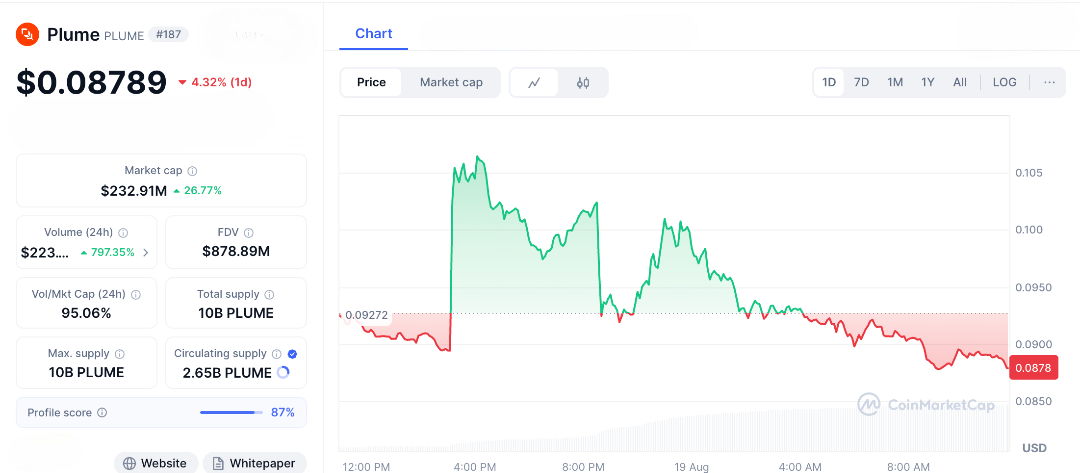

Plume Coin is a token designed to support a blockchain built for real-world assets (RWA) like real estate, commodities, and carbon credits. Its price has recently dropped 4.32% to around $0.087. This dip has split investors, some see it as a great buying opportunity, while others worry it might fall further.

Plume Coin isn’t just another altcoin. It aims to make traditionally hard-to-trade assets easier to exchange, more profitable, and free from lots of paperwork and middlemen. The idea quickly attracted attention. The team behind Plume Coin sees huge potential in the trillion-dollar RWA market.

Plume Coin is used for staking, governance, and ecosystem rewards, aiming to unlock significant liquidity. Initially, the hype around its low fees and smooth integration boosted its price. However, challenges like market fluctuations, investor uncertainty, and competition from big players like Ondo and Mantra have caused its value to decline from earlier highs. Today, Plume Coin is at a crucial point. Will it prove to be a hidden gem ready to rise, or just another project struggling in a competitive market? Only time will tell.

Just yesterday, Plume Coin shot up 18% after Binance announced its inclusion in the HODLer Airdrops program, distributing 150 million tokens to eligible users. The listing brought fresh liquidity with USDT and BNB trading pairs, sparking a frenzy as prices briefly touched $0.102. But the high didn’t last long. A glitch in the airdrop rollout triggered a sudden dip, only for Binance to resolve it swiftly, leading to a 2.6% rebound to $0.1006. The episode showcased crypto’s trademark volatility euphoria one minute, panic the next.

We are now witnessing the collapse of Binance. This coin was just listed and look at the situation unbelievable! @cz_binance if you don’t change your team, you will end up in the dark pages of history. What a disgrace 😓🤯 #PLUME pic.twitter.com/36fXuDZohV

— Coin Borsa X (@CoinBorsaX) August 18, 2025

Today, however, bears regained control. Plume slid 4.32% amid broader market jitters, settling at $0.0878, with daily trading volume crossing a hefty $223 million. On social feeds, dip-buyers were quick to pounce one user dubbed the slump a “good opportunity” while on-chain data hinted at whales quietly accumulating.

Analysts, meanwhile, point to technical signals worth watching:

-

Moving averages show a bullish cross, suggesting potential upside.

-

Key support hovers near $0.085 if it holds, reversal momentum could kick in.

-

Still, the token is down 3.9% over the week, raising the classic crypto question, Is this a floor, or a trapdoor?

For now, Plume’s trajectory sits at a crossroads. The airdrop hype proved it can capture attention but sustaining momentum may depend on whether bulls defend that fragile support zone or whether bears drag it deeper into correction territory.

At $0.087, Plume Coin sits at a critical crossroads. Optimists call it the ground floor, pointing to Binance’s recent airdrop listing as a catalyst that placed the RWA-focused token firmly on the mainstream radar. With RWAs expected to expand into a multi-trillion-dollar market, Plume’s early positioning in DeFi integrations whether tokenising oil royalties or looping carbon credits offers a narrative bulls believe could drive the next leg higher.

The Bull Case

-

Catalysts: Binance exposure, rising RWA adoption, and institutional experimentation with tokenised treasuries.

-

Forecasts: Some analysts see near-term upside toward $0.097 by month’s end, with longer-term projections as high as $0.195 in 2026 if adoption accelerates.

-

Tokenomics Tailwind: Grants, airdrops, and ecosystem incentives continue to incentivise participation, while capped supply creates potential scarcity.

The Bear Case

-

Competitive Pressures: Rivals like Centrifuge and Ondo already command significant RWA mindshare, fragmenting the space.

-

Macro Risks: Higher interest rates and regulatory scrutiny could dampen tokenised yield products, slowing inflows.

-

Technical Fragility: A clean break below $0.080 may spark panic selling, especially if trading volume thins out, undermining confidence.

Verdict

Plume Coin’s story is less about today’s dip and more about whether it can sustain real adoption in an increasingly crowded RWA race. For now, $0.087 could be a launchpad or a ledge. All eyes are on whether bulls can defend support and convert narrative momentum into tangible growth.

Plume Coin— Dip or Diamond?

In the ever-changing world of crypto, Plume Coin’s journey feels like an underdog story. It experiences bold innovations but also faces market ups and downs. One day its value soars, and the next it dips, showing that in the world of crypto, today’s drop could become tomorrow’s success or a cautionary lesson. With rumors of more airdrops circulating, the suspense is high. Will buyers come in at $0.087, or will the value slide further? Either way, it’s a story worth keeping an eye on.

FAQs

- What is Plume Coin?

Plume Coin (PLUME) is the native token of the Plume Network, a layer-2 blockchain on Ethereum for tokenising real-world assets like real estate and carbon credits. - Why did Plume Coin slump 4%?

Plume Coin dropped to $0.089 due to market volatility and airdrop-related sell pressure, despite recent Binance listing hype. - Is $0.08 the bottom for Plume Coin?

It could be a buying opportunity if support holds, but further dips are possible if market sentiment sours or volume fades. - What makes Plume Coin unique?

Plume Coin powers a modular blockchain for RWA tokenisation, offering low fees, compliance tools, and DeFi integration for assets like art and commodities. - Should I invest in Plume Coin?

With strong fundamentals and growth potential, Plume Coin is intriguing, but its volatility requires careful research and risk assessment.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.