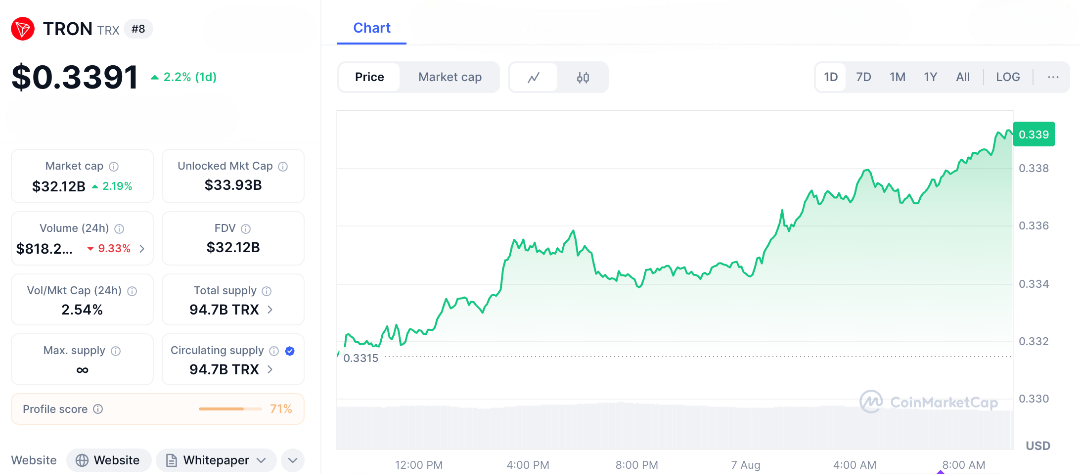

While the focus in crypto often falls on the usual suspects like Bitcoin halvings, Ethereum upgrades, and meme coin mania, Tron (TRX) is quietly experiencing its own rally. As of August 7, 2025, TRX is trading at $0.33, up 2% today, and steadily outpacing major altcoins. Unlike the rapid ups and downs that plague much of the market, TRX’s chart shows a steady, controlled growth. Founded by Justin Sun and initially dismissed as all hype, TRX now moves billions in USDT daily, making it one of the most used blockchains in the world. Long-term holders have recently made $1.4 billion in profits, yet demand remains strong, indicating that new investors might be coming in.

What’s driving this strength? TRX’s dominance in stablecoins, particularly in Asia, low fees, and fast transactions favored by DeFi projects, and a solid base at $0.33 that has held steady even during altcoin market turbulence.

Technical analysts are now forecasting a push to $0.45, pointing to rising trading volumes, large investors buying in, and an ascending triangle forming on the weekly chart. In a year filled with ETF news and tokenization, Tron isn’t making a lot of noise, but it’s showing strong potential. Don’t mistake this quiet for inactivity; TRX could be the surprise success of 2025.

Tron Price Holding Strong

The Tron Price’s solid footing above $0.33 isn’t just luck it’s the result of strong fundamentals and technical signals aligning. With over $81 billion in USDT flowing through the TRX network, it’s dominating the stablecoin scene, leaving rivals behind in the race for DeFi, remittances, and real-world adoption. It’s fast, low-fee architecture makes it a go-to for cross-border payments and high-frequency dApp transactions.

On-chain data confirms the momentum:

-

Transaction volumes in the billions daily

-

Rapid growth in tokenized assets and gaming dApps

-

Circulating supply at 94.7 billion TRX, with a market cap nearing $32 billion

From a technical standpoint, It’s chart is flashing bullish signals:

-

Bullish pennant forming on the daily timeframe

-

RSI at 69, suggesting strength without overbought conditions

-

Key support at $0.33 has absorbed dips, even as Bitcoin slips by 1% this week

Meanwhile, TRX is up 4% weekly, outperforming both Bitcoin and Ethereum signalling rising investor interest.

Why Tron’s Price Might Be Ready to Break Out

What makes Tron’s potential price breakout so exciting and easy to share is that it’s actually doing things in the real world. Unlike many crypto projects that are all hype, Tron stands out because it’s energy-efficient and runs on a proof-of-stake system, which is a big plus for investors who care about sustainability. It’s also teamed up with big names like Tether, giving it a solid role in the global financial space. Long-term holders recently cashed out around $1.4 billion in profits, showing strong confidence in Tron’s future while still reinvesting into it another bullish sign. If the broader economy starts to calm down and the Fed eases up on liquidity fears, Tron’s price could take off again, just like it did in past rallies.

More Than Just a Price Hold—It’s a Power Move

This steady hold at $0.33 shows just how far Tron has come. Once viewed as just a hype project, it’s now proving to be a utility-driven network. This solid foundation could be the stepping stone towards reaching $0.45, rewarding those who have held on.

Tron stands out for its steady growth. Whether the price rises soon or consolidates for a while, Tron’s story is becoming more compelling, especially with user engagement nearly doubling across the network. In a market always chasing the next big thing, Tron might be the unexpected winner of the season. Keep an eye on it, this could be a breakout worth noticing.

FAQs

- What is XRP’s Path to $10?

XRP’s Path to $10 involves factors like regulatory clarity from the SEC lawsuit, ETF approvals, and expanded global partnerships driving demand in 2025. - How could the SEC lawsuit resolution aid XRP’s Path to $10?

A favorable outcome classifying XRP as a non-security could enable ETFs, attracting institutional investments and boosting XRP from $3 to $10 or more. - What role do partnerships play in XRP’s Path to $10?

Ripple’s ODL service with banks in over 40 countries cuts remittance costs by 60%, increasing XRP utility and adoption for potential price surges. - What technical indicators support XRP’s Path to $10?

Bullish patterns like $3 resistance tests and RSI at 62 suggest upside, with forecasts of $7-$10 based on historical rallies and market trends. - What risks might impede XRP’s Path to $10?

Delays in SEC resolution or economic downturns could limit gains, despite XRP’s strengths in fast, low-cost international payments.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.