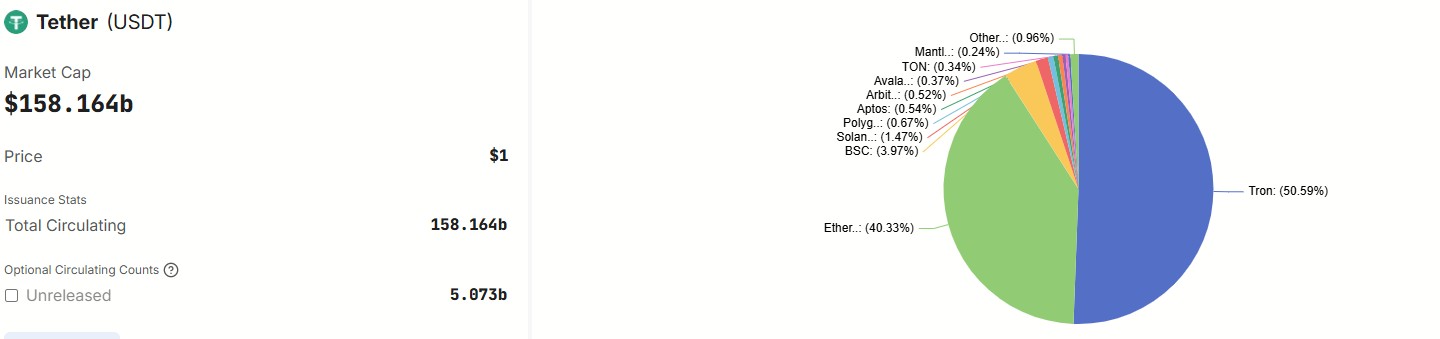

This dominance highlights just how important USDT has become in the crypto space. It’s used widely across multiple blockchains like Tron and Ethereum, and it’s backed by strong reserves including over $120 billion in U.S. Treasuries, according to Tether’s Q1 2025 report. All of this shows how Tether continues to play a major role in keeping the crypto economy steady.

Tether (USDT) has firmly cemented its spot as the top stablecoin in crypto. As of July 2, 2025, it holds a massive 62.23% share of the stablecoin market contributing $158 billion out of the total $253.655 billion .

But it’s not just about market cap. Tether is also the most traded cryptocurrency in the world and has a huge user base of over 350 million people . What keeps users confident is its strong reserves, including large amounts of U.S. Treasuries, which help maintain its steady 1:1 value with the U.S. dollar. Tether’s Q1 2025 financial report shows it’s backed by solid numbers, $149.27 billion in total assets against $143.68 billion in liabilities as of March 31. This strong balance sheet reinforces trust and proves Tether’s key role in the crypto economy.

While Tether still leads the stablecoin market, USD Coin (USDC) is catching up fast. As of July 2, 2025, USDC’s market cap has doubled to $61 billion up from around $30.86 billion at the start of the year .

What’s fuelling this surge? Strategic moves like partnerships with financial giants BlackRock and BNY Mellon have boosted trust, especially among big institutional investors. Plus, Circle the company behind USDC went public in June 2025, and its stock skyrocketed 168% on day one, giving USDC even more credibility. USDC added $16 billion in market cap from January to April this year, while Tether grew by $7 billion showing that USDC is growing at a much faster pace and steadily gaining ground.

Stablecoin Regulation Heats Up

Regulations are playing a big role in shaping the future of stablecoins. In May 2025, the U.S. Senate passed the GENIUS Act, which aims to create clear national rules for stablecoin issuers. This could give a big advantage to companies like Circle thanks to their strong focus on transparency.

Tether, on the other hand, has faced criticism in the past for not being clear enough about what backs its tokens. But it’s working to rebuild trust recently securing a stablecoin license in El Salvador, according to its Q4 2024 report. This step shows Tether’s push toward better compliance and global growth, especially in emerging markets. Meanwhile, new players are shaking things up. Ethena’s USDe stablecoin has grown fast hitting a market cap of $5.22 billion as of June 2025, passing DAI to become the third-largest stablecoin . The SuperEx report calls USDe a “dark horse” in the race.

Another trend to watch: yield-bearing stablecoins. These offer returns while holding your tokens, and together they now hold over $13 billion in market share (about 6%) . While they’re not yet rivalling Tether or Circle, they’re adding pressure and variety to the market.

Can USDC Catch Up to Tether? A Look at the Numbers

To understand the potential for USDC or others to catch up, let’s examine the market shares and growth rates. As of July 2, 2025, Tether holds 62.23%, USDC 24.33%, and other stablecoins, including USDe, account for the remaining 13.44%, based on the total market cap of $253.655 billion. The table below summarizes the key figures:

Tether’s market capitalisation on December 31, 2024, was $143.68 billion . By July 2, 2025, this figure had grown to $158 billion, marking a $14 billion increase approximately a 9.86% growth rate over the first half of the year. In comparison, USD Coin (USDC) experienced a significant growth surge, doubling its market cap from $30.86 billion to $61.72 billion during the same period. This sharp rise is likely driven by increasing institutional adoption and enhanced regulatory clarity surrounding USDC.

If current trends continue with USDC doubling annually and Tether maintaining a steady 10% yearly growth simple extrapolation suggests that USDC could surpass Tether by 2027. Under this projection, USDC would reach a market cap of approximately $246.88 billion, while Tether would grow to around $191 billion. However, it is important to note that these figures are speculative and subject to change. Market dynamics such as regulatory developments, investor sentiment, and emerging competition could significantly influence these trajectories.

Tether remains the top leader in the stablecoin market, with the largest market cap and a strong position, at least for now. However, the quick growth of USDC and new competitors like USDe show that the market is changing. Data suggests that USDC might catch up if its growth continues at the current rate. Still, Tether’s strong position, widespread global use, and strategic moves like getting a license in El Salvador make it a powerful player. As the crypto world evolves, the stablecoin competition will be influenced by factors like clear regulations, new technology, and changing investor preferences. While Tether may stay on top for now, the rise of its competitors makes this an exciting story to follow.

FAQs

- What is Tether Today’s market dominance in the stablecoin space?

Tether Today holds about 62.23% of the stablecoin market, with a market cap of $157.85 billion out of a total $253.655 billion as of July 2, 2025. - How has USDC grown compared to Tether in 2025?

USDC doubled its market cap from $30.86 billion to $61.72 billion in 2025, while Tether grew by about 9.86%, from $143.68 billion to $157.85 billion. - Can USDC overtake Tether in the future?

If USDC maintains its 100% annual growth rate and Tether grows at 10%, USDC could potentially surpass Tether by 2027, though this depends on market and regulatory factors. - What are other stablecoins challenging Tether Today?

Ethena USDe, with a $5.22 billion market cap, and yield-bearing stablecoins, holding a 6% market share, are emerging competitors but remain far behind Tether and USDC. - How do regulations impact Tether and USDC?

The US GENIUS Act of May 2025 favors transparent issuers like USDC, but Tether’s license in El Salvador shows its efforts to adapt to global regulatory demands.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.