After gaining strong Wall Street support, Numeraire Crypto (NMR), the native token of Numerai hedge fund, soared 130% in a 24-hour period. On Tuesday, JPMorgan Asset Management announced a commitment of up to $500 million to Numeraire crypto a move that could double its assets under management to nearly $1 billion.

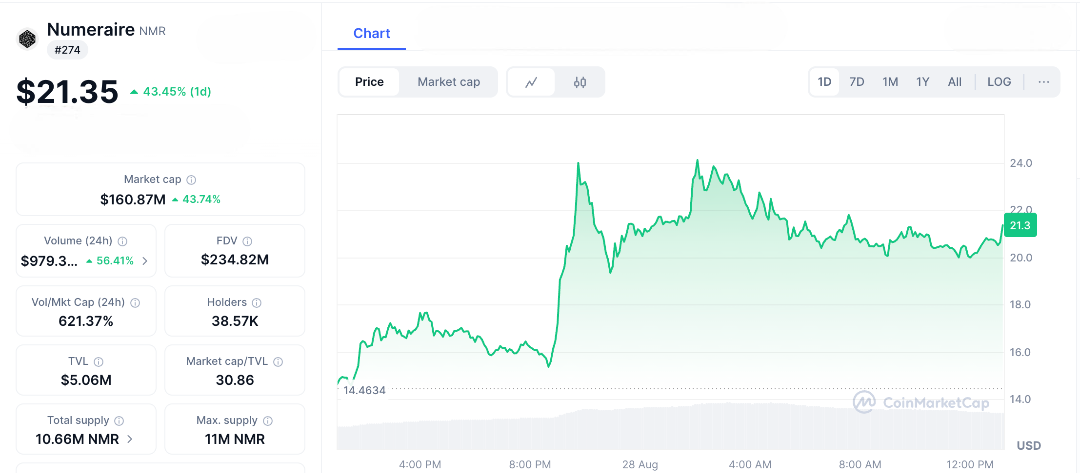

The token, now trading at $21.35 with a market cap of $160 million, is riding the wave of excitement. This surge highlights one thing loud and clear institutional investors are warming up to AI-powered, crowdsourced trading models. With JPMorgan’s stamp of approval, many believe NMR might just be making the leap from a niche project to a mainstream crypto contender.

How AI, Data Scientists, and NMR Are Changing Hedge Funds

Founded in 2015 by Richard Craib, Numeraire crypto isn’t your typical hedge fund. Instead of a closed-off Wall Street team, it taps into a global network of data scientists who submit encrypted predictions on stock movements. Here’s the twist they stake NMR tokens to back their forecasts. If their predictions are accurate, they earn rewards if not, their staked tokens get burned. This built-in deflationary mechanism keeps the ecosystem competitive and lean.

And the results are showing. Numerai delivered a 25% net return in 2024 a performance strong enough to catch JPMorgan’s eye, leading to its $500 million investment, which will be rolled out over the next year. “Numerai’s performance track record finally convinced big investors,” Craib said, adding that the fund has even brought in talent from Meta to strengthen its research team.

On the numbers side, NMR’s circulating supply stands at 7.53 million out of a 10.7 million cap, with trading activity going wild. In just 24 hours, volume spiked to $979 million a massive 1,200% jump as the token rallied on the back of Wall Street’s newfound interest.

JPMorgan’s Big Crypto Move: A Change of Heart?

This deal is a really big deal because it shows how JPMorgan’s feelings about crypto are changing. For a long time, the bank’s CEO, Jamie Dimon, was pretty skeptical. But lately, they’ve been dipping their toes in the water with projects like their own digital coin for payments. This investment is part of a much larger trend. Big, traditional companies are finally getting serious about crypto, from the new Bitcoin ETFs to even bitcoin miners finding new work in AI!

A Wild Price Ride

As you’d expect, the news sent the token on a wild ride!

-

It was trading below $8 before anyone heard the news.

-

Then, it absolutely skyrocketed, hitting a peak of $23!

-

It’s since settled down a bit, showing just how volatile crypto can be.

The excitement blew up on social media, with users calling it a “game changer” and speculating it could go even higher. The good news didn’t stop there! The excitement spilled over into the whole sector of AI related crypto tokens, boosting competitors and showing how one big announcement can lift many boats.

From Niche Idea to Wall Street Darling: A Quick Timeline

Let’s break down how this project grew from a small startup to catching the eye of a banking giant:

-

2015: It all started when Numeraire crypto launched with a big idea a global, crowdsourced hedge fund.

-

2017: They introduced their NMR token on Ethereum, letting people earn rewards for making good stock market predictions.

-

July 2025: The project showed its strength by announcing a $1 million token buyback.

-

Aug. 26, 2025: The huge news broke JPMorgan invested. This caused the token’s price to surge an incredible 130% almost overnight!

Why This News is a Big Deal

Analysts see JPMorgan’s move as a massive vote of confidence. It’s not just about one token it suggests that big banks are starting to believe in the power of “decentralised finance” (DeFi) and AI for making investment decisions. This could potentially change how hedge funds operate in the future.

This exciting rally shows that when a traditional finance giant like JPMorgan gets involved, it can supercharge the crypto market. However, for the growth to last, the project will need to prove it can deliver consistent, real-world results.

FAQs

1. What is Numeraire (NMR)? Numeraire crypto is an Ethereum-based token with a fixed supply of 11 million, used for staking in Numerai’s crowdsourced AI hedge fund to back data scientists’ market predictions.

2. What is Numerai? Numerai is a San Francisco-based hedge fund founded in 2015 that crowdsources AI models from global data scientists for stock predictions, rewarding accurate ones with NMR tokens.

3. What caused the 130% surge in Numeraire crypto? JPMorgan Asset Management’s $500 million commitment to Numerai, announced on August 26, 2025, doubled the fund’s assets to nearly $1 billion, sparking the rally from ~$8 to $21.53.

4. How does NMR token work in Numerai? Data scientists stake NMR on their models; successful predictions earn rewards, while failures result in token burns, creating incentives for accuracy and reducing supply over time.

5. What was Numerai’s performance leading to the investment? Numerai delivered a 25.45% net return in 2024 with only one down month, rebounding from a 17% loss in 2023, attracting institutional interest like from Paul Tudor Jones.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.