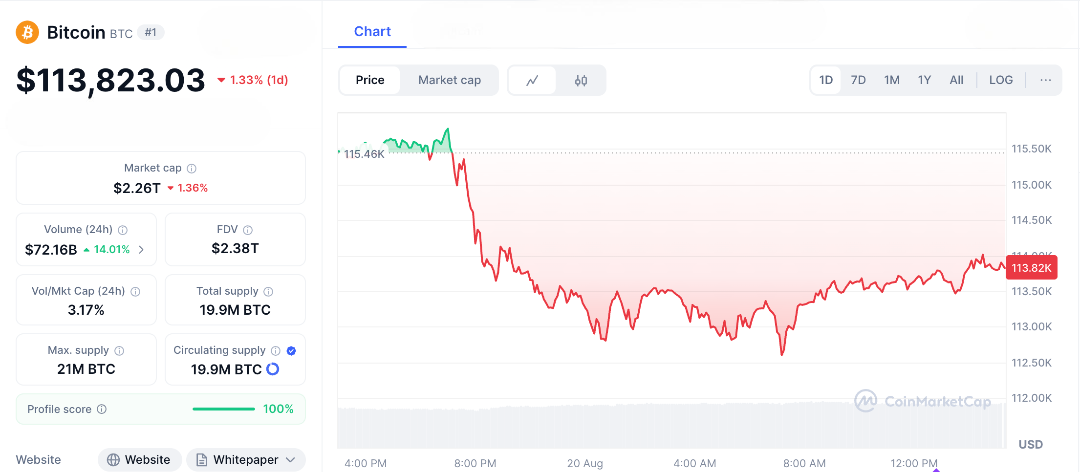

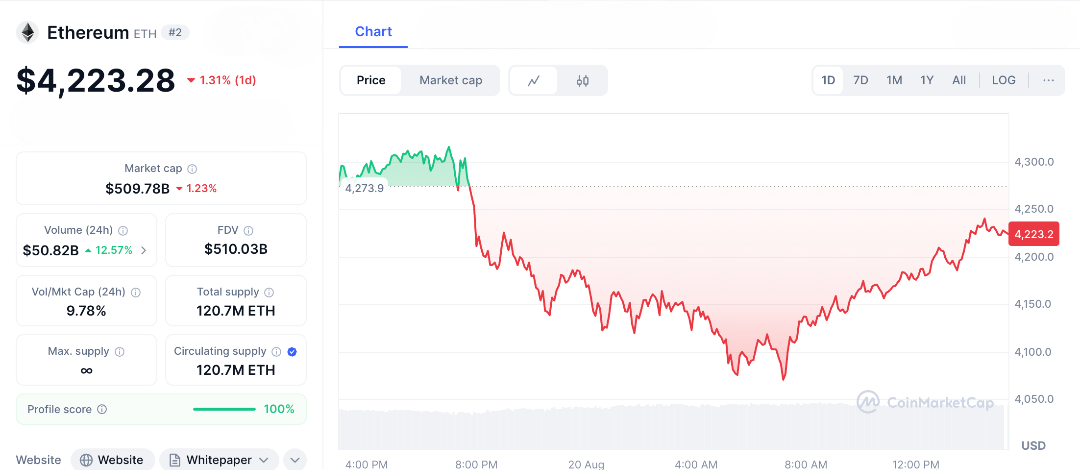

Why Is Crypto Dropping ? Crypto markets are experiencing a downturn, and investors are concerned. Bitcoin has dropped to around $113,000 from its recent high near $124,000. Ethereum is now below $4,100, and XRP is under $3. Many altcoins have fallen by 2-6% in just 24 hours, wiping billions from the market. The recent declines are due to a mix of global economic worries and specific market issues, like leveraged positions and profit-taking. While these drops can be worrying, history shows that crypto often recovers after such corrections. The big question is whether this is just a brief storm or the start of a longer downturn. For traders and investors, it’s a crucial time to stay alert.

Why Is Crypto Dropping?

The recent crypto slump isn’t random there are clear culprits. First, investors are watching the Federal Reserve, especially Chair Jerome Powell’s upcoming Jackson Hole speech. Hints that interest rate cuts might be delayed due to stubborn inflation and soft economic data have markets on edge. Higher rates push money out of risky assets like crypto and into safer investments, amplifying the decline.

On top of that, U.S. trade tensions are flaring, with proposals for 50% tariffs on certain imports potentially slowing global growth and tightening liquidity. Crypto reacts sharply to these macro-economic cues because, unlike traditional stocks, tokens rely heavily on sentiment and speculation. When uncertainty rises, they often fall first.

It’s not just global economics causing crypto to stumble internal pressures are adding fuel to the fire. The SEC’s ongoing scrutiny of tokens and exchanges is shaking investor confidence, while advances in AI spark fears that some blockchain projects could lose relevance. Indicators show caution building, the Crypto Fear & Greed Index dropped from 68 to 56 in just a week, reflecting rising nervousness.

Individual hits, like XRP’s sharp drop amid Ripple-related uncertainty, highlight how one token’s trouble can affect the broader market. The effect spreads like a domino chain Bitcoin slips, dragging Ethereum down, which in turn pulls Solana and other altcoins along, magnifying overall losses.

Even as crypto tumbles, opportunities are quietly forming. Short-term, August could stay choppy, Bitcoin might test support near $110,000 while the market waits for Fed signals. If Chair Powell hints at interest rate cuts, we could see a rebound, with BTC climbing back toward $120,000 by month’s end.

Looking further ahead, things could get brighter. Institutional inflows via ETFs continue, potentially pushing Bitcoin toward $130,000 if sentiment improves. Ethereum could rise to $4,500–$4,800, and broader adoption in DeFi and NFTs may help stabilise altcoins. In short, this drop might just be a shakeout, weeding out weak hands and setting the stage for the next bull run driven by halving cycles, tech upgrades, and growing adoption.

What Could Happen Next in Crypto Markets?

There are still risks to consider. Geopolitical issues or unexpected moves by the Federal Reserve could push Bitcoin down to around $92,000 before it recovers. However, history shows that crypto is resilient. After the crashes in 2022, the markets eventually increased fivefold. During this dip, large investors, known as whales, are quietly buying more, showing their confidence in a future rebound. So, why is crypto dropping? It’s the market’s way of testing investors’ faith, reminding us that sometimes panic comes before growth. As Federal Reserve Chairman Powell speaks, the market could either recover or face more challenges.

Today’s drop might just be setting the stage for future gains, so keep an eye on the charts and share this story with your fellow crypto enthusiasts.

FAQs

- Why is crypto dropping right now?

Crypto is dropping due to Fed rate uncertainty, trade tensions, regulatory scrutiny, and cascading liquidations, erasing billions in value. - How much has Bitcoin fallen?

Bitcoin dropped to $113,000 from $124,000 peaks, with broader altcoins like Ethereum and XRP losing 2-6% in a day. - What role does the Fed play in the drop?

High interest rates and delayed cuts make risk assets like crypto less attractive, amplifying the drop amid economic jitters. - Will crypto recover soon?

A rebound could occur if the Fed signals cuts, potentially lifting Bitcoin to $120,000, but macro risks may deepen the dip. - Is it safe to invest during this drop?

The drop might offer opportunities for whales, but volatility and potential further declines demand caution and research.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.