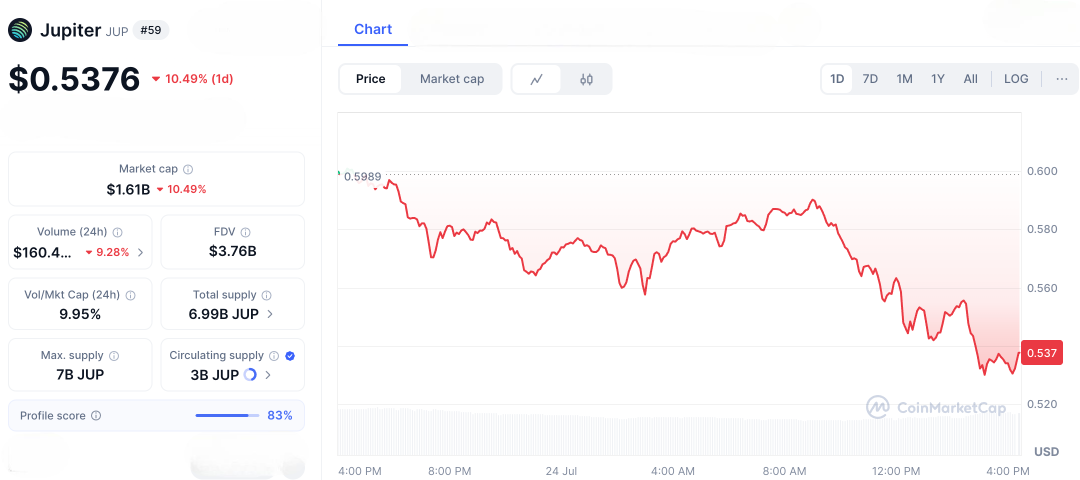

In the rough-and-tumble world of decentralized exchanges, Jupiter Crypto (JUP) has taken a hard hit down about 60% from its all-time high. It’s now trading near $0.53, below its $1.58 peak, with a market cap around $1.6B. That drop has people wondering: is this the start of a wider DEX wipeout, or a smart buy-the-dip moment? Jupiter is Solana’s leading DEX aggregator, built to find the best swap rates with low slippage. And while the price has slid, trading volumes are picking up and some bullish chart patterns are starting to form. I’ve seen moves like this go both ways some become legendary rebounds, others fade out. If you’re eyeing an entry, stay diversified, watch on-chain data, and manage risk. This could be a golden setup or a warning shot. The next few weeks will tell.

Rewinding Jupiter Crypto’s Rollercoaster Ride

Let’s scroll back and look at how Jupiter Crypto made its mark. Born from the Solana ecosystem, it was built to help users find the best swap deals across DEXes like Raydium and Orca basically your go-to for smart, low-slippage trades. When it launched, it wasn’t just hype it delivered. With slick features like limit orders and perpetuals, it quickly became a trader favourite. Then came the big moment, the JUP airdrop. Early users were rewarded, and prices soared. For a while, it felt like JUP could only go up. But like many crypto stories, things cooled down. Regulatory fears, Bitcoin’s shaky moves, and broader market nerves sent JUP into a 60% freefall classic Icarus moment. Even just recently, it dropped 11% in a single session, reflecting pain across the altcoin space. But here’s the twist: some analysts are seeing signs of life again. A bullish fractal pattern similar to ones before past rallies could point to a 37% bounce back to $0.74, if support holds strong.

Jupiter Crypto’s Comeback Story

The DEX world is adding new challenges to Jupiter Crypto’s story. Solana’s total value locked (TVL) is increasing, but the competition is tough. Ethereum Layer 2s and cross-chain aggregators are drawing liquidity in different directions. Despite this, Jupiter’s recent actions have given hope. They invested $150 million USDC into JLP loans, boosting liquidity and attracting users. Since hitting a low of $0.30 in April, JUP has rebounded by over 110%, with daily trading volume increasing by 175% to $342 million.

This isn’t just hype; it shows resilience. JUP has been rising 25% weekly on news like the new lending system. Big investors (whales) are quietly buying, and the community is excited, seeing this as a bargain before the next big surge. If Bitcoin remains stable and interest in Solana increases, Jupiter Crypto could rise back to $1, which some analysts are predicting.

Volatility and Risks in Jupiter Crypto’s Journey

But every great crypto story has its challenges and volatility is the biggest villain here. Some skeptics warn that if decentralised exchange (DEX) trading slows down because of economic troubles or if Solana suffers another network outage, things could get messy. Right now, Jupiter Crypto’s Relative Strength Index (RSI) is flirting with “overbought” levels after its recent rally. That means there could be a pullback ahead, possibly dropping back to around $0.45 support.

Looking ahead to July, predictions are all over the place. Some expect prices to hover near $0.50, with potential highs of $0.65 if the momentum keeps up but there’s also a risk of sliding back to $0.45 if bearish trends take over. On top of that, growing regulatory pressure on DeFi could make things worse, turning what looks like a great buying opportunity into a painful lesson for those caught off guard. Having seen plenty of crypto crashes, I know this for sure: dips can be tempting, but they require steady nerves and smart diversification to navigate safely.

Jupiter Crypto at the Crossroads

Jupiter Crypto stands at a crucial moment, much like how Solana once outpaced Ethereum. It’s not just a token for bundling trades, but a symbol of hope for Solana’s comeback. With its ecosystem expanding through new partnerships and features like dollar-cost averaging, this dip could be a golden opportunity for patient holders. Timing is critical. Big investors are defending the $0.50 level, looking for breakouts above $0.52 and aiming for $0.55. With altcoins like SEI gaining attention this July, Jupiter could either ride the wave or fall behind.

Keep in mind, this isn’t financial advice, just an update from the ever-changing crypto market where fortunes can change quickly. If the bullish trends hold and trading volumes remain high, this 60% dip might become one of the biggest comebacks. However, it could also signal a tougher time for decentralized exchanges (DEXes). Traders are divided and forums are buzzing, so will you buy the dip or wait it out? In the world of crypto, the next move is always a surprise.

FAQs

- What is Jupiter Crypto’s current price?

Jupiter Crypto’s JUP token is trading around $0.63, following recent volatility and a rebound from lower levels. - Why has Jupiter Crypto slumped 60% from its ATH?

The decline stems from broader market corrections, regulatory concerns, and altcoin pressures, dropping from a peak near $1.58. - Could Jupiter Crypto rally to $0.74 soon?

A bullish fractal pattern suggests a potential 37% surge to $0.74 if support holds and volumes continue to rise. - Is a DEX bloodbath likely amid Jupiter Crypto’s dip?

While competition and volatility pose risks, Jupiter’s ecosystem growth and Solana’s strength could avert a wider downturn. - Is this dip a golden entry for Jupiter Crypto?

For risk-tolerant investors, yes, given predictions of highs to $1, but diversification and research are essential due to market uncertainties.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.