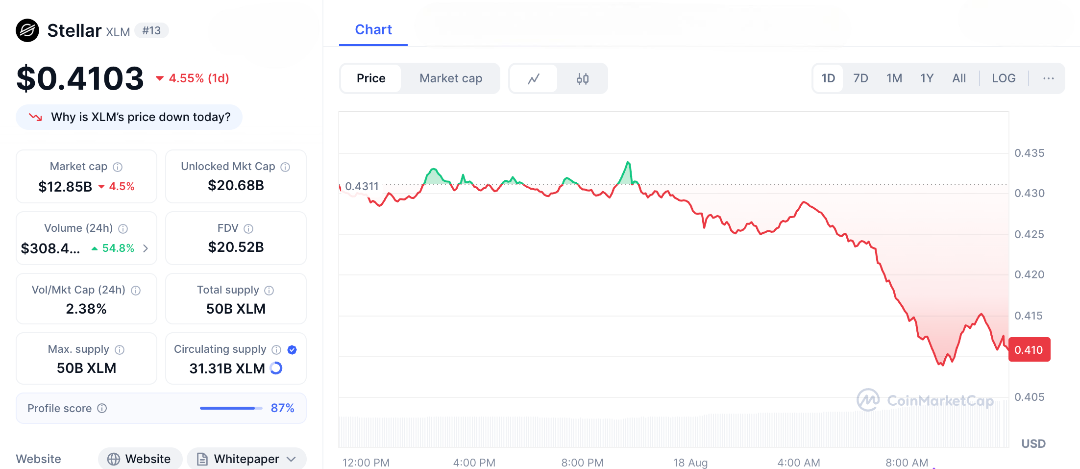

XLM has quietly navigated the ups and downs of the crypto market, supporting Stellar’s mission for fast and affordable global payments. Back in 2017, XLM was trading for less than $0.01 before skyrocketing by 38,000% to reach $0.93 due to growing interest. Today, it trades at $0.41 and is testing resistance at $0.433, with the potential to rise to between $0.47 and $0.52. This potential move is generating interest among traders.

With Stellar maintaining its position at $0.41, it’s clear that momentum is quietly building. Social media is buzzing with discussions and charts showing “XLM to $0.52 buy the dip?” If XLM manages to clear the $0.433 resistance level, it could signal a significant breakout, making it a rally worth paying attention to.

XLM Price Rally

The recent XLM price rally isn’t just about charts it reflects real adoption on the Stellar network. Over 100 million smart contract transactions have been processed, with borrowing, lending, and tokenisation attracting users to Stellar’s low-fee ecosystem. Confidence is growing further as Paxos plans to expand stablecoins onto Stellar, positioning Stellar as a bridge for global finance in the $800 billion remittance market. On-chain metrics back the bullish case, daily transactions are up 40% quarterly, and wallets are growing steadily, with 5,000 new addresses added weekly, showing demand beyond mere hype.

Currently, XLM trades at $0.41, giving it a market cap of $12 billion still a fraction of its potential. Technical charts hint at a bullish flag pattern, with RSI at 47, suggesting there’s room for upside without overheat. If Stellar breaks resistance at $0.433, it could target $0.47–$0.52, offering 20% gains in a short window .

The recent rise in XLM’s price isn’t happening by accident. It’s part of Stellar’s growth from a basic payment system to a more complex DeFi hub. New upgrades like Soroban are adding smart contracts, which attract more developers to Stellar’s network.

However, there are still risks. If XLM can’t break through the $0.433 resistance level, the price might fall back to $0.3788, especially if the overall market, including Bitcoin, takes a hit. Competition from XRP or upgrades from Swift could also limit its gains. Yet, Stellar’s fast and cheap transactions give it an advantage.

A successful breakout past $0.433 could lead to the next big phase for altcoins, especially if Bitcoin stabilizes. As adoption grows, Stellar could reach $0.52. The resistance levels between $0.433 and $0.47 are crucial. This moment of potential breakthrough is more than just numbers on a chart, it’s capturing the interest of the crypto community.

With Stellar working on new partnerships and expanding its DeFi offerings, everyone is watching to see if it will reach the $0.47–$0.52 range or if this is just a temporary rise. If XLM breaks through, the next surge could be significant, making it a key move to monitor. Keep an eye on Stellar because the next few days could be crucial for its future.

FAQs

- What is the current XLM price?

As of August 18, 2025, the XLM price is $0.41, with a $12 billion market cap after an 87% weekly rally. - Why might XLM price reach $0.47–$0.52?

Clearing $0.433 resistance, supported by bullish patterns and Stellar’s adoption, could push XLM price higher. - What fuels XLM price growth?

Stellar’s 100 million smart contract transactions and stablecoin expansions like Paxos drive demand for XLM. - What risks could impact XLM price?

Failure to break $0.433 or competition from XRP might see XLM price drop to $0.3788 supports. - What makes XLM stand out?

XLM powers fast, low-cost payments in the $800 billion remittance market, enhanced by DeFi upgrades like Soroban.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.