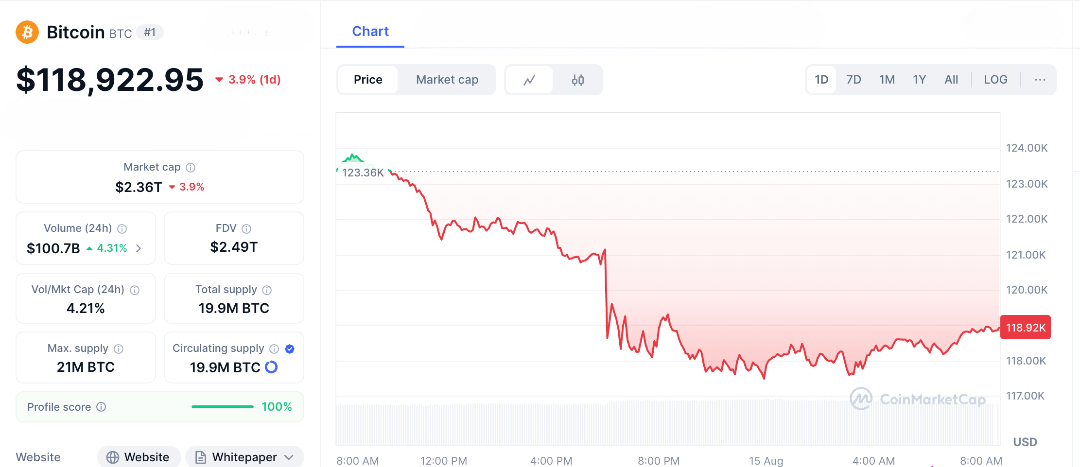

Today, August 15, 2025, the crypto market experienced chaos as over $1 billion was wiped out, causing concern among traders. Some fear this could be the start of a long bear market, while others see it as a great chance to “buy the dip.” Yesterday, hotter-than-expected U.S. PPI data indicated that inflation might still be on the rise, leading to a sharp market reaction. Bitcoin fell by 5% to $118,000, and the overall crypto market cap dropped by 3.49% to $4.03 trillion before making a slight recovery.

The most significant impact was the loss of over $577 million in long positions within just one hour, showing how quickly things can change in the crypto world. Is this a short-term drop before prices bounce back, or the beginning of a more prolonged downturn? Only time will tell.

Panic, Potential, and a Perfect Storm

Let’s break down what just happened in the wild world of crypto. The trigger? July’s U.S. Producer Price Index (PPI) came in at 0.2% month-over-month, higher than the expected 0.1%. That tiny difference sparked big fears that the Fed might delay rate cuts bad news for risky assets like crypto. Bitcoin, the market’s trendsetter, took the first hit dropping to $117,254 before bouncing back to around 118,922 . Ethereum wasn’t spared either, sliding 7% to $4,638 as altcoins across the board turned red.

The impact was severe, with liquidations skyrocketing by 90% to over $1 billion, quickly wiping out leveraged long positions. This wasn’t limited to crypto; global stock markets also took a hit, especially with Trump’s talk of tariffs adding to the cautious mood. However, crypto’s use of high leverage made the sell-off much worse. What could have been a minor correction turned into a major downturn.

Is This the Start of a Bear Market or a Golden Dip?

The big question on everyone’s mind, Is the bear run just starting?

Bears are worried. They highlight that Bitcoin’s Relative Strength Index (RSI) was over 70 before the crash, typically a sign that it was “overbought.” Economists are also cautioning about a possible severe downturn that could drop valuations to $93 billion if history repeats itself. Concerns about new trade wars from tariff discussions and persistent inflation add to the gloomy outlook. If inflows from ETFs slow down in this uncertain climate, there could be room for a further drop.

On social media platform X, opinions are divided. Some predict a wild $1 million Bitcoin surge followed by a sharp crash, while others view this as a typical market correction.

BREAKING: 💥Over $1 BILLION in crypto positions liquidated in the last 24 hours.

The market just went through a bloodbath. pic.twitter.com/TaQzNS7JzN

— Crypto Decode (@TheCryptoDecode) August 14, 2025

Bulls, meanwhile, are digging into history. They note that post-halving dips often come before big rallies. With Bitcoin’s dominance slipping below 50%, they’re eyeing the possibility of alt season a period when altcoins surge. If this crash shakes out weak hands, they argue, it could be the perfect time to buy. After all, similar liquidation events in the past have been followed by 20–50% rebounds within weeks.

The recent crypto crash shows just how risky leveraging can be. In just one hour, $577 million was wiped out, highlighting why over 90% of futures traders often lose money. However, panic can also bring opportunity. Big investors took advantage of the dip to buy more, and on-chain data shows that the number of Bitcoin addresses has reached an all-time high, indicating strong long-term confidence.

If the Federal Reserve reduces interest rates and tariff tensions ease, this could be the market’s bottom, turning today’s losses into tomorrow’s gains. Historically, such periods of fear often lead to weak investors selling off, while patient buyers build their positions.

The Viral Takeaway – Bull or Bear, It’s Your Move

Here’s a crucial tip, learn from this crash to protect your portfolio. Avoid using too much leverage, keep your cryptocurrency safe in a cold wallet, and confidently buy during dips. History shows that patience often pays off in crypto. If we are entering a bear market, it’s wise to build up cash reserves. But if this is just a temporary dip, buying Bitcoin at $120K could turn out to be a smart move.

This crash might spark the next big bull run, or it could lead to a longer downturn. Share if this drop affected your investments or if you’re taking the opportunity to buy. Whether the market turns bullish or bearish, the decision is in your hands.

FAQs

What caused the recent Crypto Crash?

The Crypto Crash was triggered by hotter-than-expected U.S. PPI data at 3.3% YoY, raising fears of delayed Fed rate cuts, sparking a $1.03B liquidation wave.

2. How much was liquidated in the Crypto Crash?

Over $1.03B in positions were liquidated in 24 hours, with $787.5M from long positions, affecting 215,000 traders, led by Ethereum and Bitcoin.

3. Is the Crypto Crash the start of a bear market?

It might signal a bearish phase if macro pressures persist, but historical post-halving dips suggest a potential rebound, making it a buy-the-dip opportunity.

4. Which cryptos were hit hardest in the Crypto Crash?

Ethereum led with $322M in liquidations, followed by Bitcoin at $113M, with XRP, Solana, and Dogecoin also facing significant losses.

5. Should I buy the dip after the Crypto Crash?

Buying could be strategic if support levels hold (e.g., BTC at $118K), but diversify, use dollar-cost averaging, and monitor macro signals to manage risks.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.