In the fast-evolving world of decentralized finance (DeFi), most protocols still operate within the closed loop of blockchain-native assets, i.e., lending crypto to borrow crypto. But Credefi (CREDI) breaks that mold. Instead of recycling liquidity within digital markets, Credefi channels crypto capital into real-world small and medium-sized enterprise (SME) loans, helping underbanked businesses thrive while offering yield-bearing opportunities to crypto lenders. It’s DeFi with tangible impact & anchored in traditional economic value.

Founded with a mission to bridge blockchain innovation with Europe’s underserved SME sector, Credefi represents a practical, outward-looking model in a space often driven by speculation. And in 2025, with its token on the rise and lending activity reaching new highs, Credefi is showing what the next phase of DeFi might look like.

How Does Credefi Work?

Credefi’s architecture blends the flexibility of DeFi mechanics with the discipline of traditional credit systems, enabling users to deploy stablecoins into real-economy lending through several key mechanisms:

1. Portfolio-Based SME Lending

Investors can allocate capital into diversified loan portfolios, segmented by risk and expected yield. These portfolios are composed of vetted SME loans often delivering annualized returns above 10%. Borrowers receive financing for genuine operational needs, from equipment purchases to payroll support.

2. Direct Peer-to-Peer Lending

Credefi also enables lenders to directly match with individual SME borrowers. This opens up tailored opportunities across varying risk levels. A standout feature is its zero-collateral lending product which is available to verified borrowers with strong credit histories and on-chain reputations.

3. Real-World Asset Bonds and Trade Finance

Using NFT-bonded loan structures, Credefi facilitates lending against traditional instruments like invoices, receivables, real estate, and transport assets. This creates liquidity from otherwise locked-up business value, expanding DeFi utility into logistics, retail, and manufacturing.

4. On-Chain Risk Scoring

To manage risk effectively, Credefi combines its own proprietary scoring algorithms with credit assessments from Experian, one of the world’s largest credit bureaus. This dual-layer analysis reduces default risk while bringing credibility and transparency to the process.

5. Fiat On/Off-Ramps

Unlike many DeFi platforms that assume crypto-native users, Credefi supports bank account transfers, making it easier for SMEs and traditional finance participants to access blockchain-based lending without navigating wallets or exchanges.

6. Dynamic Yields and Incentives

In addition to interest payments, lenders earn CREDI token rewards, boosting returns; especially during high-demand cycles or new feature rollouts.

The Role of the CREDI Token

The CREDI token powers the Credefi ecosystem by providing both utility and incentives:

-

Staking and Governance: Holders can stake CREDI for APY, receive protocol profits, and vote on governance proposals.

-

Ecosystem Incentives: Lenders, borrowers, and liquidity providers earn tokens through platform activity, aligning user growth with protocol success.

-

Risk Buffering: A portion of CREDI is allocated as an insurance reserve to protect against borrower defaults.

-

Access and Utility: Token holders can unlock premium lending pools, access NFT bond products, and enjoy discounted transaction fees.

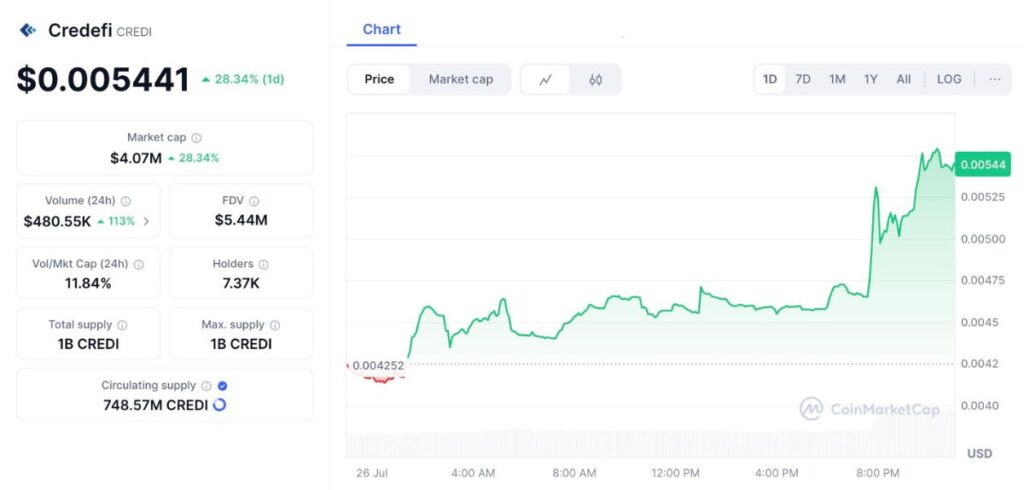

Tokenomics & Pricing Analysis

Credefi’s CREDI token is central to platform participation and security. With a maximum supply of 1 billion tokens and a circulating supply of approximately 748.57 million, CREDI enables staking for yield, platform governance, access to premium lending pools, payment of transaction fees, and acts as an insurance buffer within the protocol. Distribution and incentive structures are designed to reward both lenders and borrowers, with portions of tokens reserved for ecosystem growth, team vesting, community incentives, and risk management. Team and incentive allocations use long-term vesting to maintain credibility and align interests.

Current Pricing Analysis (as of July 26, 2025):

-

Price: $0.005441

-

Circulating Supply: 748.57 million tokens

-

Market Cap: $4.07 million

-

24h Trading Volume: $480,550

-

Recent Returns: Up 28.34% in one day, 3.06% for the week, and 9.49% over the past month

Source: CoinMarketCap

Recent price strength is not only a result of speculation. It has coincided with product launches—such as direct P2P lending, the rollout of NFT bonds, new onboarding for SME borrowers, and increased stablecoin demand on a platform promising real-world, risk-adjusted yield. Surging trading volumes and price action also reflect improved visibility and adoption, although short-term rallies in mid-cap DeFi tokens can reverse quickly, emphasizing the need for both optimism and caution.

What Makes Credefi Stand Out?

Credefi sits at the intersection of DeFi innovation and real-world credit markets, competing with both blockchain-native and traditional players:

-

Vs. Aave & Compound: These giants dominate DeFi lending but focus on overcollateralized loans between crypto users. Credefi, by contrast, links capital to real-world economic activity.

-

Vs. Goldfinch & Maple Finance: While these newer protocols target real-world credit, Goldfinch emphasizes emerging markets and uncollateralized lending, whereas Maple is geared toward institutional borrowers. Credefi’s sweet spot is European SMEs. a largely underserved segment.

-

Vs. Traditional Fintechs: Non-crypto lending platforms lack blockchain’s transparency, cross-border reach, and token-driven incentive systems.

Credefi’s blend of rigorous credit checks, dynamic DeFi features, and real-world use cases gives it a unique value proposition in a crowded market.

Why CREDI Is Gaining Momentum in 2025

Recent months have seen surging interest in Credefi, driven by both strong fundamentals and renewed attention on DeFi projects delivering real-world value:

-

Price Performance: The CREDI token is up 28% in a single day and over 9% month-over-month, reflecting growing confidence in the protocol’s business model.

-

New Product Rollouts: Features like NFT-bonded trade finance, expanded P2P lending, and improved fiat ramps have widened participation and boosted platform activity.

-

SME Adoption: Businesses across Europe, long underserved by banks, are increasingly turning to Credefi for capital. In return, crypto lenders enjoy stable, predictable returns in an otherwise volatile market.

Challenges Ahead

Credefi’s model is promising, but not without challenges:

-

Regulatory Risks: Integrating DeFi with fiat and traditional lending invites scrutiny. Regulatory changes across Europe and beyond could impact operations.

-

Macroeconomic Exposure: SME loans are inherently tied to broader economic health. A downturn could increase defaults, despite credit screening.

-

Token Volatility: Like most DeFi protocols, the CREDI token is still subject to speculation and market swings, something long-term investors must watch.

The Road Ahead

Credefi embodies a new wave of DeFi, one grounded in real-world impact rather than pure digital abstraction. By solving tangible credit access problems for SMEs and creating yield-generating opportunities for crypto holders, it demonstrates how blockchain can power inclusive economic growth.

As DeFi enters its next maturity phase, projects like Credefi & those that combine transparency, utility, and regulatory foresight are likely to stand the test of time. Whether the market continues to reward fundamentals over hype remains to be seen. But if 2025 is any indication, Credefi is positioning itself as a blueprint for how DeFi can transform finance beyond the chain.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.