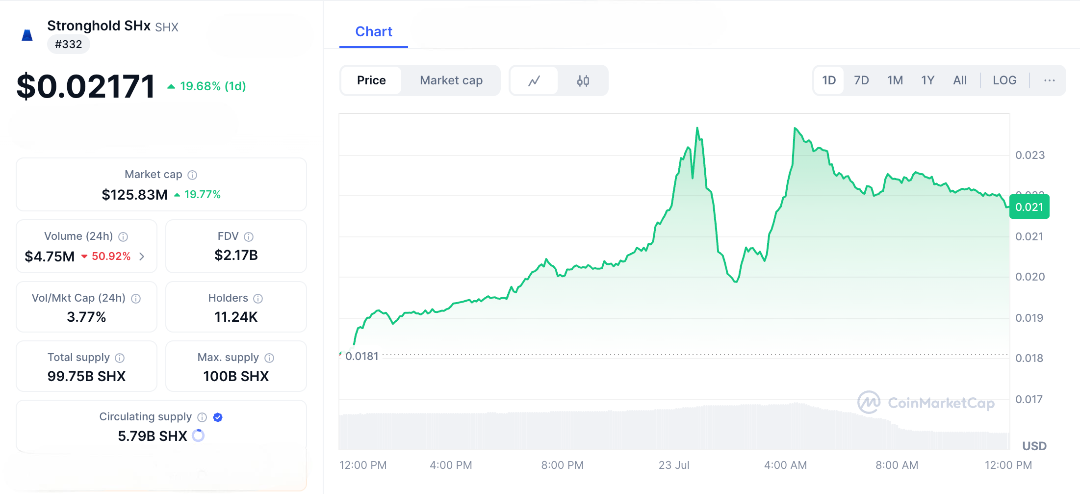

In a crypto world full of bold promises and even bolder energy bills, SHX Crypto stands out as a bit of a mystery and maybe a breath of fresh air. It claims to be the eco-friendly alternative in a space where many tokens still rely on power-hungry systems. Built on the Stellar network, it is the native token of the Stronghold platform, aiming to offer fast, low-energy transactions. That’s a big deal at a time when the world is actively looking for more sustainable finance options. At the moment, SHX is trading around $0.021, with a market cap of about $125.83 million. It’s small compared to the big players, but it’s catching attention for the right reasons. As someone who’s seen it all Bitcoin mining in frozen regions to solar-powered crypto setups SHX’s story feels different. It’s not just about hype. It’s about whether a greener, more efficient payment system can actually work. So the big question, Is SHX the real deal, or just another green-sounding promise that fades under pressure? Either way, it’s one token worth keeping an eye on.

The Eco-Friendly Underdog with Big Ambitions

Let’s break it down like a crypto detective on a mission. SHX Crypto was created by Tammy Camp and Sean Bennett, two founders with a clear goal: to connect traditional finance with the power of blockchain without trashing the planet in the process. Built on the Stellar network, it uses a super-efficient system called the Stellar Consensus Protocol. Unlike Bitcoin’s energy-hungry setup that relies on massive server farms, Stellar’s method is lean and green. It runs on something called federated Byzantine agreement a fancy way of saying it uses way less energy per transaction. And the benefits? SHX offers real-time payments, low transaction fees for businesses, and even some DeFi rewards all while keeping its carbon footprint tiny compared to Bitcoin or even Ethereum before it switched to proof-of-stake.

In a world where regulators and investors are hunting for greener crypto options, it is shaping up to be a promising contender. It’s more than just another token it’s trying to prove that you can have speed, savings, and sustainability all in one.

Real Use, Real Impact, and a Growing hype

What makes SHX Crypto even more exciting? It’s not just theory it’s actually being used in the real world. Through the Stronghold ecosystem, it helps power things like merchant cash advances using DeFi, connects with old-school payment systems via APIs, and makes cross-border payments faster and cheaper. Picture this: a small business in a developing country gets quick access to capital no banks, no delays, and all with a token that uses less energy than your morning coffee maker.

And it’s not stopping there. In a major move to build trust and long-term stability, Stronghold locked up 60 billion SHX tokens that’s 60% of the total supply in escrow for five years. That’s a bold step to prevent flooding the market and to show they’re serious about the project’s future. They’re also getting noticed in big places, recently sponsoring the Wyoming Blockchain Symposium, a clear sign that Stronghold is playing in bigger, more institutional arenas from fintech boardrooms to policy discussions on Capitol Hill. And guess what? The market noticed too. SHX recently jumped 27% in a single day, with trading volume hitting $10 million, outperforming many other tokens in a shaky market. The signs are clear: SHX isn’t just green it’s growing.

Is SHX Crypto a True Eco-Champion or Just Hype?

Here’s where the story gets interesting. Is SHX Crypto’s green reputation genuinely earned, or is it more of a clever marketing move covering up risks? There’s no denying that Stellar’s network is far more energy-efficient than Bitcoin and other proof-of-work blockchains. But the whole crypto world is full of overhyped “green” claims that don’t always hold up under scrutiny.

SHX has a total supply capped at 100 billion tokens, but only about 5.8 billion are currently circulating. That raises a red flag if too many tokens unlock and flood the market, it could dilute value and shake investor confidence. Plus, SHX’s price has been rollercoaster-level volatile. Even after bouncing back 66% from June lows, it’s had wild swings similar to other eco-themed tokens that have fizzled out when regulatory pressures or hype fade. And despite its energy efficiency, SHX isn’t immune to the broader crypto market’s ups and downs, especially since much depends on Bitcoin’s often energy-heavy mining and market sentiment. So if global rules tighten around crypto’s environmental impact, the big question is: Will SHX stand strong, or will its green story deflate like so many others before it?

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.