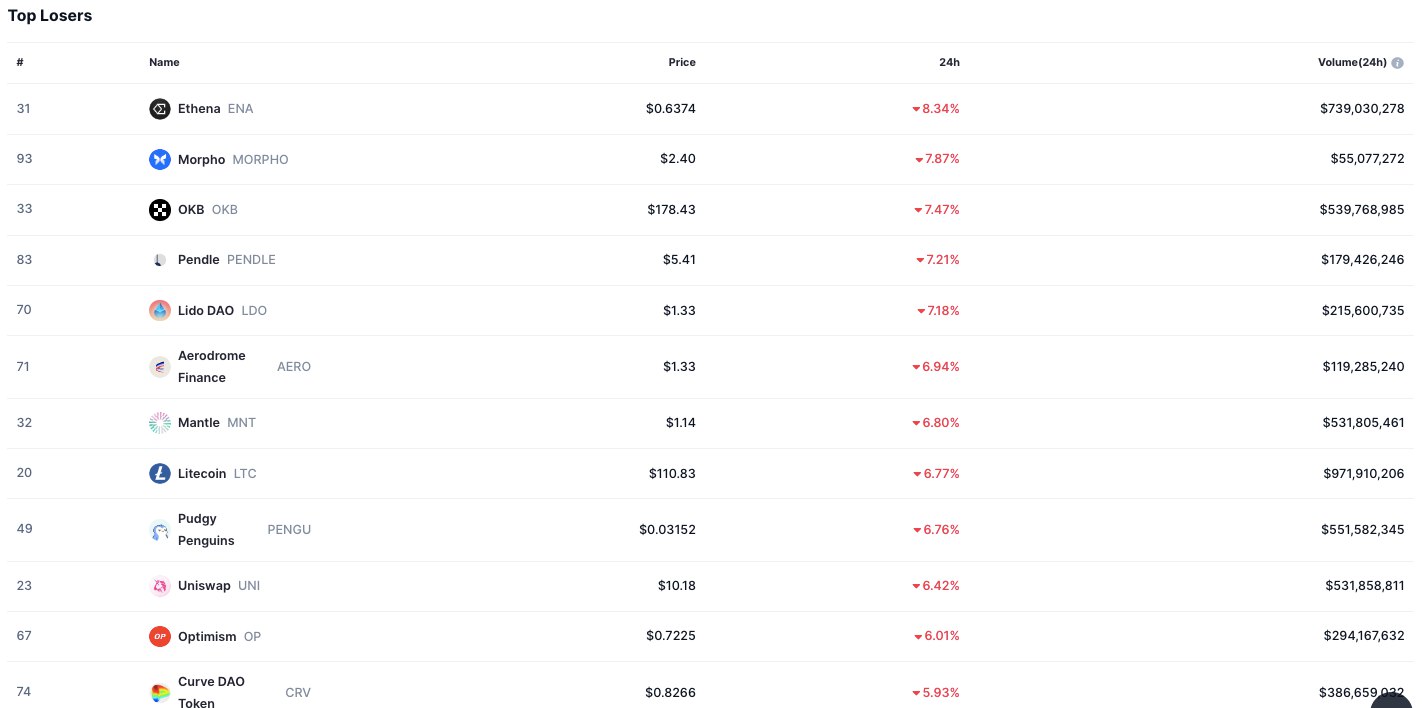

- Ethena leads losses with 8.34% drop, posting $739M in trading volume.

- DeFi and Layer 2 tokens see steep declines, signaling market-wide stress.

- Litecoin sheds 6.77% with $972M volume, showing large-cap tokens also under pressure.

The crypto market experienced general declines over the past 24 hours, with several major tokens recording losses amid heavy trading activity. According to CoinMarketCap data, the declines extended across decentralized finance (DeFi) assets, Layer 2 protocols, and large-cap tokens, reflecting uniform pressure across multiple sectors. Trading volumes remained high, signaling heightened volatility despite the downturn.

Ethena (ENA) posted the largest fall in the crypto market, dropping 8.34% to $0.6374. The token recorded more than $739 million in trading activity, the highest among the top losers. Its decline positioned ENA as the worst performer in the high-volume category.

Morpho (MORPHO) followed with a 7.87% decrease to $2.40, backed by over $55 million in daily volume. OKB (OKB), the utility token associated with OKX exchange, fell 7.47% to $178.43 on strong trading activity surpassing $539 million.

Source: CoinMarketCap

DeFi tokens also came under pressure. Pendle (PENDLE) declined 7.21% to $5.41, while Lido DAO (LDO) dropped 7.18% to $1.33, supported by more than $215 million in trading.

Layer 2 and DeFi Tokens Face Heavy Selling

Losses extended to Layer 2 protocols, adding to the crypto market downturn. Aerodrome Finance (AERO) shed 6.94% to $1.33, while Mantle (MNT) slipped 6.80% to $1.14, with volumes above $531 million. Optimism (OP), another Layer 2 token, recorded a 6.01% decline to $0.7225.

In the DeFi sector, Uniswap (UNI) retreated 6.42% to $10.18, and Curve DAO Token (CRV) posted the smallest decline on the list at 5.93%, closing at $0.8266.

Broader Market Pressure Extends to Large-Cap Tokens

As highlighted in our previous post, the crypto market weakness was not limited to smaller tokens. Litecoin (LTC), one of the most established assets, fell 6.77% to $110.83. Its trading activity was among the strongest, reaching nearly $972 million. Smaller-cap assets were also affected. Pudgy Penguins (PENGU) dropped 6.76% to $0.03152, marking one of the notable losses in the lower market-cap segment.

The declines spanned across high-volume tokens, DeFi projects, Layer 2 solutions, and large-cap cryptocurrencies, showing market-wide stress. Despite the losses, activity across exchanges remained robust, indicating continued engagement from traders even in a risk-off environment.

The uniform pullback across sectors displays how declines in the crypto market were not confined to individual projects. Instead, the losses showed broader downward pressure, strengthened by strong trading volumes that signaled heightened volatility throughout the session.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.