Why Renzo Crypto Is Gaining Serious Momentum

Renzo Crypto isn’t just making noise it’s backing it up with real results. As of July 16, 2025, its native token REZ jumped over 35% ahead of its listing on Bithumb, reaching around $0.01412 with a massive 1.72 billion REZ traded. This isn’t just hype this is real adoption in action.

What’s driving it? For starters, Renzo is making re-staking easier for everyone from individual users to big financial institutions. Take its partnership with Concrete, for example. Together, they’ve launched Flow vaults, which let banks and funds create their own re-staking tokens in just a few days. These vaults come with built-in KYC compliance, separate asset tracking, and a super simple one-click interface no need to mess with smart contract code. The result? Over $1 billion in deposits before the official launch, with major support from platforms like Ether.fi and Kelp. In a world where competitors like Symbiotic are still figuring out stability, Renzo is already building bridges between traditional finance and DeFi and making it look easy.

How Renzo Stands Out from the Restaking Crowd

Let’s be real there’s no shortage of liquid restaking protocols in 2025. But when you compare them side by side, Renzo Crypto consistently rises to the top.

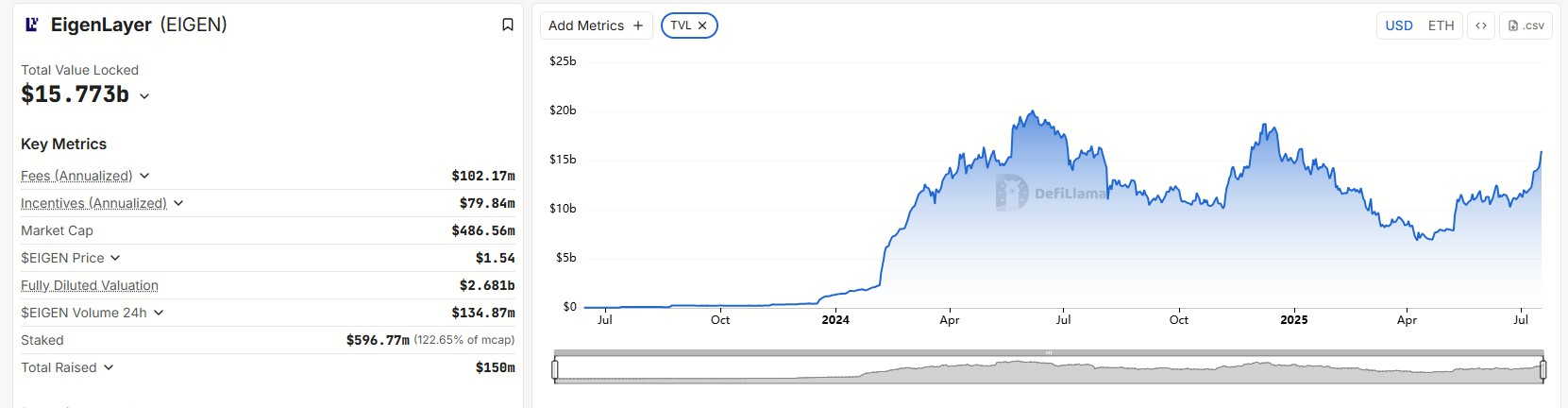

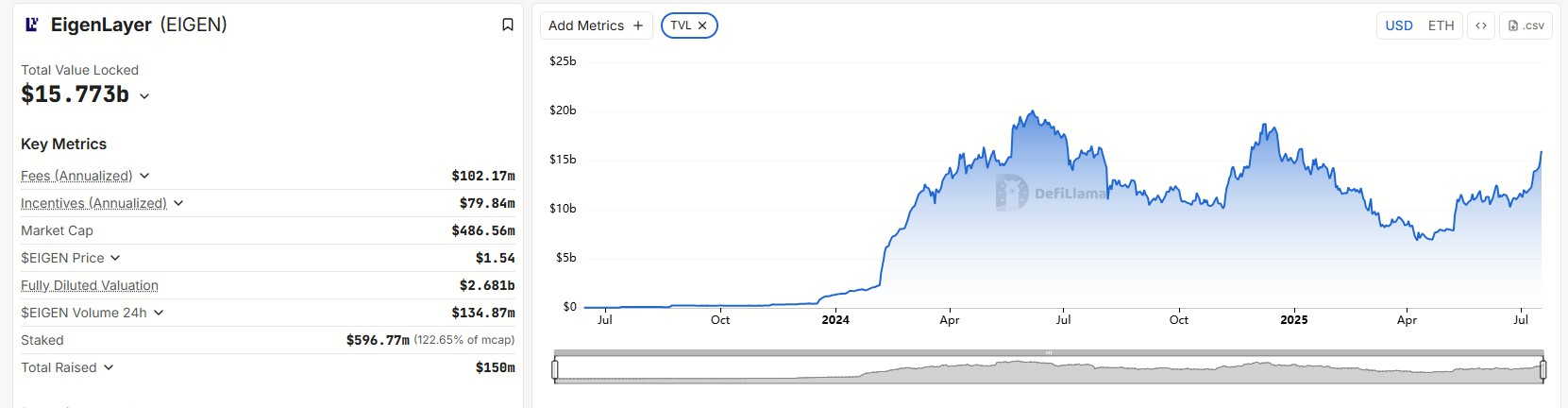

Sure, EigenLayer is the OG with a massive $15.78 billion TVL, but it sticks to Ethereum only, which limits flexibility. Symbiotic, backed by Paradigm, is gaining attention for its permissionless setup but it comes with higher risks since it allows ERC-20 and LP tokens as collateral, something more cautious users might think twice about. Kelp DAO is solid, with over $628 million locked and zero fees for depositing LSTs. Still, it doesn’t offer the multi-chain access or institutional-grade tools that Renzo brings to the table.

Puffer Finance is impressive too, especially with its anti-slashing tech and fast processing. But with capped staking pools and an ETH-only model, it just doesn’t offer the same level of accessibility. That’s where Renzo Crypto really shines. With auto-compounding ezETH, multi-chain support, and a slick, user-friendly platform, it’s easy to use and powerful under the hood. It stacks rewards from Ethereum staking, EigenLayer points, and even ezPoints, giving users more bang for their buck.

Why Renzo Crypto Is Winning Hearts in 2025

Renzo Crypto’s rise isn’t just hype, it’s about empowering users. In a tough market where many are just holding on, Renzo helps users turn idle ETH into real, growing rewards. That’s why over 2,000 people have already deposited $20 million worth of ETH because it works.

What sets it apart? Renzo solves big problems like fragmented liquidity and high barriers to entry. It’s not just easy to use, it’s smart. Its REZ token allows users to vote on important decisions and keeps the ecosystem running smoothly. Even when other re-staking platforms struggled and total value locked (TVL) dropped 37% in six months, Renzo stayed strong with airdrops, point rewards, and a supportive community. Renzo isn’t making empty promises. It delivers real results, offering safety, simplicity, and solid returns. If you’re considering getting into re-staking, Renzo might be your best option.

FAQs

- What makes Renzo Crypto a top re-staking protocol?

Renzo Crypto excels with its liquid re-staking token ezETH, multi-chain support, and partnerships that enhance yields and accessibility for users.

- How does Renzo Crypto compare to EigenLayer?

While EigenLayer focuses on Ethereum security, Renzo Crypto builds on it with user-friendly interfaces, higher compounded yields, and cross-chain capabilities.

- What are the yields like on Renzo Crypto?

Users can earn stacked rewards from Ethereum staking, EigenLayer points, and additional incentives, often surpassing traditional staking by securing AVSs.

- Is Renzo Crypto suitable for institutions?

Yes, features like Flow vaults with KYC compliance and custom LRTs make it ideal for regulated entities seeking secure re-staking options.

- What risks come with using Renzo Crypto?

As with any DeFi protocol, risks include smart contract vulnerabilities and market volatility, though Renzo Crypto mitigates these through audits and diversified assets.