Are you wondering if Cardano (ADA) is a smart investment choice in 2025? Cardano (ADA), a third-generation blockchain, has sparked interest with its $0.5880 price and 69% yearly gain as of July 2025. Launched in 2017 by Charles Hoskinson, a co-founder of Ethereum, it aims to address scalability and sustainability challenges. This analysis, based on the latest market data, explores Cardano’s position to encourage critical thinking and further research.

What is Cardano ? A Quick Overview

Cardano is a blockchain platform designed to support smart contracts, decentralized applications (dApps), and real-world use cases like education and identity management. Unlike Bitcoin’s Proof-of-Work, Cardano’s Ouroboros PoS reduces energy consumption, appealing to environmentally conscious investors. Its two-layer architecture consists of Settlement Layer (CSL) for transactions and Computation Layer (CCL) for smart contracts, aiming for flexibility and scalability.

Developed through peer-reviewed research, Cardano prioritizes long-term stability over rapid deployment.

Cardano Tokenomics

ADA, Cardano’s native token, powers its ecosystem with a circulating supply of 35.38 billion out of a 45 billion maximum, and a total supply of 44.99 billion. The market cap is $20.84 billion, with a fully diluted cap of $26.50 billion, and daily trading volume reaches $570.55 million (0.0303 of market cap). Initial distribution allocated funds to IOHK, the Cardano Foundation, and Emurgo, with a treasury system funding development. This large supply and staking (over 70% of ADA) suggest growth potential, but dilution could pressure prices.

Market Snapshot and Technical Insights

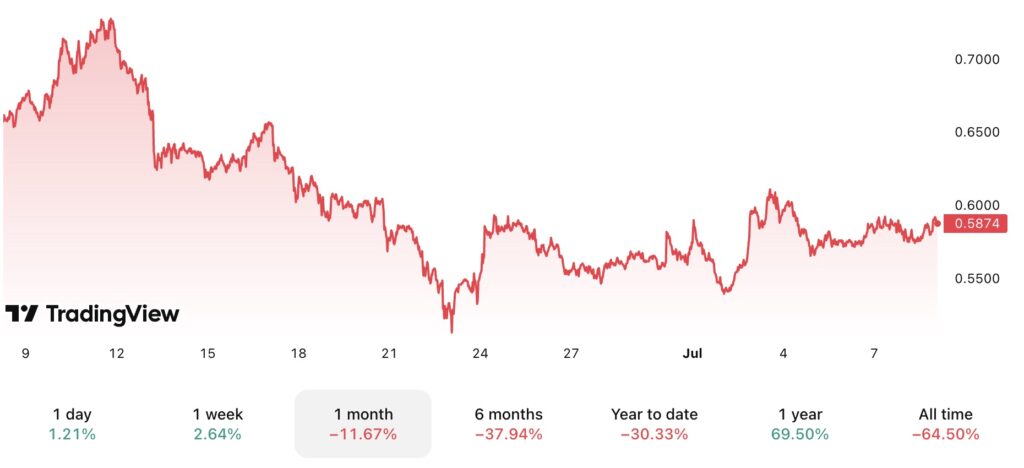

Source: TradingView

Priced at $0.5880, ADA shows a 2.73% rise over the past week but an 11.59% drop over the past month, contrasted by a 69% increase over the year, with an all-time high of $3.0994. The 30-day technical indicators provide a detailed view of its market dynamics:

-

MACD (12, 26) at -0.0080 reflects the difference between the 12-day and 26-day exponential moving averages, a metric that highlights momentum trends. The slight negative value indicates a recent slowdown in upward momentum, though the gap is narrow, suggesting the short-term and long-term trends are close to converging. This could imply a stabilization phase or a potential shift, depending on future data.

-

RSI (14) at 49.5466, calculated over 14 days, measures the speed and change of price movements. Sitting just below the 50 midpoint, it indicates a balanced market with neither strong buying nor selling pressure, offering a neutral stance that aligns with the recent volatility.

-

Moving averages: The 10-day EMA at $0.6346 and 10-day SMA at $0.7030 show where the price has recently trended, both above the current $0.5880, hinting at a pullback from earlier highs. Conversely, the 30-day SMA at $0.5035, below the current price, reflects a longer-term upward trend. This divergence between short-term and long-term averages underscores a market in transition, with the current price testing its recent range.

Factors Supporting Cardano as a Good Investment

Cardano’s strengths make it attractive. Several factors could drive ADA’s price higher:

-

Upgrades: The Leios upgrade and Hydra Layer 2 promise faster transactions, potentially attracting developers and boosting demand.

-

Partnerships: Expansion of the Ethiopian project or new collaborations (e.g., with governments or enterprises) could enhance adoption.

-

Market Sentiment: A “Buy” MACD signal and 69% yearly gain may draw investor interest if bullish trends persist.

-

ETF Speculation: Rumors of a Cardano ETF could spark institutional buying, though unconfirmed. These catalysts, rooted in Cardano’s roadmap, warrant monitoring.

Risks and Challenges of Investing in Cardano

Investing in ADA carries risks. Few notable ones being:

-

Volatility: The 11.59% monthly drop highlights market sensitivity.

-

Competition: Ethereum, Solana, and Polkadot lead in dApp adoption and ecosystem size.

-

Regulation: Potential SEC classification as a security could impose restrictions.

-

Dilution: A 45 billion max supply may cap price growth if demand lags.

Conclusion

Price predictions vary widely. Bullish scenarios suggest ADA could reach $1.00 by year-end 2025 if upgrades succeed and an ETF is approved, driven by its 69% annual gain. Bearish outlooks warn of a drop below $0.50 if a market downturn or regulatory crackdown occurs. Long-term (2030) estimates range from $2 to $5, contingent on adoption.

Cardano offers a compelling case with its innovative technology, sustainable PoS, and 69% yearly growth, trading at $0.5880 as of July 2025. Yet, its 11.59% monthly decline and competitive risks demand caution. Weigh these pros and cons, research further, and align your decision with your financial goals.

FAQs

-

What sets Cardano apart? Its PoS and research focus differ from Ethereum’s broader adoption.

-

Is ADA risky? Yes, volatility and regulation are concerns.

-

How to stake? Use Daedalus or Yoroi

-

What are the challenges? Competition, dilution, and delays are key issues.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.