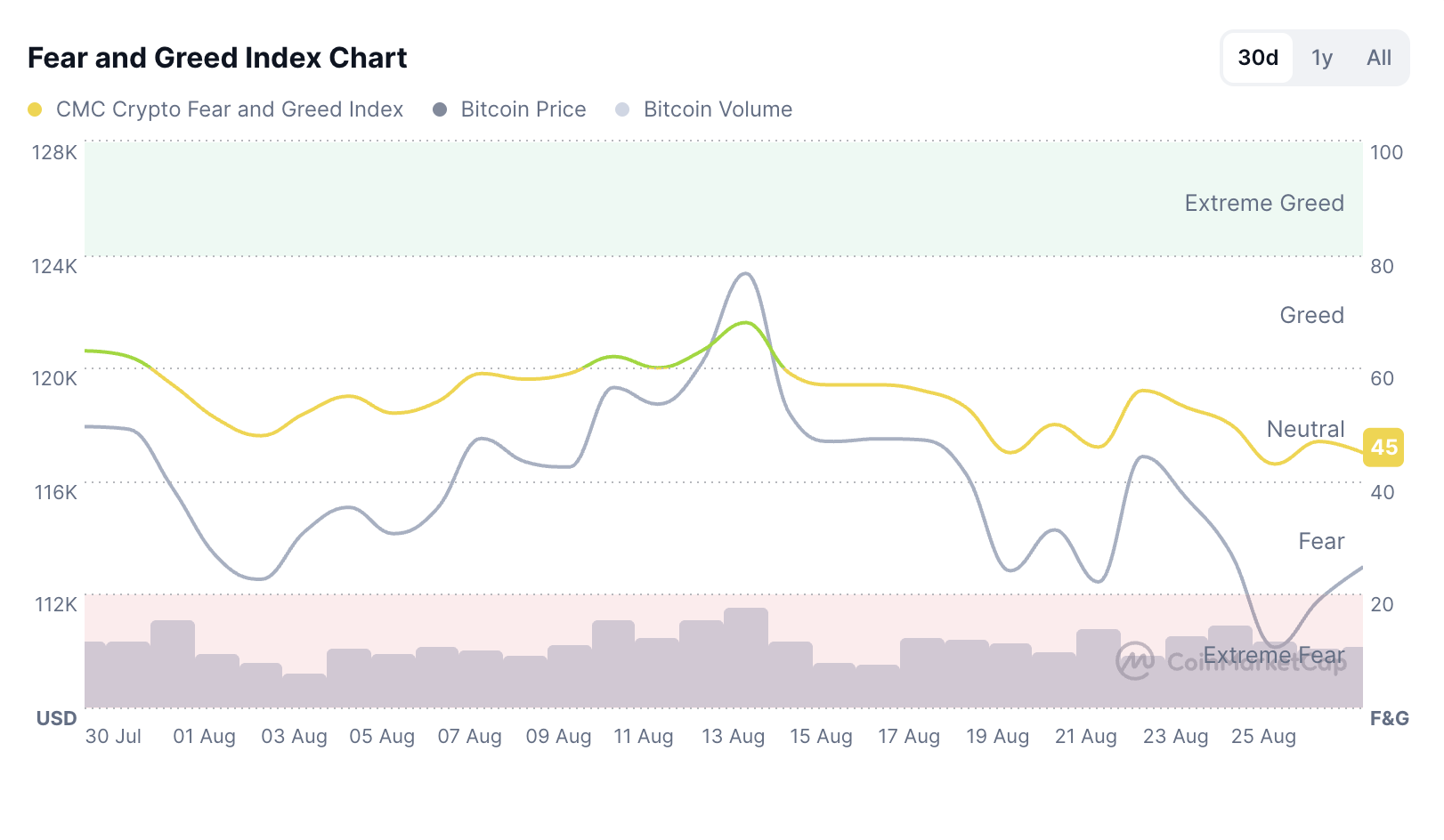

Right now, the crypto market is taking a breather! The Crypto Fear and Greed Index is sitting right in the middle at 45 a neutral score that tells us investors aren’t feeling overly fearful or greedy at the moment.

After some rocky weeks, things have settled down:

-

Bitcoin is holding steady around $113,000

-

Ethereum is trading near $4,554

This kind of pause often comes before the next big move. Some traders see it as a chance to carefully enter the market, while others are waiting to see what happens next with upcoming economic news and regulations. Whether this calm leads to a rally or a dip remains to be seen but for now, it’s a welcome break from the rollercoaster!

Crypto Fear and Greed Index Holds Neutral at 45

The Crypto Fear and Greed Index, tracked by Alternative.me, is sitting at 45 a neutral zone on its 0–100 scale (0 = extreme fear, 100 = extreme greed). Here’s how the index is built:

-

25% market volatility

-

25% trading volume

-

15% social media sentiment

-

15% surveys

-

10% Bitcoin dominance

-

10% trends

At 45, the index is slightly down from 51 yesterday, but still above the 47 dip on Aug. 25. Experts also confirmed the reading on Aug. 27, describing market sentiment as “neutral” with traders staying cautious. Supporting the calm mood, on-chain data shows Bitcoin’s 24h trading volume at $50B with very little price action. Meanwhile, Ethereum’s gas fees have stabilised, signalling a cooldown in speculative activity.

From Greed to Neutral

It’s been a rollercoaster of a month! Back in July, the Crypto Fear and Greed Index hit 73 , fuelled by excitement around Bitcoin ETF inflows and the aftermath of the halving. But since then, things have cooled off. What changed? Rising U.S. interest rate concerns and ongoing geopolitical tensions made investors more cautious, pulling the sentiment back toward neutral.

Historical data shows that when the Crypto Fear and Greed Index lingers in the neutral zone (40–60), it can sometimes signal that a big move is coming. For example, in 2023, a similar neutral period was followed by a strong rally. That’s why many experienced traders keep a close eye on this index not to predict the future, but to better understand market psychology and timing.

A Market Showing Strength

Despite the neutral sentiment, there are some positive signs under the surface that point to a resilient market:

-

₿ Bitcoin Dominance at 55%, This means Bitcoin is maintaining its lead, but altcoins aren’t being sold off aggressively a sign of healthy balance instead of panic.

-

Institutions Are Still Buying, Big players like BlackRock’s IBIT ETF added $200 million in net inflows this week alone, showing that smart money continues to see long-term value.

That said, it’s not all smooth sailing. Bitcoin’s 30-day volatility is still at 24%, a reminder that crypto moves fast and can swing unexpectedly.

Why the Confidence? Regulation Is Helping

This period of stability didn’t come out of nowhere. Recent U.S. regulatory progress like the GENIUS Act has helped build trust and clarity in the crypto space. That’s encouraging both institutions and everyday investors to participate with more confidence. Still, with global economic uncertainty always looming, the best strategy remains a diversified portfolio don’t put all your digital eggs in one basket!

Finding Opportunity in the Calm

A neutral Crypto Fear & Greed Index reading like 45 isn’t just a number it’s a signal. It tells us the market is taking a breath, and for attentive investors, that can be a strategic moment. With less emotional trading , prices often reflect more grounded value. That means this could be a good time to review your portfolio, dollar-cost average, or research new entries without the pressure of extreme market sentiment. But remember patience is still your best friend. Macro events, regulatory news, or global shifts can change the mood fast. Staying diversified and not over-investing is how you keep calm no matter what the index does next.

FAQs

1. What is the Crypto Fear & Greed Index? It’s a daily metric (0-100) measuring market sentiment using volatility, volume, social media, surveys, Bitcoin dominance, and trends, with 45 signalling neutrality.

2. Why is the index at 48 on August 28, 2025? The Crypto Fear & Greed Index reflects balanced sentiment as Bitcoin stabilizes at $113,000 and trading volumes normalise, per Alternative.me data.

3. What does a neutral index reading mean? A score of 48 indicates neither fear nor greed dominates, suggesting a consolidation phase that could precede a breakout or dip.

4. How is the index calculated? It aggregates volatility (25%), trading volume (25%), social media (15%), surveys (15%), Bitcoin dominance (10%), and trends (10%).

5. Why is this index relevant for investors? It acts as a contrarian indicator; neutral levels like 48 often signal accumulation opportunities before major market moves, as seen in 2023.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.