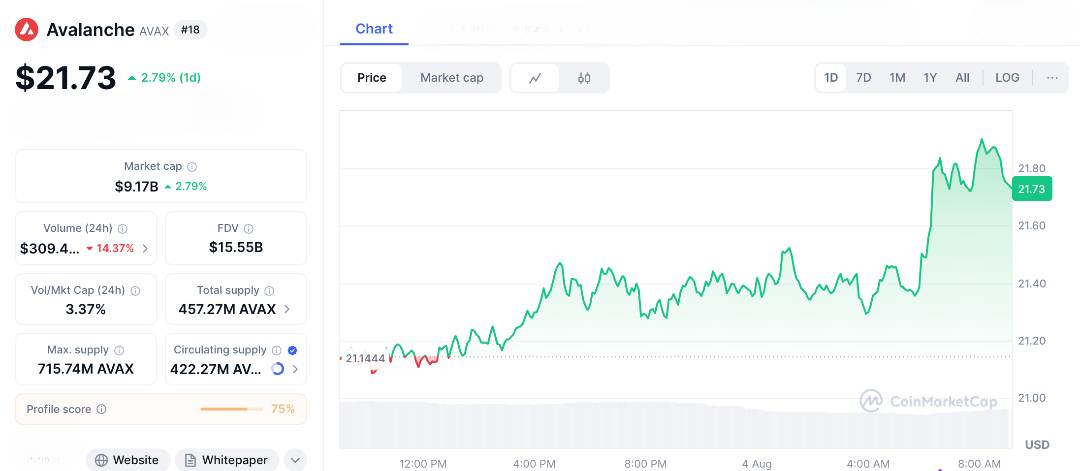

With blazing-fast transactions and ultra-low fees, Avalanche’s unique subnet design has become a home for everything from DeFi projects to real-world asset tokenisation. Observing the highs of Ethereum’s upgrades and the wild rides of memecoin mania, one thing is certain – stability in crypto is rarely just stability. It’s usually the quiet before something big. Today (August 4, 2025) AVAX is holding strong at around $21.41, after bouncing back from a recent dip below $20. This isn’t just a breather it feels like the market’s taking a deep breath, waiting for what’s next. Could Avalanche be gearing up for its next big move? The charts are levelling, traders are watching closely, and that old question is floating around again: “Is it time for AVAX to erupt?”

Avalanche (AVAX) Holds Steady After Wild Swings

Avalanche’s recent price rollercoaster isn’t just about numbers it’s a story of big-picture pressure and behind-the-scenes progress. A few weeks ago, AVAX was riding high thanks to the Octane upgrade, which pumped up DeFi total value locked by nearly 40%. That brought fresh interest and capital into Avalanche’s ecosystem, especially around tokenized assets. It looked like the bulls were back. Then came the reality check.

Inflation fears shook global markets, Bitcoin dipped below $115,000, and AVAX felt the impact dropping fast as the entire crypto sector slid about 6% in a week. Big players started closing leveraged positions, which only made the fall steeper. But here’s the twist most people missed: the Avalanche network itself is hyping.

-

Daily transactions jumped 170% quarter-over-quarter

-

Active wallet addresses surged 210%

-

And despite the price drop, on-chain activity hit new highs

Now AVAX is sitting just above $21.73, a level that’s starting to feel like solid ground again. The RSI is at a neutral 63.75, meaning there’s still room for growth without the market getting overheated. So while the price chart looks rocky, Avalanche’s fundamentals are quietly building momentum. Don’t be surprised if this calm leads to the next big climb.

Why Everyone’s Watching Avalanche (AVAX) Again

What’s driving all the hype around Avalanche lately? Simple: it’s not just hype it’s real-world use cases taking shape. Just recently, the Sky’s Grove protocol announced a massive $250 million expansion onto Avalanche, teaming up with Centrifuge to bring tokenized credit into the mix. That’s a big step toward making AVAX a serious player in institutional finance. On top of that, Grayscale is eyeing AVAX for potential inclusion in its future ETF lineup. That kind of spotlight tends to wake up investors. But what really makes Avalanche stand out is its tech. Its subnets custom, scalable mini-blockchains can handle thousands of transactions per second, with fees that cost just pennies and finality in under two seconds.

From gaming apps to enterprise tools, developers are flocking to it. Meanwhile, Ethereum’s still bogged down with high fees and congestion, and Solana continues to battle network outages. Against that backdrop, Avalanche’s price holding steady above $21 is starting to look more like quiet strength than stagnation. With a market cap around $9.17 billion, it’s still far below its 2021 peak when AVAX hit $144 leaving some to wonder: is this just the calm before the next breakout?

Could Avalanche’s Calm Be the Spark for the Next Big Rally?

Imagine this moment catching fire across crypto communities: a developer in Tokyo launches a slick DeFi app on Avalanche’s lightning-fast network, while a trader in New York posts a chart showing AVAX’s bullish candle with the caption, “Stabilizing for the surge?” But it’s not all smooth sailing. If big market sell-offs pick up or regulators crack down in important regions, AVAX might dip down to test support around $18.

Still, many analysts are optimistic, predicting AVAX could bounce back to $30 by the end of the quarter especially if institutional investors jump in. Of course, with crypto, volatility is always a wildcard. From my experience covering AVAX’s story, these quiet periods often set the stage for big moves like the 600% rallies we’ve seen before, fuelled by upgrade excitement. So, is Avalanche gearing up for another breakout? Stay tuned this could be just the beginning.

Avalanche at $21: The Calm Before the Next Climb?

Avalanche holding steady above $21 reminds us why crypto is so captivating it’s that mix of innovative tech and exciting market twists that keeps us all hooked. Is this calm before a big surge, or just a pause on the way up? Either way, it’s a moment worth watching closely and definitely worth sharing with your friends and fellow crypto fans. In the wild adventure of blockchain, those who stay alert often find the biggest rewards. Avalanche’s story might just be gearing up for its next big climb.

FAQs

- Did China Ban Crypto recently?

No, recent rumors recycle the 2021 ban; no new official policy or statement has been issued by Chinese authorities. - What was China’s 2021 crypto ban?

It prohibited financial institutions from crypto transactions, banned mining, and targeted exchanges to curb capital outflows. - Why are rumors of a new ban spreading?

Unverified social media posts and blogs amplified old news, possibly for engagement or market manipulation. - How do these rumors affect crypto markets?

They can cause temporary dips, like Bitcoin below $115,000, but markets often rebound as the rumors prove baseless. - Is crypto still active in China?

Yes, underground trading via OTC and VPNs persists, while Hong Kong allows licensed exchanges and stablecoin trials.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.