The Crypto Bill episode unfolded like a blockbuster movie on Capitol Hill, full of last-minute twists, power plays, and market chaos. Just when it seemed the crypto world was finally getting clear rules, unexpected procedural issues caused the bill package to fall apart. Within hours, billions were wiped off Bitcoin and altcoins as investors panicked. But then came the unexpected twist, President Trump stepped in and brokered a deal after a tough 10-hour standoff, reviving hope and moving the bills forward.

Now, the big question is, are you ready for what’s next? This isn’t just political drama, it’s a market-changing event that could significantly impact your crypto investments.

Crypto Week Turns Chaotic

It all started with what was hyped as “Crypto Week” a bold, Republican-led effort to push forward three game-changing crypto bills:

-

The GENIUS Act: Stablecoin oversight with federal safeguards

-

The CLARITY Act: Defining which digital assets are securities vs. commodities

-

An anti-CBDC bill: Blocking U.S. central bank digital currency initiatives

These aren’t technical tweaks they’re historic pivots that could unlock institutional capital while establishing rules to curb fraud and financial instability. But then, chaos erupted on Capitol Hill. In a dramatic turn Tuesday, ultraconservative House Republicans joined forces with Democrats to sink the procedural rule needed to bring the bills to the floor. The vote, 208–221 a rare rebellion against GOP leadership.

The fallout? Immediate market tremors:

-

Bitcoin plunged from $123,000 to under $117,000

-

Ethereum dropped 5%

-

Coinbase fell 4%, and Circle slid 7%, reflecting fears around stablecoin regulation

The sell-off was swift and brutal proof that regulatory uncertainty still haunts the crypto markets.

Trump Flips the Script

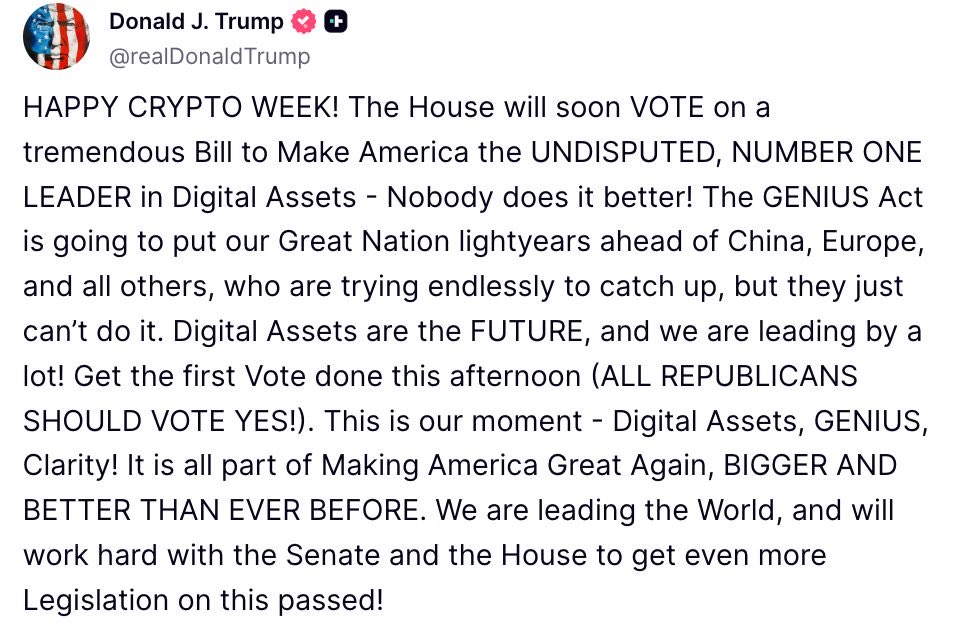

Enter Trump, the master negotiator, who wasn’t about to let his pro-crypto crusade go up in smoke. With the bills hanging by a thread, he summoned 11 of the 12 GOP holdouts to a late-night huddle and emerged with a classic Truth Social victory post:

“They’re all in.”

By Wednesday, after what became the longest House vote in history nearly 10 straight hours of suspense the procedural roadblock was smashed: Vote passed: 217–212

🚨 BREAKING: The House has just voted to ADVANCE crypto bills, after multiple members flipped their votes following a meeting with Trump

This rule FAILED in the House yesterday, so Trump brought 12 GOP nay voters to the Oval Office, and convinced them to vote YES.

Well done. pic.twitter.com/5snxu1JFNS

— Nick Sortor (@nicksortor) July 16, 2025

That greenlit final debates on the full Crypto Bill suite, with House Speaker Mike Johnson calling it a major legislative win. The momentum is undeniable. The GENIUS Act, already cleared by the Senate, could now land on the President’s desk any day.

And let’s be clear: Trump’s fingerprints are everywhere. His earlier executive actions including a CBDC ban mirror the bills’ mission: No government digital dollar , Full-speed ahead on private innovation . This isn’t just another Trump headline. It’s a coordinated push to keep America ahead of China and other global players in the digital asset race.

Markets Steady, But the Plot Thickens

The markets breathed a sigh of relief as news of the vote change broke. Bitcoin stabilized, traders cautiously returned, and the mood shifted from panic to cautious optimism. But here’s the twist that could make this story even bigger: The whole Crypto Bill saga shows just how fragile the power balance in Washington really is. On one side, Democrats are raising concerns, fearing weak consumer protections and potential loopholes that could benefit Trump-linked crypto ventures like the $TRUMP meme coin and World Liberty Financial. Yes, even meme coins are now part of the political debate.

Amendments are being drafted behind closed doors, and more battles are expected in the Senate. Any delay or rejection could cause another market scare. The last time the bill stalled, the market lost $200 billion in value overnight.

Plus, there are macroeconomic concerns like tariff tensions and interest rate uncertainty, creating the perfect storm. In crypto, volatility thrives on headlines, and policy changes can either crash or boost your investments instantly. The next headline could determine whether we see a bull run or a market crash.

A Story of Rebellion, Redemption, and Riches

For storytellers like me, this is a treasure trove, a real-life drama with rebellion, redemption, and potential big rewards. Investors who held onto blue-chip cryptos like Bitcoin or diversified with stablecoins during the recent dip have come out ahead. On the other hand, those who panicked and sold early are still experiencing losses. If the Crypto Bill passes, expect clear rules that could lead to a major market rally. Stablecoins could rise under new federal regulations, DeFi platforms might gain trust, and big institutions could enter the market. But if Senate Democrats block or weaken the bill, we might see another market drop.

The smart move? Build your portfolio with strong, resilient assets. Consider Ethereum for its powerful smart contracts or Solana for fast transactions. Don’t forget to set stop-losses and watch for projects with real-world applications. This Crypto Bill story is still unfolding, and those who prepare now might turn market dips into golden opportunities.

FAQs

- What caused the Crypto Bill to fail the initial procedural vote?

Ultraconservative Republicans and Democrats opposed the bill packaging, leading to a 208-221 defeat amid broader spending disputes. - How did Trump influence the Crypto Bill’s revival?

He met with holdouts in the Oval Office, securing their vote flips and enabling the procedural rule to pass after a 10-hour vote. - What impact did the Crypto Bill stall have on markets?

Bitcoin dipped below $117,000, Ethereum fell 5%, and crypto stocks like Coinbase declined, erasing billions in value temporarily. - What are the key components of the Crypto Bill package?

It includes the GENIUS Act for stablecoins, CLARITY Act for asset rules, and an anti-CBDC measure to prevent government digital currencies. - Should investors prepare for more dips related to the Crypto Bill?

Yes, potential Senate delays or amendments could trigger volatility, so diversify and monitor updates closely for strategic positioning.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.