- Binance led July 2025 with 39.8% market share and $698.3B in spot trading volume.

- MEXC rose to second place with $150.4B volume, marking strong growth from June.

- Top 10 exchanges saw Q2 volumes drop 27.7%, with Crypto.com recording the steepest decline.

Binance retained its position as the largest centralized cryptocurrency exchange in July 2025, with a 39.8% share of global spot trading volume. The platform processed $698.3 billion in trades during the month, a 61.4% increase from June’s $432.6 billion. The surge in activity coincided with a broader market rally, driven in part by Bitcoin reaching new all-time highs.

Data from July showed a large gap between Binance and its nearest competitors. MEXC ranked second with an 8.6% share and $150.4 billion in spot trading volume, marking a 61.8% increase from June’s $93.0 billion. Gate placed third with a 7.8% share and $137.2 billion in volume, up 61.3% month-on-month.

Top 10 Centralized Crypto Exchanges by Market Share

1. @binance – 39.8%

2. @MEXC_Official – 8.6%

3. @Gate – 7.8%

4. @bitgetglobal – 7.6%

5. @Bybit_Official – 7.2%

6. @Official_Upbit – 6.3%

7. @okx – 6.0%

8. @HTX_Global – 5.8%

9. @coinbase – 5.8%

10. @cryptocom – 5.1%— CoinGecko (@coingecko) August 14, 2025

The rest of the top 10, Bitget, Bybit, Upbit, OKX, HTX, Coinbase, and Crypto.com, held a combined 43.8% market share, with individual shares ranging between 5% and 7%. Binance’s lead in both liquidity and transaction volume remained unmatched, reinforcing its dominance in the sector.

On a quarterly scale, as reported by Blockchain Magazine, Binance processed $1.47 trillion in Q2 2025, representing 38.0% of the top 10’s $3.8 trillion total volume. However, the figure was down 21.6% from Q1’s $2.0 trillion, showing a softer market before July’s rebound.

Binance’s Competitors See Shifts in Rankings

MEXC’s July performance marked its second-best month of 2025, trailing only May’s $163.1 billion. Its Q2 volume rose to $346.2 billion from $334.0 billion in Q1, a big increase from its eighth-place ranking earlier in the year.

Coinbase fell to ninth in July with a 5.8% share and $101.7 billion in trading volume. Although it posted the largest month-on-month growth in the top 10 at 82.6%, up from $55.7 billion in June, Coinbase has seen its market share decline from 7.0% in January. The drop in activity came alongside a decrease in Coinbase’s (COIN) share price, despite favorable U.S. regulatory conditions.

Overall, seven of the top 10 exchanges recorded lower volumes in Q2 2025. Crypto.com experienced the highest drop, falling 61.4% from $560.2 billion in Q1 to $216.4 billion in Q2. Combined, the top 10 saw a 27.7% decrease in volumes, down $1.5 trillion from the prior quarter.

Binance Performance in the Context of 2024 Trends

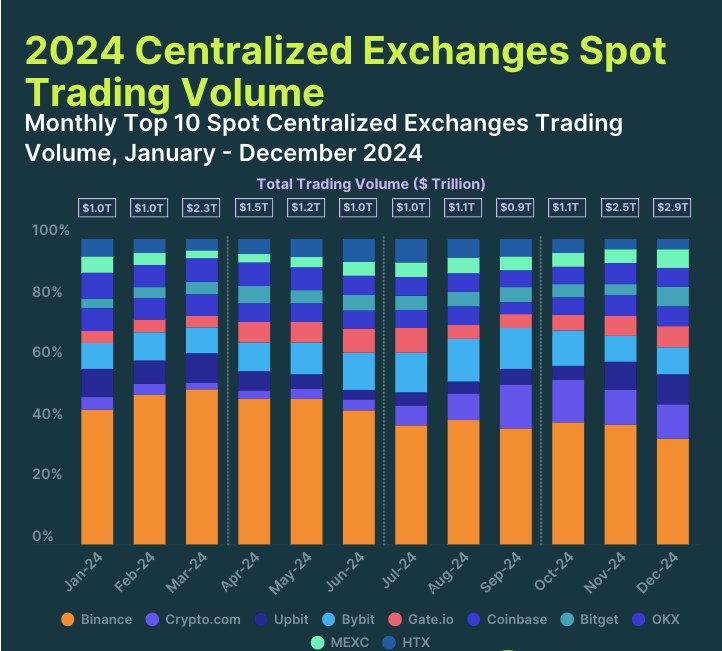

Trading data from 2024 shows the market environment leading into 2025. Monthly volumes for the top 10 centralized exchanges fluctuated between $0.9 trillion and $2.9 trillion. Activity surged in March, November, and December, with the year’s peak in December at $2.9 trillion.

Source: Coingecko

Binance maintained the largest share throughout 2024, though its proportion shifted during months of heightened market activity. OKX and Bybit made late-year gains, narrowing the gap slightly.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.