The journey of XRP has been like a rollercoaster ride in the world of cryptocurrencies. It has seen incredibly high gains and sharp drops, testing the patience and nerves of its investors. In 2017, XRP was less than a penny per coin. Then, in early 2018, it soared to an all-time high of $3.84, an astonishing 38,000% increase, driven by excitement from individual investors and Ripple’s growing partnerships with banks for faster payments.

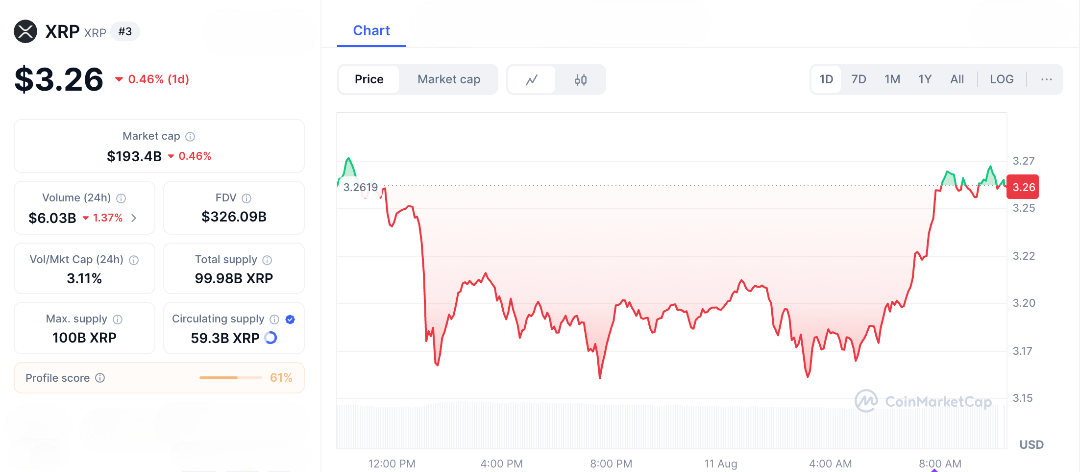

Over the years, XRP’s price movements have reflected its practical uses and the controversies it has faced. Legal battles, regulatory challenges, and success stories in adoption have all had an impact. Currently, XRP is trading around $3.26 in a steadier market, but its price history shows resilience and hints that its story might not be over yet. In the world of cryptocurrencies, previous peaks often pave the way for future highs. If you’re considering your next investment move, keep an eye on XRP, it may have more surprising moments ahead.

From a Penny Token to a Global Sensation

The story of the XRP Chart begins in 2013, when Ripple launched XRP as a fast, low-cost bridge for cross-border payments a big upgrade from slow and expensive traditional wire transfers. For years, XRP’s price barely moved, staying under $0.01. Then came the 2017 bull run, and everything changed. In January, XRP was worth just $0.006. By December, it had climbed to $0.25, and soon after, it rocketed to an all-time high of $3.84. This wasn’t just hype Ripple was running payment pilots in over 40 countries, and excitement grew that it could even challenge SWIFT, the global payments giant.

That meteoric 64,000% surge made XRP one of the top three cryptocurrencies by market cap. But the glory didn’t last long. The 2018 bear market dragged the price down to around $0.28 a 92% crash fueled by regulatory uncertainty and the harsh “crypto winter” that froze momentum across most altcoins.

From Legal Lows to a Comeback Story

By 2020, the XRP Chart hit what many thought was its breaking point. The SEC filed a lawsuit claiming Ripple had sold unregistered securities and the market reacted instantly. XRP’s price crashed from $0.58 to $0.17 overnight, a brutal 70% drop that also saw it delisted from major U.S. exchanges. But XRP wasn’t done. In the 2021 bull run, it roared back to $1.96, boosted by global adoption, before settling around $0.50 as the lawsuit dragged on.

Then came July 2023, the turning point. A partial court win ruling that XRP wasn’t a security when sold to retail investors sent the price up 70% in a day, landing at $0.82. It was proof that XRP’s chart moves fast when legal news hits. Since then, momentum has kept building. On the back of ETF speculation and growing remittance use, XRP climbed to $3, with daily transaction volumes topping $2 billion showing that this token’s story is far from over.

The XRP chart is exciting because its price often makes big moves in response to real-world events and achievements. In 2017, partnerships with banks like Santander triggered a huge increase in XRP’s value. In 2021, the growing remittance market in Asia, worth about $800 billion, gave XRP another boost.

Currently, XRP trades around $3.26 and the chart shows some stability. The Relative Strength Index (RSI) is at 63.05, and support levels near $2.70 have been holding. Analysts think the price could jump to $5 if ETF approvals come through, similar to how Bitcoin surged after its own ETF news. XRP’s price history is full of dramatic rises and falls, rising 1,000% in some months and dropping 90% in others. This makes it a thrilling option for investors.

XRP’s chart reflects Ripple’s ongoing efforts to become a key player in mainstream finance. If blockchain technology truly transforms global payments, XRP’s chart could see another big rise, offering significant potential gains for investors.

The Risks and Rewards Behind the XRP Chart

The XRP chart shows massive gains, but also highlights some risks to be aware of. One major concern is the ongoing regulatory issues, especially with the SEC’s appeal, which could potentially push XRP’s price below $2.50. Additionally, improvements to the traditional SWIFT payments system might limit how high XRP can climb. Despite these challenges, XRP has shown resilience. For example, after dropping to $0.17 following a lawsuit, it rebounded to $3, marking a 1,600% gain due to increased adoption. For investors, the XRP chart is more than just numbers; it represents a range of opportunities. Currently, the price of $3.26 seems to be a stable base before the next significant move.

FAQs

- What is the highest peak on the XRP Chart?

The XRP Chart shows an all-time high of $3.84, reached in early 2018 during a 38,000% rally from $0.006. - How did the SEC lawsuit impact the XRP Chart?

The 2020 SEC lawsuit triggered a 70% drop from $0.58 to $0.17, with a 2023 partial win boosting XRP to $0.82. - What caused the 2017 surge on the XRP Chart?

Bank partnerships and exchange listings drove XRP from under $0.01 to $3.84, a massive 38,000% gain. - What is XRP’s current price on the XRP Chart?

As of August 11, 2025, the XRP Chart shows XRP at around $3, with a $170 billion market cap. - Could the XRP Chart signal another big move?

ETF approvals and growing payment adoption could push XRP to $5, echoing past rallies on the XRP Chart.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.