Ripple’s cryptocurrency, XRP, is once again in the spotlight. Speculation about the approval of a spot XRP exchange-traded fund (ETF) has raised excitement in the crypto world. Analysts suggest that if institutional adoption increases and regulatory approval comes through, XRP could climb as high as $8 by the end of 2025. However, the path ahead is not without challenges. While momentum and optimism are building, risks tied to regulation and market volatility continue to play a major role.

XRP’s Current Position

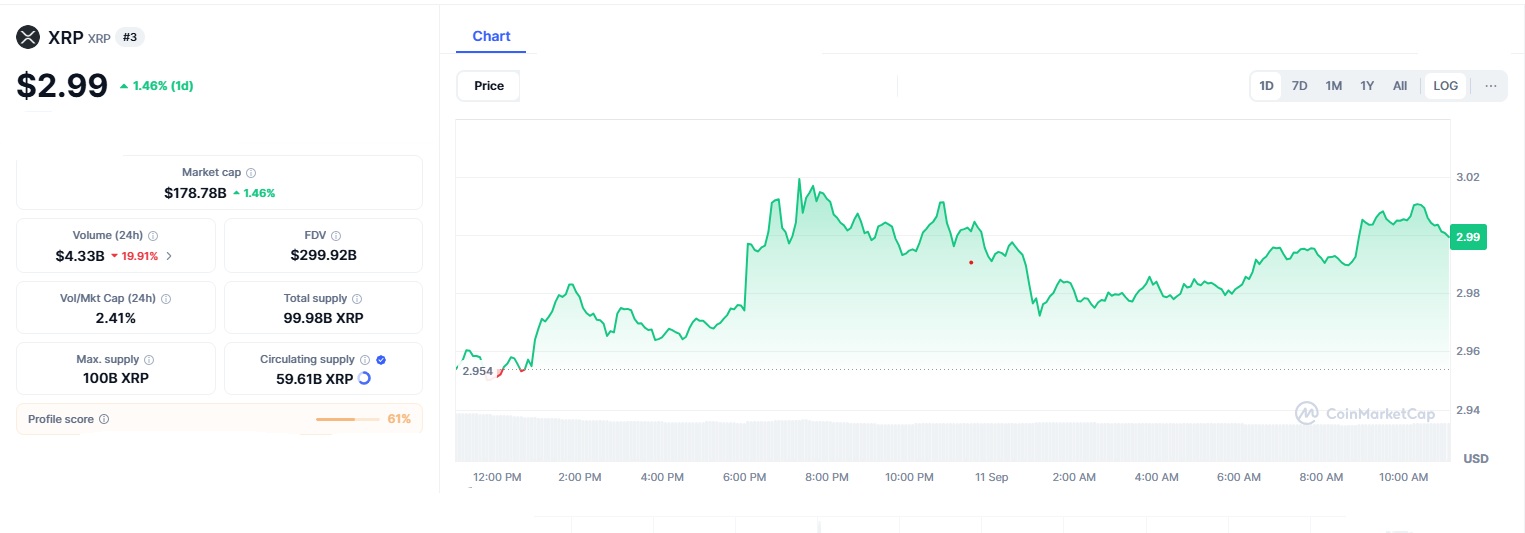

As of September 11, 2025, XRP is trading at $2.99, marking a 1.46% daily gain and giving it a market capitalization of nearly $179 billion. These numbers underline XRP’s strength as one of the largest cryptocurrencies, but they also show how far it remains from its ambitious targets.

The recent excitement comes from ETF applications submitted to the U.S. Securities and Exchange Commission (SEC). Several well-known firms, including Bitwise, Grayscale, and VanEck, are competing to launch XRP-based ETF products. If approved, these ETFs would allow traditional investors, such as hedge funds and retirement accounts, to gain exposure to XRP without directly buying the token.

Ripple’s CEO, Brad Garlinghouse, had already hinted back in 2024 that XRP ETFs were “inevitable,” pointing to Bitcoin’s massive inflows after its ETF approval as evidence. Indeed, when Bitcoin ETFs were given the green light, billions of dollars poured into the market in just weeks. Many analysts believe XRP could experience a similar effect, with ETFs acting as a gateway for mainstream investors.

On-chain data reflects this growing optimism. On September 8, 2025, XRP recorded net inflows of $9.28 million, which indicates that institutional players may be increasing their positions. Analysts believe that if XRP can break above $3.20, it could quickly target $5, with the most optimistic forecasts pointing to $8 by the fourth quarter of 2025. Adding to this outlook is Ripple’s stablecoin, RLUSD, which has been gaining traction since its launch earlier in 2025. Stablecoins serve as a bridge between traditional finance and crypto, and RLUSD’s adoption in payments could further strengthen the XRP ecosystem.

Market Challenges

Despite the optimism, there are also warning signs. Regulatory uncertainty is still a major factor. On September 29, 2025, a joint SEC and CFTC roundtable is set to address stricter crypto regulations. Any delay or stricter stance could push ETF approvals further down the road. From a technical perspective, XRP recently dipped below the $2.85 Fibonacci support level, and its MACD (Moving Average Convergence Divergence) turned negative, pointing toward bearish risks. If selling pressure continues, the next key level to watch would be $2.71.

Coinbase’s XRP reserves have also dropped sharply, by 83% since June 2025. While some view this as accumulation by long-term holders, others fear it may create more price volatility if those tokens flood back onto the market. Ripple has faced regulatory challenges in the past as well. Its 2023 legal victory helped classify XRP as a non-security, which gave the token breathing room. Yet, the company was still hit with a $125 million fine, showing that oversight is ongoing and risks remain.

Partnerships and Real-World Use

One of Ripple’s strongest advantages is its growing list of partnerships. Its annual Swell conference, which kicked off on September 5, 2025, is expected to reveal several new collaborations that could add to XRP’s real-world use cases. Companies like VivoPower have already begun accepting RLUSD for payments in the electric vehicle sector, which shows how Ripple is moving beyond speculation into utility.

Some analysts even argue that if U.S. banks were to settle a significant portion of their $77.45 billion in daily payments using XRP, the token’s price could theoretically surge far higher than $8, possibly to $35 in the long term. While this projection is speculative, it highlights the potential scale of XRP’s ambitions.

Key Events in 2025

To better understand XRP’s journey, here are some major milestones so far this year:

- January 2025: Ripple launches its RLUSD stablecoin, expanding its ecosystem.

- July 2025: XRP reaches a yearly high of $3.65, fueled by legal clarity and strong trading volume.

- August 2025: Multiple ETF filings are submitted by leading asset managers, sparking speculation.

- September 8, 2025: Institutional inflows increase as XRP breaks above $3.

- October 2025: The SEC’s decision on ETFs is expected, alongside new announcements from Ripple’s Swell conference.

Balancing Hype and Risk

The ETF story is both an opportunity and a risk. On one hand, approval could transform XRP into a mainstream investment product, bringing in billions in liquidity. On the other hand, heavy reliance on speculation can backfire if regulators delay or reject ETF filings. Market volatility also remains a major challenge, with XRP experiencing average daily swings of 5.31%.

Crypto prediction markets like Polymarket show an 92% probability of ETF approval, but traders are still watching critical support levels near $2.82–$2.84. If XRP fails to hold these levels, the price could revisit summer lows, undoing much of its recent gains.

Outlook

The potential approval of an XRP ETF could mark a turning point, not only for Ripple but for the broader crypto sector. It could bring new legitimacy and adoption, especially if combined with real-world applications of the RLUSD stablecoin and ongoing partnerships.

However, the market must also remain cautious. The road to $8 will require regulatory clarity, consistent institutional support, and strong fundamentals to match investor enthusiasm. For now, XRP remains in a delicate balance between high expectations and the realities of a complex and volatile market.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.