- MYX Finance tops Binance Wallet IDOs with 1,848.55x ROI on $180K raised.

- OKZOO posts 287.38x ROI, showing small raises can deliver strong gains.

- Larger IDOs like HYPER yield lower multipliers despite higher fundraising.

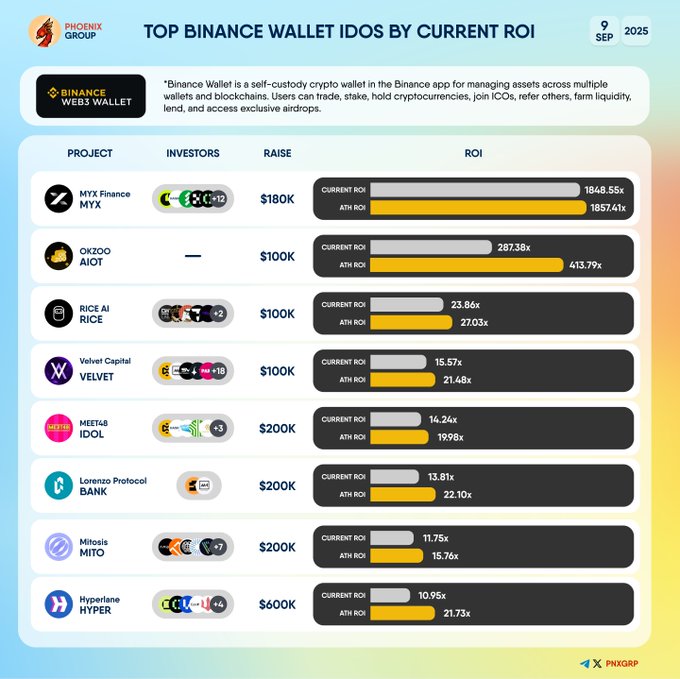

The latest ranking of Binance Wallet IDOs published on September 9, 2025, shows large differences in return on investment (ROI) across multiple projects. Data released by Phoenix Group shows both strong multipliers and steady outcomes, providing insight into how recent offerings have performed relative to their initial funding.

MYX Finance and OKZOO Lead Binance Wallet IDOs

MYX Finance (MYX) tops the ranking with a current ROI of 1,848.55x, only below its all-time high of 1,857.14x. The project raised $180,000, making it the strongest performer in the category by ROI.

https://twitter.com/pnxgrp/status/1965362287650193874

OKZOO (AIOT) follows in second place with a 287.38x ROI and a peak of 413.79x. Despite raising a modest $100,000, its strong performance displays how smaller-scale offerings within Binance Wallet IDOs can deliver high returns under favorable conditions. These results emphasize the role of efficient capital deployment in generating outsized gains.

Mid-Tier Projects Deliver Consistent Results

Several projects delivered more limited but consistent outcomes. Rice AI (RICE), which raised $100,000, recorded a current ROI of 23.86x with a 27.03x high. Velvet Capital (VELVET) followed with 15.57x ROI, down from an earlier 21.48x peak.

MEET48 (IDOL), which secured $200,000 in fundraising, posted a 14.24x ROI with a high of 19.98x. These tokens display balanced mid-tier performance, reflecting stable growth cycles within the broader field of Binance Wallet IDOs. Their results positioned them between the strongest leaders and the lower-tier projects in the analysis.

Larger Raises Produce Smaller Multipliers

The last group includes Lorenzo Protocol (BANK), Mitosis (MITO), and Hyperlane (HYPER). BANK and MITO each raised $200,000, while HYPER collected $600,000. Their current ROIs ranged from 10.95x to 13.81x, though all three projects reached higher peak values earlier in their trading history.

Source: Phoenix Group

These outcomes indicate that larger raises did not produce the highest multipliers, even if returns remained in double digits. Within Binance Wallet IDOs, the data suggests a correlation between smaller fundraising amounts and higher relative growth potential compared to larger-scale offerings.

The September 2025 analysis of Binance Wallet IDOs displays how varying fundraising scales influenced ROI across projects. MYX Finance set the benchmark with record-level performance, while OKZOO showed how a modest raise translated into substantial gains. Mid-tier projects such as Rice AI, Velvet Capital, and MEET48 maintained consistent results, while larger raises delivered lower but still notable returns.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.