Large investors keep adding certain digital coins to their holdings, sparking talk about where the prices could go next. ADA, SUI, SHIB, and XYZVerse (XYZ) have caught the most attention. With so much activity around these tokens, many are looking at what might happen if the trend keeps up. The possible numbers may surprise many.

Cardano (ADA)

Source: TradingView

ADA drifted between 0.81 and 1.07 this week. It slipped 3.10% in 7 days and 1.46% in 1 month, yet it still holds a 14.81% gain over 6 months. The token now trades close to 0.88, right on its 10-day average and a notch under the 100-day line at 0.91.

Momentum looks neutral. RSI at 49.63 and stochastic at 55.36 show neither overbought nor oversold pressure. MACD sits just above zero at 0.002622, hinting at a flat trend. The nearest ceiling sits at 1.17; cracking it opens a path to 1.42. A dip below 0.81 could send ADA toward the 0.66 floor or even 0.41 if selling snowballs.

If buyers push through 1.17, ADA could add about 30% from current levels and test 1.42, matching the 6-month climb pace. Failing that, a slide to 0.66 would shave roughly 25%. Sideways trade between 0.81 and 1.07 remains the base case until volume picks up. With the long-term trend still positive and short-term signals mixed, the next breakout direction may set the tone for Q3.

Price Prediction for XYZVerse ($XYZ): Is a 30x Jump Possible?

XYZVerse has entered the meme coin market at a time when community-driven tokens continue to dominate speculative trading. The rise of meme coins like PEPE, Dogwifhat, and Bonk proves that strong branding, viral marketing, and community engagement can drive massive gains.

The broader market sentiment also plays a key role in XYZVerse’s potential. As the altcoin season is about to start, lower-cap meme coins are seeing increased investor interest. Given that XYZVerse is still in presale, it could benefit from this wave if it secures strategic exchange listings and maintains community hype post-launch.

Key Strengths of XYZVerse in the Current Market:

- Strong branding with sports and influencer partnerships, broadening its appeal

- Deflationary mechanics (17.13% token burn) to reduce supply pressure

- Liquidity allocation (15%) to support stability after launch

- Community incentives (10%) fostering engagement and holding

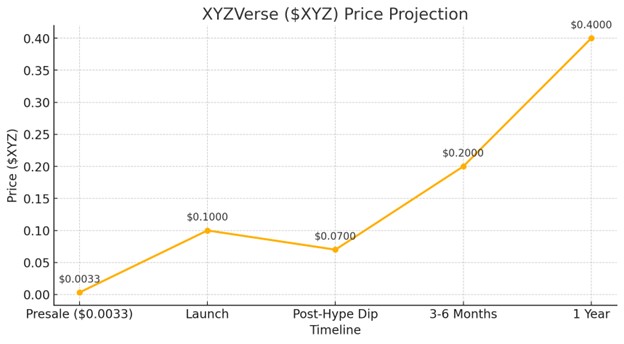

Price Prediction for $XYZ

- Current Presale Price: $0.005

- Projected Post-Presale Target: $0.10 (as per project’s estimates)

- Potential ATH (First 1-2 Weeks Post-Launch): $0.15 – $0.25 (if demand surges and listings drive FOMO)

- Long-Term Potential (6-12 Months): $0.20 – $0.40 (if the project secures major partnerships and listings)

Buy $XYZ Early for Maximum Gains

Realistic Expectations: Will XYZ Hit $0.10?

A 30x jump from presale to $0.10 is possible but depends on:

- Strong Exchange Listings – If XYZVerse lands on major CEX platforms like KuCoin, OKX, or Binance, its price could skyrocket on launch day.

- Sustained Community Growth – Meme coins need viral momentum. If XYZVerse delivers on its sports influencer partnerships, it could drive massive social media engagement.

- Market Conditions – If Bitcoin and altcoins remain bullish, speculation-driven assets like XYZVerse tend to benefit.

Is a 3000% Surge Possible for $XYZ?

XYZVerse has the ingredients for a strong launch, but its long-term success depends on execution. If the team delivers strong marketing, high-profile listings, and real community engagement, the $0.10+ target, which is around 3000% from the current price, could be achievable.

Invest in $XYZ Before It Surges

Sui (SUI)

Source: TradingView

Sui trades between 3.52 and 4.10 after a rough week. The token slipped 11.76 percent in 7 days and 10.91 percent in 1 month. Even with the pullback the 6 month chart still shows an 8.18 percent gain.

Short term action swims near the 10 day average at 3.55 and just under the 100 day line at 3.61. Momentum tools sit in the middle with RSI at 50.19 and Stoch at 55.26. A tiny positive MACD print of 0.0102 hints that sellers are losing grip.

If buyers step in above the nearest floor at 3.27 the price could test 4.42. That move would add about 15 percent from the mid band of the current range. A clean break could open a path toward 5 which implies near 30 percent upside. Failure to hold 3.27 may drag the chart to the deeper base at 2.70 which is roughly 25 percent below. For now the data point to a cautious rebound rather than a fresh slide.

Shiba Inu (SHIB)

Source: TradingView

Over last seven days price dipped 9.56%. Over thirty days slide 18.73%. Over six months down 16.52%. Current range 0.00001229 to 0.00001398 shows small gap but trend still negative. Yet the slide has slowed in the past two sessions, hinting at a pause.

The 10 day and 100 day moving lines sit close at 0.00001259 and 0.00001263. This tight spread shows the coin is at a decision spot. RSI at 56 and Stochastic at 72 point to mild buying power, not mania. First barrier waits at 0.00001493. A push through could aim for 0.00001662, a 28% jump from current mid range. If buyers fade the coin may test 0.00001155 and then 0.00000986, about 20% below now.

Short term bias is neutral to slight upside. A close above 0.00001400 would tilt the scale toward bulls. Failure to hold 0.00001200 would hand control to sellers. Based on recent data, odds lean 60-40 for a mild climb toward the first barrier within the next two weeks, but gains beyond that need fresh volume. The zone between 0.00001250 and 0.00001260 is the pivot that traders will watch hour by hour.

Conclusion

Altcoins ADA, SUI, SHIB show solid whale backing and upside in the 2025 run, but First All-Sport Memecoin XYZVerse (XYZ) targets 20,000% gains as the leading sports-driven meme movement.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.