July 19, 2025: Render Crypto is buzzing in the blockchain world, with its token RENDER priced at $4.07, up 7.48% in the last week and 28.02% in the past month. With a market cap of $2.11 billion, Render is making waves as a unique platform that lets people share computer power to create stunning digital content. But what exactly is it, and why should you care? This guide explains Render Crypto in simple terms, breaking down its purpose, how it works, its market performance, and how it stacks up against others.

What Is Render Crypto, Really?

Imagine you’re a video game designer or a movie animator who needs a super-powerful computer to create lifelike graphics, but buying one is too expensive. Now, picture a network where people with extra computer power (like gamers with high-end GPUs) lend it to you for a small fee. That’s Render Crypto in a nutshell. Launched in 2019 by OTOY, a company known for its rendering software, Render is a decentralized platform that connects creators who need computing power with people who have it to spare.

At its core, Render uses a special digital currency called RENDER, which works like money within the network. It’s built on blockchains like Ethereum, Polygon, and Solana, which are like digital ledgers that keep everything secure and transparent. Unlike traditional cloud services like Amazon Web Services (AWS), where a big company controls everything, Render lets individuals share resources directly, making it cheaper and more accessible. It’s part of a growing trend called Decentralized Physical Infrastructure Networks (DePIN), where everyday people power the internet’s future.

How Does Render Crypto Work?

Think of Render as a global marketplace for computer power, run by a community rather than a single company. Here’s how it operates in easy steps:

-

The Marketplace Setup: Creators, like animators or AI developers, upload their rendering jobs (e.g., turning a 3D model into a smooth video) to the Render Network. These jobs need serious computing muscle, often provided by Graphics Processing Units (GPUs), the brains behind high-end graphics.

-

Node Operators Step In: People with spare GPU power, called Node Operators, offer their computers to process these jobs. They’re like volunteers who get paid for helping out.

-

RENDER as the Currency: Creators pay Node Operators in RENDER tokens for their work. OTOY, the company behind Render, takes a tiny cut (about 1%) to keep the network running. Node Operators also earn RENDER as rewards, encouraging more people to join.

-

Cross-Chain Magic: Render works across Ethereum (secure but slow), Polygon (fast and cheap), and Solana (ultra-fast), giving creators flexibility based on their needs.

This system cuts out middlemen, reduces costs (e.g., a $500 rendering job on AWS might cost $50 on Render), and supports tools like OctaneRender and Redshift, which are favorites among professionals. But it relies on enough Node Operators being online, which can be a challenge compared to centralized options.

Market Performance and Tokenomics

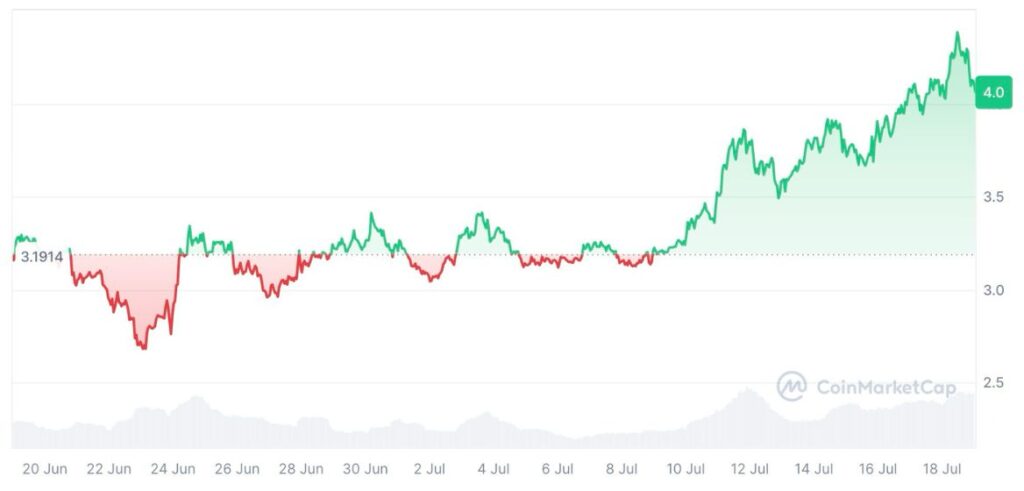

Source: CoinMarketCap

Let’s break down Render’s numbers as of July 19, 2025:

-

Price: $4.07 per RENDER, which means each token has grown 7.48% in the last week and 28.02% in the past month

-

Market Cap: $2.11 billion, up 1.11% recently, showing the total value of all RENDER in circulation is climbing slowly but steadily.

-

24-Hour Volume: $145.75 million, up 21.23%, meaning a lot of people are buying and selling RENDER right now.

-

Fully Diluted Valuation (FDV): $2.62 billion, which is what the network could be worth if all possible RENDER tokens (644.16 million) were in use.

-

Volume/Market Cap Ratio: 7.08%, a measure of how much trading happens compared to its value—higher numbers like this suggest active interest.

-

Total Supply: 532.88 million RENDER currently exist.

-

Max Supply: 644.16 million RENDER could eventually be created.

-

Circulating Supply: 518.12 million RENDER are available now, about 80.4% of the max, leaving 126.04 million still to come.

-

All-Time High: $13.60 on March 17, 2024 (a year ago), meaning it’s down 70.15% from its peak

-

All-Time Low: $0.03676 on June 16, 2020 (5 years ago), showing a massive 10,937.59% growth since then

The price jumps (7.48% weekly, 28.02% monthly) show Render is hot right now, likely because more people need GPU power for AI or gaming. The 21.23% volume spike suggests new investors are jumping in. But the 70.15% drop from its high and the 126.04 million uncirculated tokens could mean future price drops if too many are released at once.

Why Render Crypto Matters and What’s Driving It

Render is a big deal because it solves a real problem: the high cost and limited access to powerful computers for creating digital content. With AI, virtual reality, and video games booming, Render’s decentralized GPU power is timely. Here’s why it’s growing:

-

AI and Creative Boom: Companies use Render to train AI models or render 3D scenes, like those in Hollywood movies or Roblox games.

-

DePIN Trend: Part of a $32 billion DePIN sector, Render taps into a $3.5 trillion potential market by 2028, as decentralized networks replace big tech.

-

Community Power: The Render Foundation supports developers with grants, though exact impacts aren’t public yet.

The 1.11% market cap rise might be slower because some investors are cashing out after the monthly gain, or because competitors are vying for attention. It’s a sign of strength but also a reminder to watch the market closely.

Who Render Competes With

Render isn’t alone in the DePIN space—other projects offer different ways to share resources. Let’s look at its rivals in detail, focusing on what they do and how they differ:

-

Helium (HNT): Helium builds a decentralized wireless network using Hotspots—small devices people set up at home to provide internet coverage. It partnered with T-Mobile to connect 900,000 phones in a weekend, showing huge real-world use. Unlike Render’s focus on GPU power, Helium targets IoT and mobile data, with a Proof of Coverage system that rewards physical setup. Its strength is widespread coverage, but it doesn’t handle rendering tasks.

-

Filecoin (FIL): Created by Protocol Labs, Filecoin lets people rent out unused hard drive space for storage. It uses advanced security checks (Proof of Spacetime, Proof of Replication) to ensure data safety, serving big companies like Netflix. While Render focuses on computing power, Filecoin excels in storage, offering a different but complementary service. Its mature network is a plus, though it lacks Render’s creative focus.

-

Theta Network (THETA/TFUEL): Theta improves video streaming by letting users share bandwidth and computing power. Its two tokens THETA for governance, TFUEL for payments mirror Render’s reward system but target video delivery, not rendering. Theta’s strength is optimizing streams for platforms like YouTube, but it doesn’t match Render’s GPU intensity.

-

Solana (SOL): Solana is a high-speed blockchain hosting Render and other DePINs. It’s not a direct competitor but provides the infrastructure Render relies on. Solana’s strength is its transaction speed (65,000 TPS), but it doesn’t specialize in rendering, making it a supportive rather than rival platform.

Render’s unique selling point is its GPU rendering focus, ideal for animators and AI developers. Helium’s connectivity and Filecoin’s storage offer different value, while Theta targets specific niches. Solana’s infrastructure challenge Render to differentiate through community adoption and technical reliability. The DePIN hype often oversells universal success. Render must prove its edge amid this diversity.

Risks To Watch Out

Render is exciting, but it’s not without risks:

-

Price Swings: The 70.15% drop from $13.60 (ATH) shows it can be volatile, and the 7.08% liquidity ratio adds to that risk.

-

Uncirculated Tokens: The 126.04 million RENDER not yet in circulation could lower the price if released too fast.

-

Rules and Regulations: New laws, like the GENIUS Act (U.S., June 2025), might affect how Render operates, especially since it involves physical hardware.

-

Technical Hiccups: Relying on Node Operators means the network could slow down if too few are online, unlike centralized services with guaranteed uptime.

Is Render Crypto for You?

Render matters because it’s part of a bigger shift where regular people, not just big companies, power the internet. With a $2.11 billion market cap and 28.02% monthly growth, it’s tapping into AI and gaming’s $300 billion potential. The 7.48% weekly rise shows people believe in its future, but the 70.15% drop from its peak and uncirculated supply remind us to be careful. As DePIN grows to a $3.5 trillion market by 2028, Render could lead the charge if it handles competition and rules smartly.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.