API3, a decentralized oracle network, has gained significant attention after being listed on Upbit, South Korea’s largest exchange. Its price jumped by over 100% in just a few hours, sparking excitement among traders and investors about whether this rally will continue or settle down soon.

API3 acts as a reliable bridge in the crypto world, linking smart contracts to external APIs without the usual weaknesses of traditional oracles. This ensures that data like DeFi prices, weather information, and other real-world feeds are secure and accurate. The team behind API3 created Airnode, a serverless node that developers can run themselves, cutting costs and reducing risks.

In its early days, API3 gained traction during the “oracle wars” by partnering with chains like Polygon and Avalanche. However, market downturns kept it under the radar. With the recent Upbit listing, API3 is stepping into the spotlight and positioning itself as a key player in providing trustworthy data for Web3.

API3’s Big Moment

The excitement around API3 starts with its smart approach to oracles. Unlike competitors that rely on third-party nodes, which can be manipulated, it lets API providers deliver data directly, backed by staking and insurance systems that keep everyone honest. This design has attracted serious partners, including Chainlink alternatives and DeFi projects hungry for dependable feeds. Token holders also benefit they can stake API3 for governance and rewards, and with a capped supply of 1 billion, scarcity adds extra appeal.

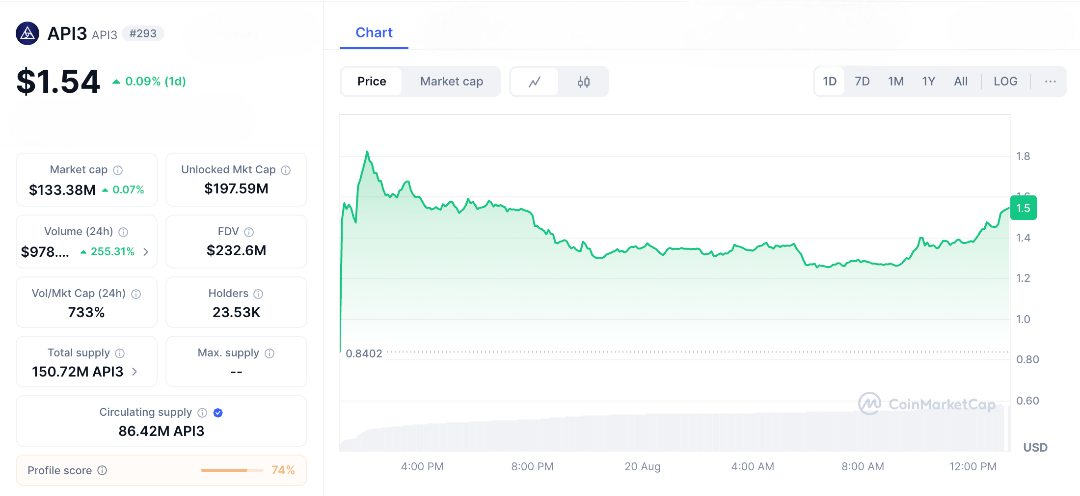

Past rallies came from tech upgrades like the OEV Network, which maximizes value for oracles, but nothing compared to yesterday’s surge. Upbit, South Korea’s major exchange, announced API3 listings with KRW and USDT pairs, sparking a frenzy. The token soared 121%, hitting an 8-month high near $1.86, with trading volume exploding past $1 billion far above its usual activity. Social media lit up with stories of overnight wins, one trader joking it felt like “waking up to a lottery” as Korean whales jumped in.

Will API3’s Momentum Continue After Its Surge?

After API3’s recent price jump, the big question is whether this momentum will keep going or take a break. The charts look promising, showing a break from a long-term downward trend and stabilizing above $1.25. Analysts believe that if the price stays above $1.35, it could climb another 70–75% to reach $2.50, especially if other altcoins also rise.

The positive outlook is supported by strong fundamentals. API3’s oracle network secures over $80 billion in value across various ecosystems, and recent funding is boosting tools for AI-powered data feeds. More protocols may move away from centralized oracles to adopt API3’s decentralized model, which could sustain the rally. Even large investors, known as whales, are accumulating API3, indicating they see long-term potential.

While the recent surge is exciting, a pause might be expected. It’s common for prices to dip after such rallies as early traders take profits. Currently, API3 is trading around $1.54, reflecting overall market uncertainties with Bitcoin near support levels. A drop to $1.00–$1.20 could actually be healthy, allowing the market to stabilize before potentially rising again. However, there are risks. Competitors like Pyth or Band Protocol could affect gains, and regulatory issues in Korea might cause volatility.

Still, It’s real strength lies in its first-party oracles. By delivering data directly from providers, it reduces downtime and security risks a big advantage when data breaches can cost billions. In short, a short pause might just set the stage for the next big move.

API3’s journey in the crypto world shows a lot of promise. The recent Upbit listing wasn’t a one-time event; it’s a sign that decentralized data is becoming important. Some traders even think the price could reach $6 after a short pause. So, should traders jump in now or wait for things to stabilize? While no one can predict the future, the charts suggest there are more opportunities ahead.

FAQs

- What is API3?

API3 is a decentralised oracle network enabling secure, direct data feeds for smart contracts, with its native token fuelling staking and governance. - Why did API3 surge after the Upbit listing?

API3 jumped 121% to $1.86 due to Upbit’s listing, boosting liquidity and trader excitement in South Korea. - Will API3 continue its rally or consolidate?

API3 could rally to $2.50 if it holds above $1.35, but a dip to $1.00-$1.20 is possible for consolidation. - What makes API3 unique?

API3’s first-party oracles, via Airnode, offer tamper-proof data feeds, securing $80 billion across DeFi and AI applications. - Is API3 a good investment now?

API3’s utility and listing momentum are promising, but volatility and competition require careful research before investing.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.