Keeta Crypto (KTA) is making headlines across the crypto world in 2025, with its journey from controversy to resurgence sparking real debate about whether it could become the next breakout Layer-1 blockchain. With high ambitions to bridge both TradFi and DeFi, fast transaction speeds, and a growing list of technical milestones, Keeta’s story is one many in the industry are following closely.

What Is Keeta Crypto?

Keeta is a high-performance, Base-powered Layer-1 blockchain aiming to provide seamless, compliant, and lightning-fast decentralized transactions. It features:

-

Reported throughput of over 10 million TPS and settlement speeds of 400 milliseconds, making it appealing for payments, real-world asset (RWA) tokenization, and fintech applications.

-

Directed Acyclic Graph (DAG) architecture for parallel processing.

-

Delegated Proof of Stake (dPoS) consensus and native on-chain compliance tools (KYC/AML, identity).

-

Designed for use cases like instant cashbacks, FX, digital identity, and cross-currency transactions.

Keeta’s self-reported partnerships including support from former Google CEO Eric Schmidt and focus on real-world integrations have made it a standout amongst new blockchain protocols.

Launch, Setback, and Market Rebound

After launching KTA on Base in March 2025, Keeta faced public skepticism. In June, blockchain sleuths raised concerns over alleged “fake testnets” and perceived insider-heavy tokenomics, triggering a sharp price drop from $1.68 to below $0.60. Keeta responded with a Google-backed public stress test (results verified by external parties) and direct communications through AMAs and status updates. As transparency increased and mainnet performance was publicly demonstrated, trading volume surged and KTA rebounded above $1.00, with renewed whale and retail participation.

Tokenomics and Distribution

-

Total Supply: 1 billion KTA

-

Circulating Supply (August 2025): 406 million

-

Split: 50% community/ecosystem (with future airdrop and incentive allocations), 20% team (9-month lock, 36-month vest), 20% investors (6-month lock, 24-month vest), 10% foundation (48-month vest).

-

Utility: KTA is used for gas, staking, governance, cross-border rewards, and more. Businesses can use it for customer incentives and global payments.

-

Unlocks: Major vesting events, especially one upcoming in September 2025, could influence near-term price and supply.

Exchange Listings and Ecosystem Steps

KTA has secured listings on several leading exchanges, including Kraken, BitMart, and LBank, alongside DeFi venues. This has dramatically increased liquidity and global investor access. The team has focused on building out developer tools (SDKs for mobile and web), KYC/identification modules, and partnerships with fintech platforms for end-user integration.

Verified stress test results and regular public updates have attracted renewed developer and institutional interest. Keeta has also targeted e-commerce, rewards programs, and B2B payments for its first suite of real-world use cases.

Price Analysis and Industry Outlook

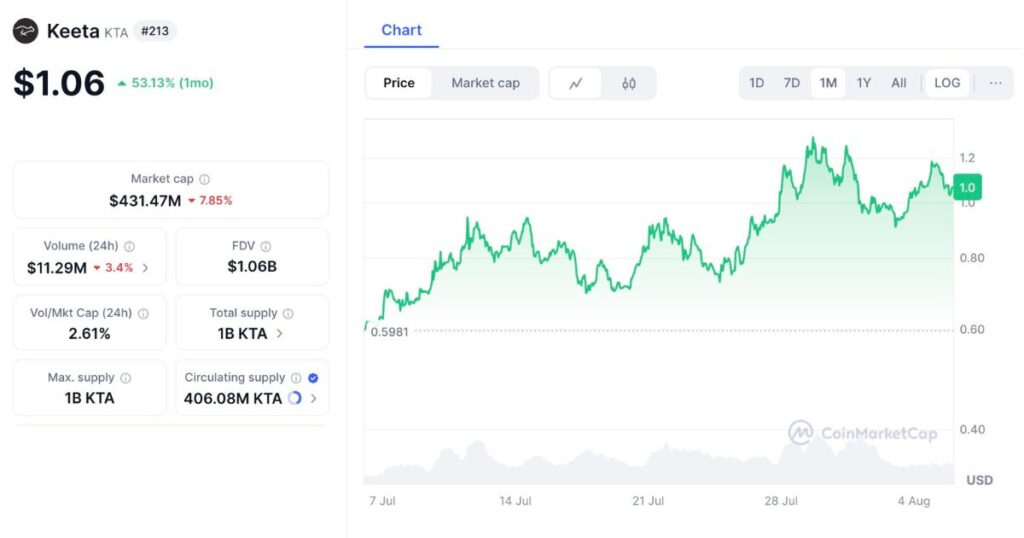

Current Price (August 6, 2025): ~$1.06

Market Cap: ~$431 million

Trading has been highly active, with daily volume above $11 million and a month-long range from $0.60 to $1.25. Much of the price action has coincided with key news events.

-

Short-Term Speculation: Most analysts see KTA consolidating between $1.00 and $1.25 through the fall, especially as major token unlocks approach and new platform features are released.

-

Upside Scenario: If mainnet upgrades and major fintech integrations are completed as promised, bulls speculate KTA could re-test $1.60–$2.00 later in 2025.

-

Long-Term Hype: Extreme speculative targets for late 2025 ($3–$5) depend on successful business adoption, clear regulatory guidance, and broad developer participation.

-

Risks: Delays in roadmap delivery, weaker market sentiment, or excessive new supply could all pressure prices, with potential retests of support around $0.80.

What to Watch

Keeta’s future depends on consistently delivering real technical progress, continuing transparent community engagement, and navigating regulatory and market shifts. The upcoming September supply unlock, the release of SDKs and identity platforms, and the onboarding of actual business clients are critical inflection points. The project’s recovery from FUD and rapid price rebound are promising; however, industry observers remain attentive to whether Keeta will deliver on its promise or face new headwinds as the Layer-1 race evolves.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.