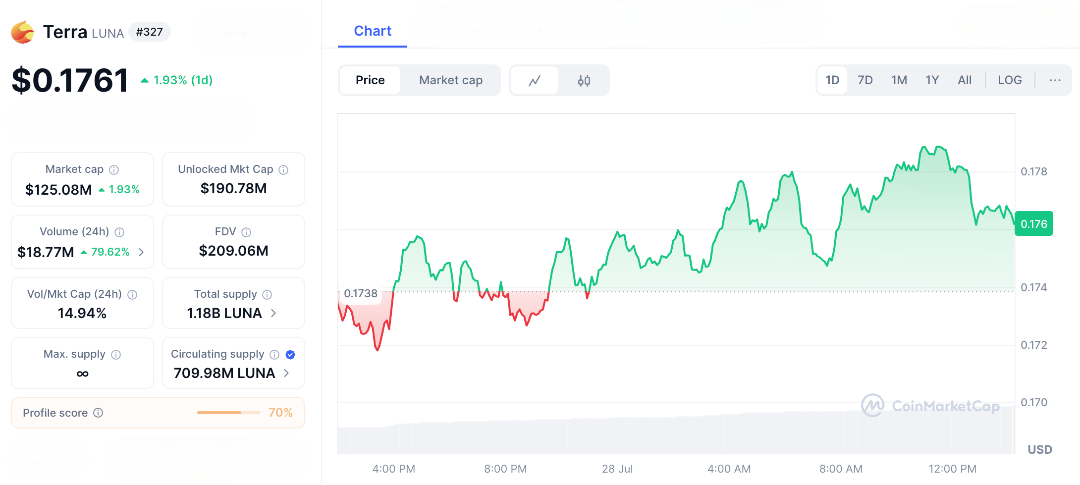

In the shadowy corridors of crypto history where fortunes are coded in blocks and obliterated in black swan events LUNA looms like a digital ghost, forever marked by one of the space’s most catastrophic implosions. Imagine this, Terra, once a beacon of decentralised stability, built on the seductive promise of algorithmic precision, collapsed in mere days, vaporising billions and turning bullish dreams into dust. As a battle-scarred crypto chronicles who’s weathered bull runs, bear winters, and more rug pulls than I’d like to admit, I’ve seen many tokens flirt with redemption. But it’s scars run deep, its legacy a cautionary tale whispered in every degen forum and late-night Discord AMA. Now trading near $0.17, it floats in a market still haunted by its past, provoking a chilling question: Would you dare hold it again? It’s a story of broken trust, blockchain resilience, and that dangerous crypto cocktail of risk and reward a narrative bound to stir debates, memes, and maybe even second chances.

The Rise, Fall, and Rebirth of LUNA

Let’s rewind to the center of the chaos. Back then, LUNA was the engine behind the Terra ecosystem, keeping its stablecoin UST pegged to the dollar through a system of clever swaps and burns. But when trust in UST cracked, everything unraveled fast. UST lost its $1 value, and the system tried to fix it by creating more LUNA flooding the market and making each token nearly worthless. People watched in shock as their investments disappeared almost overnight. It triggered lawsuits, government crackdowns, and even saw Terra’s founder go into hiding. Exchanges froze trading, online communities split apart, and faith in algorithmic stablecoins was shattered. But from the wreckage came a new path. The original Terra chain was renamed Terra Classic, with its token LUNC, while a new Terra blockchain launched under the old name LUNA. Airdrops were given to past holders as a sort of peace offering. This new version focuses more on governance and developer tools, trying to rebuild what was lost. Still, every price move carries a shadow of that crash. It’s not just a token it’s a reminder of how quickly things can fall apart in crypto.

LUNA’s Comeback Story

Fast forward to today, and LUNA’s story feels like a comeback movie one where the hero is trying to rebuild after a dramatic fall. The team behind LUNA has made some smart moves: they’ve connected with cross-chain bridges, strengthened their DeFi ecosystem, and focused on security and scalability. A recent upgrade, backed by big names like Binance, helped make transactions faster and safer, attracting developers who are tired of Ethereum’s high fees. Things are slowly looking up. Daily transactions are climbing, and the amount of crypto locked in LUNA’s network is growing. Stakers are earning 5–7% yields, which adds more reason for users to join in. Right now, it’s market cap is about $100 million a small slice of what it once was but some big holders seem to be quietly buying in, hinting at cautious confidence.

Analysts are hopeful but realistic. Some say it could reach around $0.20 by the end of the year, especially if the overall crypto market stays strong. New tokenomics like burning part of the transaction fees are helping control supply and could support slow, steady growth. Still, volatility is part of the ride. The price recently dipped below $0.12, reminding everyone that trust is still rebuilding. On top of that, the legal fallout from Terraform Labs’ collapse is still playing out, with claims for affected users extended into next year.

Why LUNA Still Lights Up Group Chats and Crypto Threads

So, what makes LUNA’s story so irresistible the kind that sparks debates, memes, and late-night DMs? It’s the dare. Buying LUNA today isn’t just a trade it’s a bold bet on redemption in a market that rarely forgives. On social platforms, you’ll find die-hard holders rallying around phoenix memes, sharing “I survived the crash” tales like battle scars. These aren’t just traders they’re storytellers, turning past losses into wisdom worth more than money. Skeptics aren’t quiet either. They pull up charts showing how LUNA struggles to break resistance, warning that newer projects might be following the same shaky path that once toppled Terra. But supporters argue there’s real substance beneath the speculation. LUNA isn’t just a memecoin comeback it powers protocol votes, shapes governance, and offers an entry point for risk-takers hoping for big returns with small stakes.

Read more : Esther the Wonder Pig – From Viral Inspiration to Crypto Meme & What the Token Trend Really Means

A Cautionary Legend or the Next Comeback King?

In the grand drama of crypto, LUNA is both a warning and a wildcard a token forever scarred by its fall, yet still reaching for a second act. With global regulators circling and stablecoins under the microscope, its future feels like a high-stakes cliffhanger. Will LUNA pull off a legendary comeback or become just another “what could’ve been”? That’s the million-dollar question. If you’re eyeing your portfolio and wondering whether to buy, hold, or bail, you’re not alone. It’s a personal gamble a choice that could turn into your own crypto folklore, shared in Discord chats and over coffee with fellow traders. Dare to hold? That decision might just become your most unforgettable story.

FAQs

- What is LUNA?

LUNA is the native token of the new Terra blockchain, reborn after the original Terra ecosystem’s collapse, focusing on governance and DeFi without an algorithmic stablecoin. - What caused LUNA’s historic crash?

The crash occurred when UST lost its dollar peg, triggering excessive LUNA minting to restore balance, leading to hyperinflation and a value wipeout. - What is the current price of LUNA?

As of July 28, 2025, LUNA trades around $0.13, showing modest recovery amid network upgrades and market fluctuations. - Why is LUNA considered risky to hold?

Its history of collapse, ongoing legal issues from Terraform Labs’ bankruptcy, and market volatility make it a high-risk investment despite recent improvements. - What could drive LUNA’s recovery?

Network upgrades, increased DeFi activity, fee-burning tokenomics, and growing on-chain transactions could fuel a rebound, with some analysts eyeing $0.20.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.