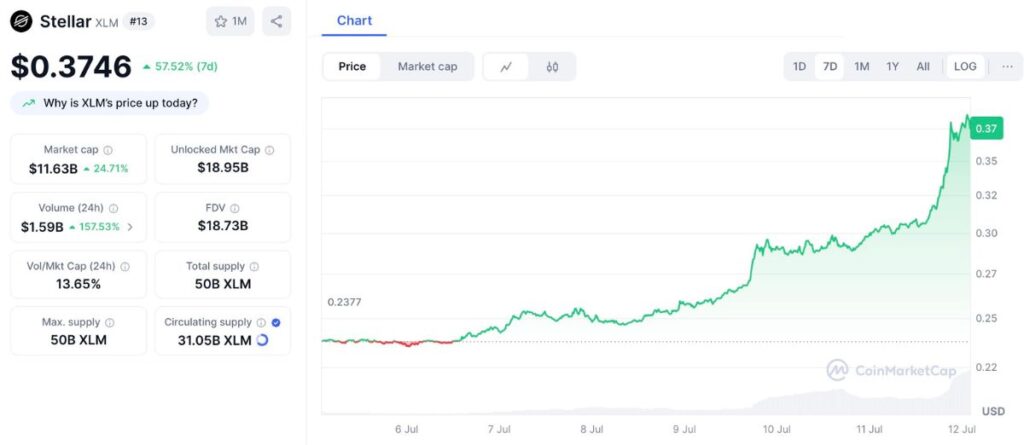

Stellar Lumens (XLM) is rocketing through the crypto cosmos. With a jaw-dropping 56% surge in the last week and an overall astonishing 319% leap over the past year, this blockchain gem is turning heads in 2025. Whispers of PayPal’s game-changing integration are fueling the fire, but what’s really propelling XLM to the stars? This deep dive uncovers the forces behind its meteoric rise and explores where this thrilling journey might lead next.

Source: CoinMarketCap

Stellar Lumens is the cryptocurrency powering the Stellar network, a blockchain designed to connect financial institutions, payment systems, and individuals. Unlike some blockchains focused on decentralized applications, Stellar emphasizes real-world utility, enabling quick transactions with minimal fees. Its consensus mechanism, Stellar Consensus Protocol (SCP), ensures efficiency, making it a favorite for remittances and micropayments. With a mission to bridge traditional finance and crypto, Stellar stands out for its partnerships and practical applications.

XLM serves as both a medium of exchange and a bridge currency within the Stellar ecosystem. The network’s focus on interoperability has fostered collaborations with banks, payment processors, and tech giants. Its ability to handle transactions in seconds, coupled with a capped supply, supports its value proposition. As the ecosystem evolves, developments in payment solutions and tokenization are shaping its trajectory, making it a noteworthy player in the 2025 crypto landscape.

Factors Driving Stellar Lumens’ Price Increase

- PayPal’s Integration: PayPal’s recent integration of Stellar for cross-border payments has been a significant catalyst. By leveraging Stellar’s speed and low costs, PayPal can offer users efficient international transfers, boosting XLM demand. This move, announced in mid-2025, aligns with PayPal’s push to expand crypto services, potentially increasing transaction volume on the Stellar network. The 34% price surge over the last month coincides with this development, suggesting a strong market response.

- Growing Adoption by Financial Institutions: Stellar’s partnerships with banks and remittance services, such as MoneyGram, have expanded its use case. These institutions value Stellar’s ability to settle transactions in real-time, reducing costs for users worldwide. This growing adoption, particularly in emerging markets, has likely contributed to the 319% yearly increase, as more entities integrate XLM for cross-border payments and asset tokenization.

- Technological Upgrades: Recent upgrades to the Stellar network, including enhanced smart contract capabilities, have broadened its appeal. These improvements allow for more complex financial products, attracting developers and businesses. The technical advancements, rolled out in early 2025, may underpin the sustained upward momentum.

- Increased Market Sentiment: The broader crypto market’s bullish turn in 2025, with Bitcoin and Ethereum leading the charge, has lifted altcoins like XLM. Positive sentiment, fueled by regulatory clarity in some regions and growing institutional interest, has likely played a role. This market-wide optimism could explain part of the 319% yearly rise, as investors seek exposure to promising projects.

- Community and Developer Activity: Stellar’s active community and developer ecosystem have driven innovation, from new dApps to payment solutions. This grassroots support, combined with grants from the Stellar Development Foundation, fosters growth.

Where Could Stellar Lumens Go?

- Short-Term Potential (Next 6 Months): The 34% monthly rise indicates strong short-term momentum, suggesting XLM could climb toward $0.75 or higher if PayPal’s integration gains traction and transaction volumes soar. However, the rapid ascent might trigger profit-taking, with support possibly forming around $0.60. Market volatility and adoption speed will be critical to monitor.

- Medium-Term Outlook (1–2 Years): With a 319% yearly increase, XLM could target $1.50 if financial institution adoption accelerates and technological upgrades prove effective. A stable regulatory landscape could support this growth, though competition from projects like Ripple (XRP) might limit gains if Stellar fails to differentiate itself.

- Long-Term Vision (3–5 Years): Over the long haul, XLM’s focus on financial inclusion could see it approach $3.00 or beyond, especially if Stellar becomes a global payment standard. This hinges on widespread adoption, regulatory backing, and the network’s capacity to scale, but economic shifts or technical hurdles could cap its potential.

Stellar Lumens’ recent price surge, fueled by PayPal’s integration and broader adoption, highlights its evolving role in finance. The 34% monthly and 319% yearly gains reflect a mix of technological promise and market enthusiasm, yet challenges like competition and regulation loom. Could PayPal’s backing propel XLM to new heights, or will its supply dynamics temper the rise? The path ahead depends on execution and market conditions.

FAQs

Q1 What makes Stellar unique?

Stellar’s SCP and focus on cross-border payments set it apart, enabling fast, cheap transactions for financial inclusion.

Q2 How has PayPal impacted XLM?

PayPal’s use of Stellar for payments has likely driven demand, aligning with the recent 34% monthly rise.

Q3 What are the risks for Stellar?

Competition and regulatory hurdles could challenge its growth.

Q4 What’s driving its ecosystem?

Developer activity and institutional partnerships are key.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.