- Crypto market cap hits $3.83T as trading surges despite cautious investor sentiment.

- Ethereum leads liquidations at $170M while Bitcoin holds 59.1% market dominance.

- Altcoins PUMP, AERO, and MNT post sharp gains, highlighting market volatility.

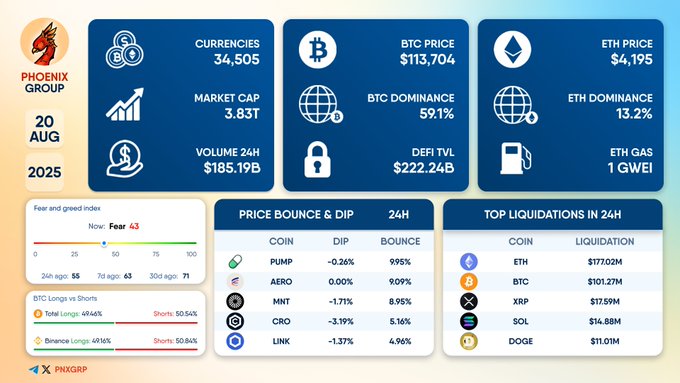

The global crypto market showed a combination of growth in trading activity and caution among investors. According to data from Phoenix Group, the overall market capitalization stood at $3.83 trillion, while the number of listed currencies surpassed 34,500. Daily trading activity was valued at $185.19 billion, pointing to strong participation across exchanges despite risk indicators.

Daily Summary on August 20, 2025$PUMP $AERO $MNT $CRO $LINK $ETH $BTC $XRP $SOL $DOGE#dailysummary #DeFi #Crypto pic.twitter.com/V2vM0DGD7n

— PHOENIX – Crypto News & Analytics (@pnxgrp) August 20, 2025

According to our previous report, Bitcoin (BTC) remained the dominant digital asset, priced at $113,704 and holding a market share of 59.1%. Ethereum (ETH) followed with a valuation of $4,195 and a 13.2% share of the market. Activity within decentralized finance also showed resilience, with the sector’s total value locked (TVL) reaching $222.24 billion. Network efficiency on Ethereum improved, with gas fees recorded at 1 Gwei, reflecting lower transaction costs for users.

Crypto Market Sentiment and Futures Data Show Uncertainty

Investor outlook leaned toward caution as the Fear and Greed Index dropped to 43 (Fear) from 55 (Neutral) two weeks earlier. Futures trading showed near equality between long and short positions. Long positions represented 49.46%, while shorts made up 50.54%, a balance that highlighted indecision among market participants.

Source: Phoenix Group

Liquidation data showed this uncertainty. Over the last 24 hours, Ethereum led liquidations at $170.02 million, followed by Bitcoin at $101.27 million. Other major tokens affected included XRP ($17.59 million), Solana ($14.88 million), and Dogecoin ($11.01 million), signaling volatility across top assets.

Altcoin Price Movements Highlight Volatility

Altcoins delivered strong movements throughout the day. PUMP registered a 995% surge after a marginal decline of 0.26%. AERO doubled in value despite a slight dip of 0.08%, while MNT increased 8.95% following a 1.71% drop. A few rebounds were also recorded in CRO (4.96%) and LINK (4.92%), both recovering after earlier pullbacks.

These figures showed the sudden shifts occurring in smaller tokens compared to the relative stability of Bitcoin and Ethereum. While overall activity remained strong, market caution persisted, influenced by fear-driven sentiment, high liquidations, and strong but uneven altcoin performance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.