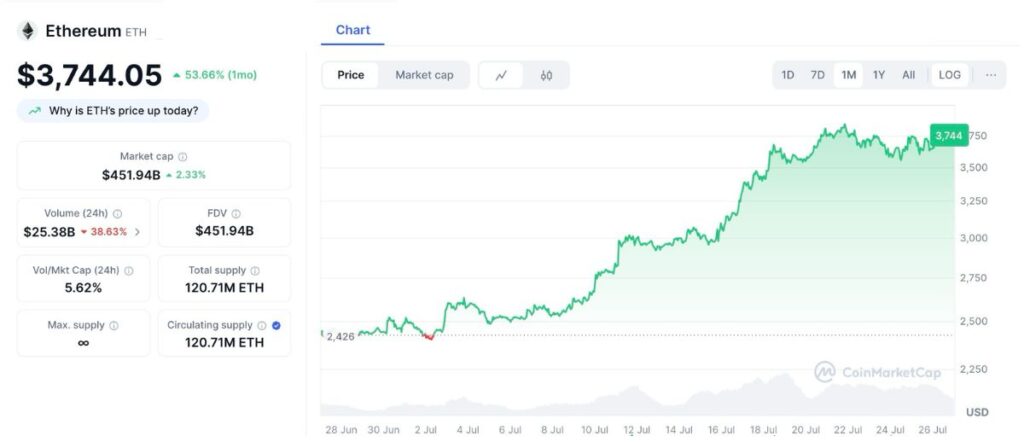

Ethereum has taken center stage in global crypto markets this July, surging more than 50% in just a few weeks and outpacing every major digital asset. This pronounced rally is not a product of speculation alone, it reflects a confluence of powerful institutional inflows, regulatory breakthroughs, and evolving blockchain fundamentals that are reshaping conversations about Ethereum’s real-world utility and long-term value. For investors, analysts, and industry participants, understanding these shifts is essential to gauging both present momentum and future trajectory.

Source: CoinMarketCap

What’s Driving Ethereum’s July Rally?

1. Major Institutional Accumulation

-

World Liberty Financial (WLFI), a newly emerged DeFi platform with political ties, has aggressively acquired Ethereum throughout July, boosting holdings from roughly 47,000 ETH to over 73,600 ETH, an increase exceeding 54%. WLFI’s large-scale buys, including multi-million-dollar transactions, signal mounting institutional faith in Ethereum’s ecosystem leadership and yield-generating potential.

-

GameSquare Holdings (Nasdaq-listed) rapidly scaled its treasury strategy, adding over 10,000 ETH (now worth more than $37 million) in July and expanding board-approved crypto investments to $250 million. These assets are deployed in DeFi to generate yields far above traditional markets, spotlighting Ethereum’s unique appeal to listed corporations.

GameSquare purchased an additional $30 million of ETH, acquiring ~8,351.89 ETH at a weighted average price of ~$3,592 per ETH.

The Company currently has ~10,170.74 ETH as of July 21, 2025. pic.twitter.com/CAKASn2C9T

— GameSquare Holdings Inc. (@GSQHoldings) July 21, 2025

-

SharpLink Gaming, a major esports and blockchain entertainment firm, now the world’s largest corporate ETH holder, accumulated nearly 80,000 ETH in a single week and purchased 10,000 ETH directly from the Ethereum Foundation, a high-profile transaction underscoring corporate conviction in Ethereum as a balance-sheet asset.

En-route to our first stop:

1,000,000 $ETH pic.twitter.com/hzlwD4x2Sp

— SharpLink (SBET) (@SharpLinkGaming) July 17, 2025

2. Record ETF Inflows

U.S. spot Ether ETFs have experienced unprecedented demand, with single-day inflows topping $450 million and net inflows since launch surpassing $9.3 billion. BlackRock’s iShares Ethereum Trust (ETHA) leads the charge, crossing $10 billion in assets under management faster than nearly any ETF in history. These institutional and retail capital inflows have reduced circulating supply and cemented price momentum above $3,700.

3. Regulatory Clarity Fuels Confidence

The GENIUS Act, signed into law on July 18, established the first clear U.S. federal framework for stablecoins—including mandated reserves, regular audits, and dual federal-state oversight. This legitimization decisively positions Ethereum as the leading infrastructure for regulated dollar-pegged tokens and institutional DeFi. The act also restricts yield-bearing stablecoins, likely redirecting yield-seeking capital toward Ethereum-based protocols.

4. Upgrades and On-Chain Growth

-

Shanghai Hard Fork (EIP-4895): The 2023 upgrade enabled staked ETH withdrawals, boosting liquidity and reinforcing confidence in Ethereum’s proof-of-stake security model. Paired with fee burns from EIP-1559, effective supply inflation remains contained as user activity surges.

-

DeFi and NFT Resurgence: Total value locked in Ethereum DeFi crossed $65 billion, and NFT markets show renewed volume. Robust on-chain activity underscores Ethereum’s foundational role in the digital assets economy.

5. Technical Momentum and Market Sentiment

All major technical indicators, including moving averages, RSI, and trading volumes point to strong bullish momentum. Analysts have raised near-term price targets to $4,000 – $4,500, while the Crypto Fear & Greed Index remains in “Extreme Greed,” reinforcing momentum trades and attracting further capital.

Is Further Growth Expected?

Optimistic yet cautious forecasts support continued upside:

-

ETF Participation: Estimates suggest as much as $20 billion in aggregate inflows over the next year from asset managers, corporate treasuries, and high-net-worth individuals.

-

DeFi Yield Migration: New stablecoin regulations may drive more capital into Ethereum-based protocols for higher yields.

-

Scalability Upgrades: Upcoming proposals like EIP-4844 (data sharding) could unlock further efficiency and utility.

Potential risks include overbought RSI levels prompting short-term pullbacks, shifting regulatory dynamics in a U.S. election year, and the inherent volatility of crypto markets.

Ethereum’s dramatic rally in July 2025 is anchored in record corporate and institutional acquisitions, historic ETF inflows, supportive regulatory developments, and robust on-chain fundamentals. The decisive moves by WLFI, GameSquare, and SharpLink Gaming lend tangible validation to Ethereum’s utility and value as both a financial and technological asset. As market foundations strengthen and the world’s largest smart-contract platform evolves, Ethereum’s current surge may signal not just speculative momentum but a deeper realignment of traditional finance around decentralized infrastructure. Continuous monitoring of institutional flows, regulatory shifts, and network upgrades will determine whether this rally sets a new baseline for long-term growth or fuels yet another wave of innovation-driven gains.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.