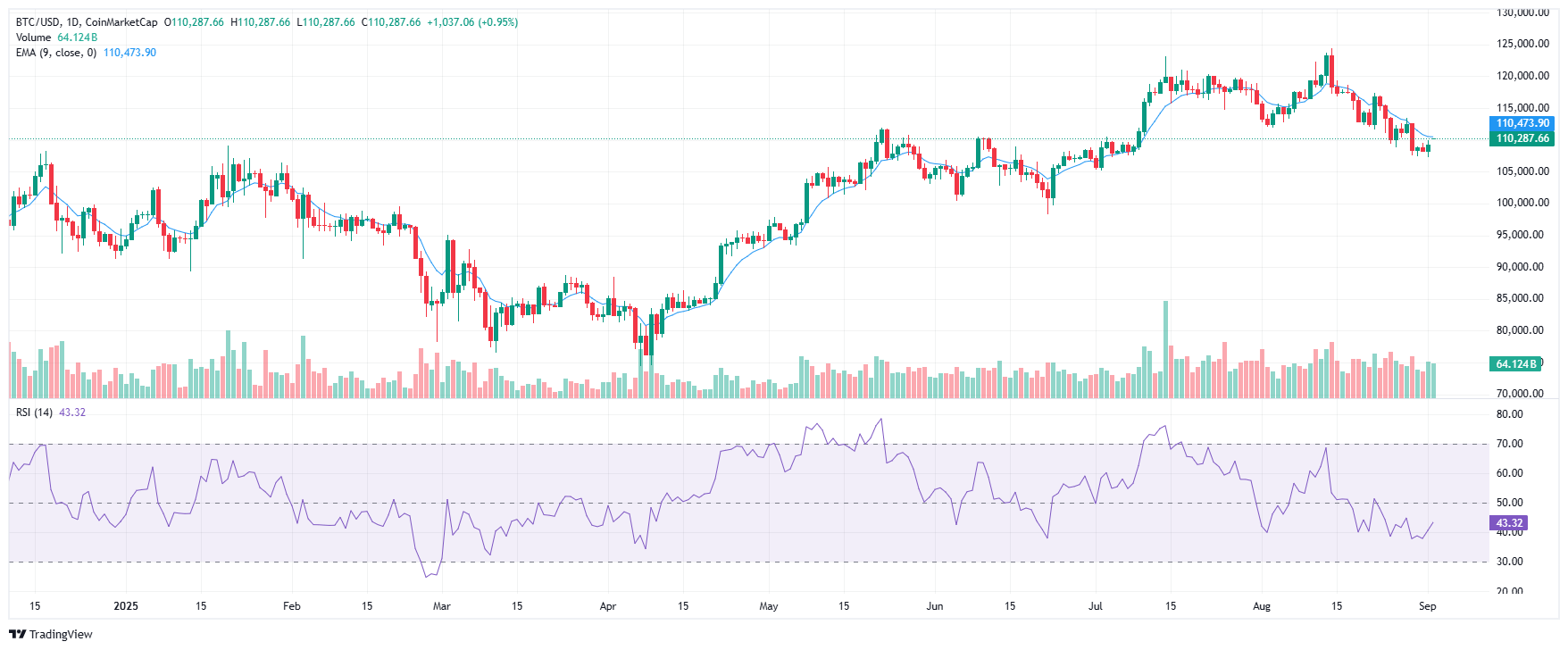

The cryptocurrency market had a tough August. Bitcoin, the largest digital asset, dropped by 7% and settled around $110,000. The wider crypto market also declined, losing about 6.18% of its value and bringing the overall market capitalization down to $3.79 trillion. Normally, when prices fall this sharply, investors pull money out. But this time, something surprising happened, investment products connected to crypto, such as exchange-traded funds (ETFs), saw $2.48 billion in new money flow in during just one week. For the month as a whole, inflows totaled $4.37 billion, pushing the year-to-date figure to $35.5 billion.

This unusual trend suggests that investors, especially large institutions, are becoming more confident in digital assets. Rather than being scared away by falling prices, they treated the dip as an opportunity. Some analysts believe this shows crypto is starting to act like a mature market, less dependent on short-term price swings. Others see it as a temporary move, with institutions using crypto as a hedge while traditional markets face uncertainty from central bank policies and global conflicts.

A closer look at the numbers shows a surprising detail. Ethereum investment products attracted far more interest than Bitcoin ones. Ethereum recorded $3.9 billion in net inflows during August, while Bitcoin products actually saw $751 million in outflows. However, by the end of the month, Bitcoin reversed some of that trend, bringing in $440 million in a single week. This shift highlights Ethereum’s growing reputation as more than just a cryptocurrency, it now plays a big role in decentralized finance (DeFi), where users earn yields of 3–5% through staking.

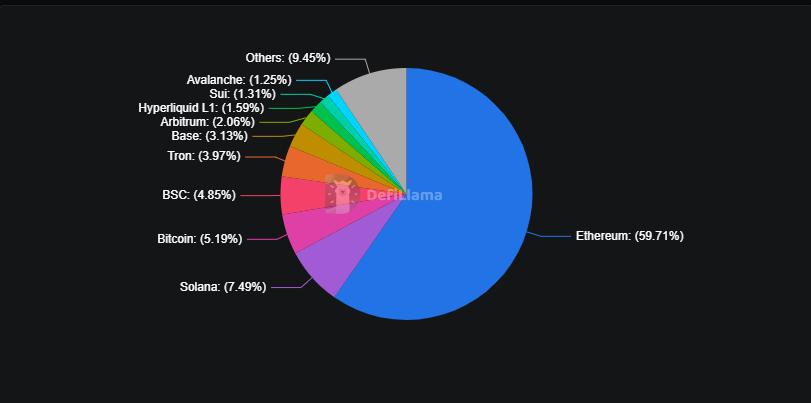

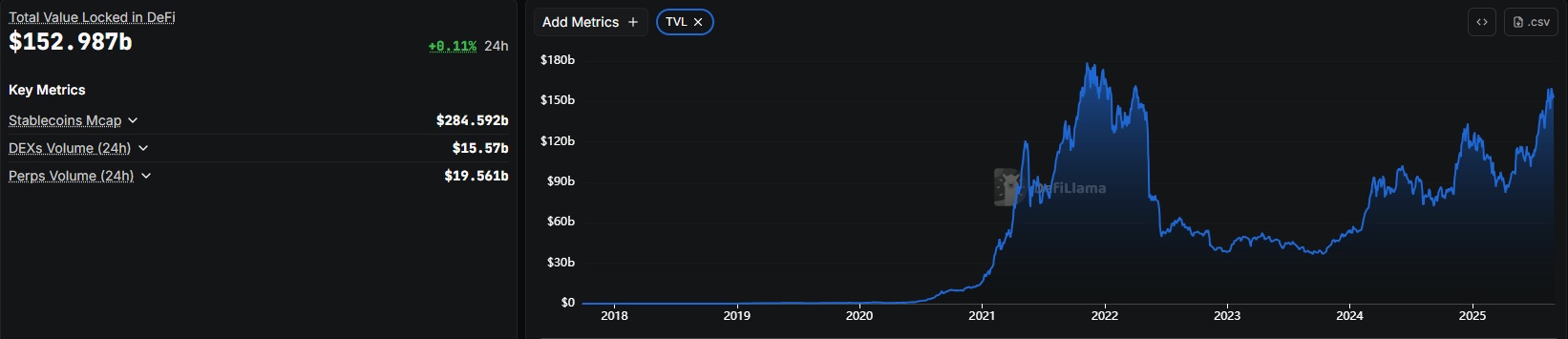

Ethereum’s recent “Pectra” upgrade also helped by lowering transaction fees and making the network more efficient. As a result, the total value locked (TVL) in DeFi rose to $152 billion, an increase of 41% compared to last year, according to data provider DefiLlama. Even though prices were weak, activity on the network was growing.

Institutional confidence also showed through ETFs managed by major companies. BlackRock’s IBIT ETF, for example, lost $615 million in August but still holds $13.1 billion in assets. That signals that large investors such as pension funds and family offices are keeping their long-term bets on crypto, even when retail investors are nervous. This difference between short-term traders selling and big institutions buying illustrates how the market is slowly changing shape.

To understand why inflows matter, it helps to look at recent context. Since January 2024, crypto ETFs have collected more than $54 billion. In August, while Bitcoin’s price struggled, Ethereum briefly climbed above $4,950 before settling near $4,390, helped by more than $300 million in single-day ETF inflows. Analysts from trading platforms noted that August highlighted a “shift in strategy.” Instead of focusing only on Bitcoin, investors are spreading exposure across Ethereum and even smaller altcoins like Solana, which gained $15.8 million in ETF inflows.

This trend also comes alongside new regulations like the U.S. “GENIUS Act,” which made it easier for stablecoins to operate legally. Supportive laws like this encourage more inflows into the sector, even while regulators still crack down on risky, unbacked tokens.

Experts commenting on the market suggested that fears of a so-called “Red September,” where prices traditionally fall further, may give way to optimism. Some believe Ethereum’s $3.9 billion August inflows are a sign that an “altcoin season” could be around the corner, where tokens beyond Bitcoin start to outperform. Others point to Bitcoin’s long-term data, in the second quarter alone, Bitcoin ETFs attracted $33.6 billion, showing faith in its scarcity-driven model, even if short-term sentiment remains shaky.

A timeline helps put this resilience into perspective:

- January 2025: ETFs launched, quickly gathering $54 billion in inflows.

- April 2025: DeFi activity rebounded, lifting total value locked to $123 billion.

- July 2025: The GENIUS Act passed, leading to another $4 billion in inflows.

- August 2025: Despite Bitcoin’s 7% price drop, inflows still reached $4.37 billion.

Crypto Market Outlook

Looking ahead, analysts predict that if the current trend continues, investments in crypto could grow from $35.5 billion this year to $50 billion by the end of 2025. Technical charts provide more insight, Bitcoin’s 200-day exponential moving average (EMA) is around $105,000, indicating strong support at that level. The relative strength index (RSI) is around 43, which many traders interpret as a sign that Bitcoin is oversold and may be ready to bounce back.

The main takeaway from August is that money continues to flow into the crypto sector even as prices fall. For newcomers, this shows that crypto is proving to be more than just a speculative market. Large institutions with significant funds are acting as stabilizers, viewing downturns as buying opportunities. If this trend continues, it could change how market cycles develop, leading to more stable growth driven by professional investors instead of wild swings from retail traders.

In simple terms, crypto is showing strength. Prices may have dropped, but the $2.5 billion coming into the market in just one week indicates that smart investors are not leaving. Instead, they are quietly building their holdings, suggesting that the long-term outlook for digital assets may be stronger than ever.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.