On August 13, 2025, Wall Street witnessed one of the most dramatic crypto listings in its history as Bullish, an institutional crypto exchange platform, made its debut on the New York Stock Exchange (NYSE) under the ticker “BLSH.” Far from a routine financial event, this IPO has galvanized market sentiment, sparked conversation across finance circles, and reshaped expectations for the next wave of crypto adoption.

A Fast-Growing Exchange Takes Center Stage

Founded in 2020 and led by ex-NYSE president Tom Farley, Bullish spent two years preparing for its public listing, ultimately opting for a traditional IPO after an earlier SPAC attempt fell through due to regulatory uncertainty. What set Bullish apart was its explicit targeting of institutional clients, a market segment now at the center of crypto’s next phase due to rising corporate treasuries in digital assets and recent White House directives allowing crypto in 401(k) plans.

Ahead of its listing, the company raised $1.11 billion at a final IPO price of $37 per share, handily exceeding earlier guidance and giving Bullish an initial valuation of $5.4 billion

IPO Day: A Surging Valuation and Wall Street Frenzy

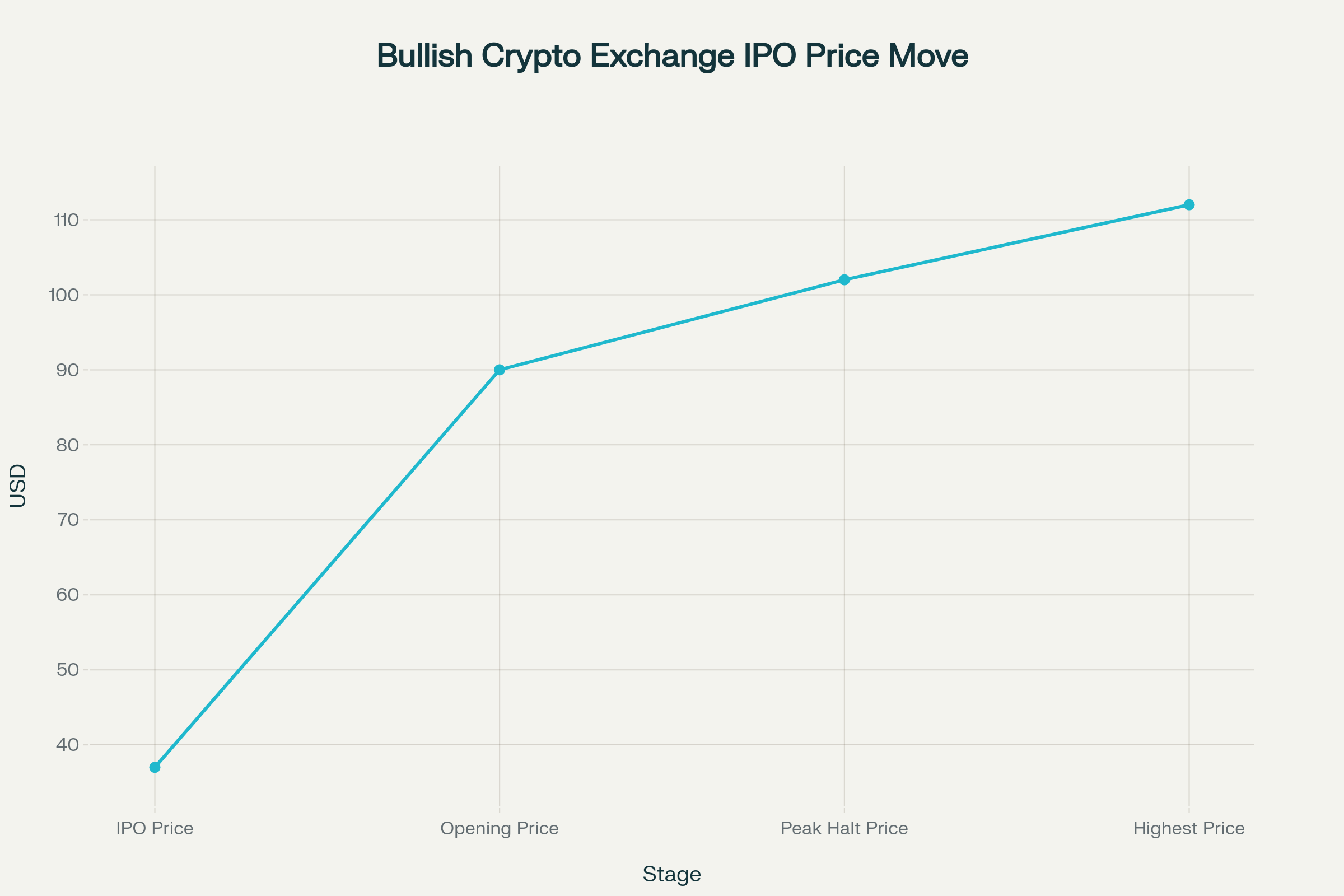

When trading began on August 13, Bullish shares opened at $90, a staggering 143% leap above the IPO price. Within minutes, the stock was halted several times for volatility as it hit $102 and surged as high as $112 during the intraday session. By the end of trading, Bullish’s market capitalization neared $14 billion, placing it among the most valuable publicly listed crypto companies globally.

Bullish (BLSH) NYSE debut, August 13, 2025. Share price action from $37 IPO, $90 open, $118 peak, settling near $92.

Major institutions such as BlackRock and Ark Invest were early buyers. By afternoon trading, the share price had consistently held gains of over 150% above the IPO price.

Why the frenzy? Several factors converged:

-

Pent-up institutional demand: Major funds, including BlackRock, ARK Invest, Galaxy Digital, and Peter Thiel’s Founders Fund, were early and aggressive buyers.

-

Proven institutional focus: Unlike retail-centric rivals, Bullish targets corporate treasuries, asset managers, and professional traders, offering high liquidity and regulatory compliance.

-

Ownership of CoinDesk: Combining a major crypto news/data platform with exchange infrastructure provides Bullish unique synergies and informational edge.

-

A renewed IPO market: Bullish’s public debut follows on the heels of other successful fintech/crypto listings, like Circle, boosting overall appetite and confidence in the sector.

Financials, Fundamentals, and the Institutional Bet

Bullish’s journey to the NYSE was paved with rapid growth. In the first quarter of 2025 alone, trading volumes jumped 78% year-over-year; through March, the exchange averaged $2.55 billion in daily trading volume and surpassed $1.25 trillion in lifetime trading volume since its 2021 launch. While posting a Q1 net loss, Bullish projects Q2 profitability with net income estimated between $106 million and $109 million.

Backing this financial growth is a strong liquidity base: Bullish disclosed about $2 billion in crypto reserves (mostly Bitcoin), with allocations to Ethereum and stablecoins, ensuring the exchange can weather large-scale transactions and market shocks.

How the IPO Reflects and Shapes the Crypto Landscape

Bullish’s public debut is more than a one-off success:

-

Legitimizing the institutional crypto narrative: As regulatory clarity improves, more exchanges and infrastructure providers are confident stepping onto public markets.

-

Setting the standard: The combination of institutional-grade trading, robust compliance, and media integration could become a blueprint for future crypto IPO aspirants.

-

Momentum for other listings: Bullish’s stunning debut is likely to embolden other crypto companies, such as Gemini and Grayscale, already reported to be considering public offerings.

-

A vote of confidence in U.S. regulatory evolution: With the White House and lawmakers clarifying legal environments (especially for stablecoins), both companies and investors now see a clearer path to mainstream adoption.

How Does Bullish Compare to Other Crypto IPOs in 2025?

Bullish’s blowout debut is part of a powerful pattern in 2025:

-

Circle Internet Financial, issuer of USDC, staged a successful Nasdaq listing in June, raising over $1B and seeing a 168% first-day pop.

-

Galaxy Digital (Mike Novogratz) moved its shares to Nasdaq from TSX in May, further legitimizing regulated crypto trading infrastructure.

-

eToro and CoreWeave have also completed major IPOs this year, with Figma (software) riding fintech/crypto IPO waves to a first-day rally of over 250%.

-

Gemini and Grayscale have confidentially filed for IPOs, expected to follow soon

This rush highlights institutional investors’ growing comfort with public crypto companies and rising demand for diversified exposure to the digital asset sector.

Risks and Realities

Despite the exuberance, challenges remain. Crypto markets are notoriously volatile, and rivals like Coinbase, Gemini, and Binance still dominate retail flows. Bullish’s future will be shaped by its ability to sustain institutional growth, diversify revenue streams, and remain nimble as regulations continue to evolve.

The Road Ahead for Bullish and Crypto Stocks

With a $13B+ valuation, seasoned leadership, and a compliance-first ethos, Bullish is now a reference play for Wall Street’s push into digital assets. The company plans to convert a significant portion of its IPO proceeds into stablecoins was clarified by the Genius Act.

Bullish’s New York BitLicense is close to approval, further expanding its regulatory footprint and signaling a coming wave of licensed, institutional crypto venues. The firm, through CoinDesk, will also help shape market education and data standards, offering a unique integration of trading and trusted information to clients.

Despite the exuberance, challenges remain. Crypto markets are notoriously volatile, and rivals like Coinbase, Gemini, and Binance still dominate retail flows. Bullish’s future will be shaped by its ability to sustain institutional growth, diversify revenue streams, and remain nimble as regulations continue to evolve.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.