As the Web3 landscape matures, one critical challenge remains unsolved: how to bring reliable, real-time data on-chain in a secure and decentralized way. Flare, a purpose-built layer-1 blockchain, is tackling this problem head-on. With a market capitalization of $1.38 billion and a rapidly expanding ecosystem, Flare is positioning itself as the foundational infrastructure for data-driven decentralized applications.

At the heart of this mission is Flare’s innovative dual-token architecture, paired with its signature technology, the Flare Time Series Oracle (FTSO). Unlike traditional oracles that rely on centralized data feeds, FTSO incentivizes a decentralized network of contributors to provide accurate, verifiable data across asset prices, real-world events, and on-chain activity.

This analysis unpacks Flare’s core mechanics, tokenomics, and competitive position in the Web3 economy, offering a clear-eyed view of its promise and challenges in 2025.

What Is Flare Crypto?

Flare Crypto is a layer-1 blockchain based on the Ethereum Virtual Machine (EVM), designed to provide decentralized access to high-integrity data from other chains and the internet. It operates with FLR, the native token for transactions, governance, and rewards, and Wrapped Flare (WFLR), used for voting and delegation. Launched by the Assemble Protocol Foundation in 2018, Flare aims to empower developers with interoperable solutions, supported by the FTSO, which incentivizes accurate data provision.

Flare’s ecosystem relies on a dual-token structure and community incentives:

-

FLR as Network Fuel: FLR covers transaction fees, enables governance voting by holders, and offers rewards for network support.

-

WFLR for Governance: Converting FLR to WFLR facilitates voting and delegation to validators, enhancing participation.

-

FTSO Rewards: Contributors providing reliable data via the FTSO earn additional tokens, strengthening network integrity.

This model targets data-driven dApps, though its adoption scale remains unverified.

Market Performance and Tokenomics (July 2025)

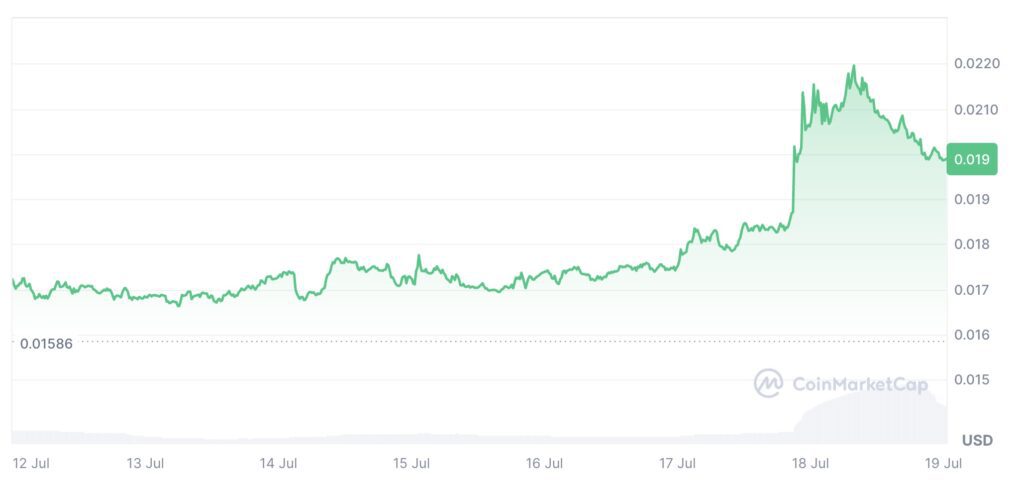

Source: CoinMarketCap

-

Price: $0.01988, down 8% in the last 24 hours, up 16.83% over the last 7 days, up 13.59% over the past month

-

Market Cap: $1.38 billion, up 7.38%, based on the circulating supply.

-

24-Hour Volume: $48.89 million, with a 0.26% change, indicating stable trading activity.

-

Fully Diluted Valuation (FDV): $2.06 billion, derived from the total supply.

-

Volume/Market Cap Ratio: 3.6%, reflecting moderate liquidity.

-

Total Supply: 103.65 billion FLR, with no maximum supply cap.

-

Circulating Supply: 69.69 billion FLR, or 67.2% of the total.

Price Movement Analysis

Flare’s relevance stems from its solution to blockchain’s data access challenge, critical as AI and DeFi grow. The 16.83% weekly rise may reflect:

-

Market Trends: Rising DeFi demand and regulatory support (e.g., GENIUS Act, U.S., June 2025) likely boosted interest.

-

Tokenomics Updates: 2024 enhancements, like improved staking, may have attracted holders.

-

Ecosystem Activity: The 69.69 billion circulating FLR suggest adoption, though unquantified.

The 8% drop could result from:

-

Profit-Taking: After a 16.83% weekly gain, traders may have sold off.

-

Market Sentiment: Broader crypto corrections might have impacted FLR.

-

Supply Pressure: The uncirculated 32.8% could loom as a dilution threat.

This volatility underscores the need for caution, as the establishment’s growth narrative may overlook short-term risks.

Risks and Challenges

Key risks include:

-

Volatility: The 8% drop and 3.6% liquidity ratio signal instability.

-

Inflation Risk: The 103.65 billion total supply with no cap could dilute value.

-

Regulatory Uncertainty: The GENIUS Act (June 2025) may impose compliance burdens.

Flare’s governance is decentralized, with FLR and WFLR holders voting on decisions, supported by staking rewards and FTSO contributions. The 2024 tokenomics updates enhance these incentives, though participation data is unavailable.

Flare’s $1.38 billion market cap and prior 16.83% weekly gain highlight its data-driven potential amid AI and DeFi growth. The 8% drop, however, tempers optimism, with uncirculated supply and market sentiment posing risks. Strategic supply management and regulatory navigation will shape its future.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.