Algorand’s native token, ALGO, is trading at around $0.24, and the market is paying close attention to its next move. The situation feels like a turning point. On one hand, the price could recover toward $0.40, giving investors a sense of relief. On the other hand, it could slide toward $0.15 if negative pressures take over. This uncertainty is not only about charts and numbers but also about major changes in the ecosystem and broader conditions in the crypto world.

From a technical standpoint, ALGO has been relatively steady near $0.24 after gaining about 1.9% in the past 24 hours. Analysts say it has support near $0.23, meaning the price has not easily fallen below that level, while resistance is sitting around $0.25 to $0.26, making it harder for the token to break higher. Forecasts for September suggest that ALGO could reach a high of about $0.295, while others expect only modest gains toward $0.256. More cautious voices warn of a decline to $0.21 if the support level does not hold. Longer-term predictions are highly divided. Some optimistic projections see ALGO climbing as high as $2.98 by the end of 2025, while more conservative outlooks expect it to stay around $0.26.

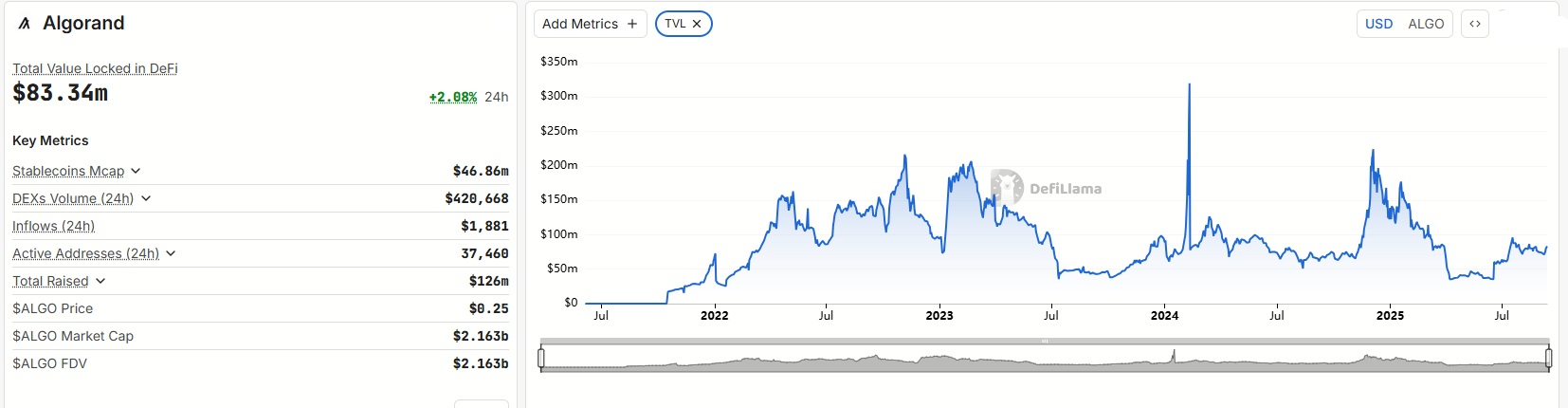

Beyond the price charts, Algorand’s ecosystem has been moving forward. In its August 2025 update, the Algorand Foundation reported $90 million in total value locked (TVL) in DeFi, with most of it linked to real-world assets (RWAs). These are financial products and instruments outside the crypto world that have been brought onto the blockchain, such as tokenized bonds or property assets. While this shows practical adoption, liquidity concerns from the USDT exit still weigh heavily.

In July, Algorand released its 2025 roadmap, which emphasized expanding real-world use cases and focusing on future challenges like quantum security. These steps underline that the blockchain is trying to move from hype-driven attention toward practical adoption. On September 9, the network launched the Aid Trust Portal, a tool designed to bring more transparency to humanitarian payments. This project demonstrates that Algorand’s technology can be used beyond speculation and trading.

The Algorand Foundation has launched the Aid Trust Portal — a tool to track and visualize humanitarian aid payments on-chain.

Already used by @UN partners via @HesabPay_, it brings unprecedented transparency to aid flows in fragile regions. pic.twitter.com/lCL0OMUHom

— Algorand Foundation (@AlgoFoundation) September 9, 2025

Efforts to strengthen liquidity also include a new partnership with XBTO, a major trading firm. The goal is to improve trading activity for ALGO across Tier-1 exchanges. However, adoption of new tools has been slow. The Beta Wallet, set to roll out on September 15, had only 15,000 sign-ups at the time of reporting. The speed at which users embrace these updates will be an important signal of the network’s future growth.

Despite challenges, Algorand continues to stand out for its design. The blockchain is known for being energy-efficient and able to process more than 10,000 transactions per second. These strengths give it an edge compared to slower or less sustainable blockchains. Yet even with strong technology, the broader crypto market environment often dictates token prices, and a weak overall market could limit ALGO’s upside.

With relative strength index (RSI) readings near neutral and trading volume increasing, the market is waiting for a breakout. If ALGO can push past $0.26, optimism could rise quickly, possibly opening the path toward $0.30 or beyond. If support at $0.23 fails, however, the downside could accelerate toward $0.21 or even $0.15.

Algorand Faces a Critical Test

Algorand is at a sensitive stage. Its short-term price may depend on whether the network can attract enough developers and users to balance out the loss of liquidity. If adoption grows, ALGO could gain stronger support from its fundamentals. If adoption slows and overall market conditions remain weak, the chances of further decline will remain.

At this point, Algorand’s future is caught between possible growth and potential setbacks, making the next few weeks an important test for both the token and the blockchain behind it.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.