Sei crypto is gaining attention, with some analysts predicting it could rival Ethereum by 2025, not through hype but with strong technology. Sei Network is designed for speed and efficiency, unlike general-purpose blockchains. It offers sub-second finality and high throughput, making it faster than older chains.

While Ethereum is dealing with upgrades to fix congestion and high fees, Sei Network offers a future where decentralized finance (DeFi) is quick and smooth. Founded by experts in order book efficiency, Sei Network has been compared to high-frequency trading systems, attracting those frustrated with Ethereum’s slow speeds. The SEI token soared above $1 during market highs but has since faced challenges. With strong metrics and growing interest, the big question is, Can this underdog outperform Ethereum?

Recall Sei’s humble beginnings a specialised chain optimised for exchanges, where transactions settle in milliseconds without the drama of rollups or sharding debates. Unlike Ethereum’s monolithic approach, it employs a twin-turbo consensus, blending Tendermint with custom tweaks for parallel processing. This isn’t abstract tech it’s the backbone for perpetuals, spot markets, and NFTs that flow without friction. Early adopters flocked as protocols like DragonSwap and Yaka Finance built empires, locking billions in value. Yet, volatility struck, with SEI dipping below $0.20 at times, as Ethereum’s vast ecosystem retained its throne through sheer inertia.

Sei Crypto has significantly expanded its utility through partnerships with Chainlink oracles and Bitcoin bridges via Fiamma. However, what really surprised many was Sei’s shift to gaming. Its low latency attracted popular games like Idle Glory and Kawaii Puzzle, making it a leader in daily plays within the Web3 gaming space. August 18, 2025, is a notable day for Sei Crypto, as it reached important milestones, proving that it’s thriving. The network’s daily active addresses have surpassed 1 million for the second time, showing strong and consistent adoption.

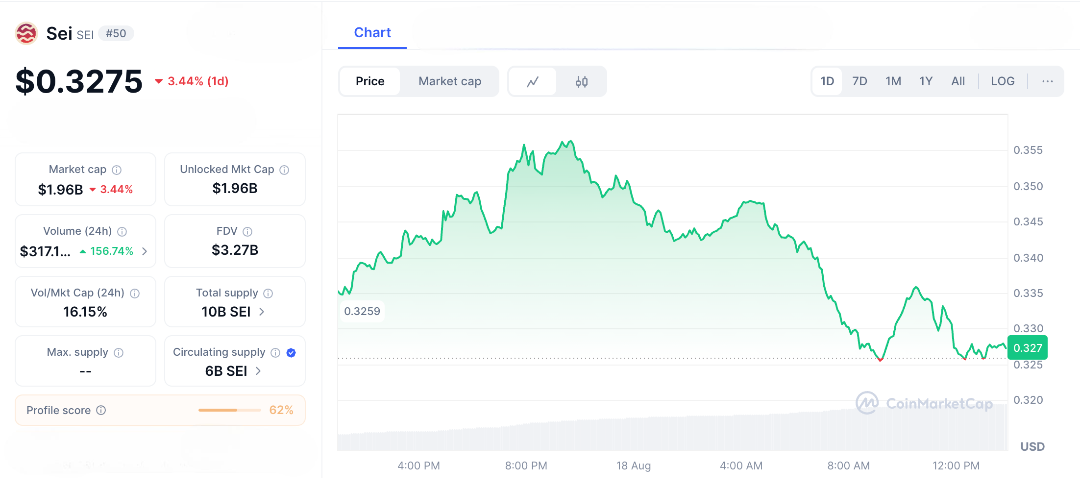

SEI’s price has climbed to around $0.32, fuelled by whale activity and overall market strength. The network now hosts over 50 million wallets, and $160 million in native USDC minted in weeks highlights its growing dominance in stablecoin activity, outpacing competitors like Tron and Algorand. Cross-chain activity is booming too. The Fiamma Bridge is live, letting Bitcoin move onto Sei trustlessly, unlocking new liquidity flows. Meanwhile, regulators are watching, with Wyoming’s Stable Token Commission considering Sei for blockchain initiatives a potential green light for institutional adoption.

It’s gaming ecosystem adds another layer of excitement. DappRadar ranks it as a leader, while the AI Accelathon offers $1 million in prizes, drawing builders eager to innovate. Combined with all-time highs in transactions, active wallets, and TVL, it is proving that it’s more than just hype it’s a fast-growing, high-performance blockchain ready for mainstream attention.

Sei Crypto’s Potential and Challenges Ahead

Analysts are excited about Sei Crypto, with one even calling it the “Solana of 2025” due to its high speed and developer-friendly features. Can it outperform Ethereum? The data suggests it might.

$SEI Update$SEI is clearly following my secondary expectation, which means we are likely building a larger and more complex sideways correction rather than finishing it right away.

This suggests that we could still see a move down into the $0.24 area, which would provide… pic.twitter.com/n9yNAKFr9k

— Crypto Wave Vision (@CryptoWaveV) August 18, 2025

While Ethereum struggles with high gas fees despite upgrades, Sei offers fees below a penny and a capacity of 12,500 transactions per second (TPS). This makes it well-suited for a booming tokenized asset market, which Chainlink predicts could reach $30 trillion by 2034. If real-world assets move to blockchain, Sei’s efficient and secure infrastructure could take a significant share of Ethereum’s DeFi market. Integrations like MetaMask are enhancing Sei’s presence in gaming and DeFi. Its strong tokenomics, with a capped supply and around 10% staking yields, along with initiatives like the OpenPad AI collaboration, support its growth.

However, Sei faces challenges. Ethereum has a huge network with trillions of dollars locked in, and regulatory changes could impact crypto markets. Competitors like Sui and Aptos are also aiming for the top spot, and market downturns could slow Sei’s momentum.

Still, Sei’s performance is impressive, with metrics exceeding expectations. As one analyst said, “Sei isn’t just trying to catch up to Ethereum; it’s outpacing it in important areas.”

Sei’s journey from a niche player to a potential leader reads like an exciting story. If current trends continue, Sei could challenge the status quo in the crypto world. Keep an eye on Sei crypto updates, they might signal the rise of a new major player. Share this with your friends because in the world of blockchain, the underdog might just rise to the top.

FAQs

- What is Sei crypto news about?

Sei crypto news highlights the Sei Network, a layer-1 blockchain optimized for trading and gaming, with its native token SEI. - Can Sei outperform Ethereum in 2025?

Analysts predict Sei could surpass Ethereum in niches like DeFi and gaming due to its speed and low fees, though risks remain. - Why is Sei gaining attention?

Sei crypto news points to record active addresses, USDC adoption, and gaming dominance, driving SEI’s price and ecosystem growth. - What makes Sei unique?

Sei’s parallelized EVM and sub-second finality excel for high-frequency trading and Web3 gaming, outpacing Ethereum’s scalability. - Is SEI a good investment?

Sei’s strong metrics and partnerships suggest potential, but crypto volatility requires careful research before investing.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.