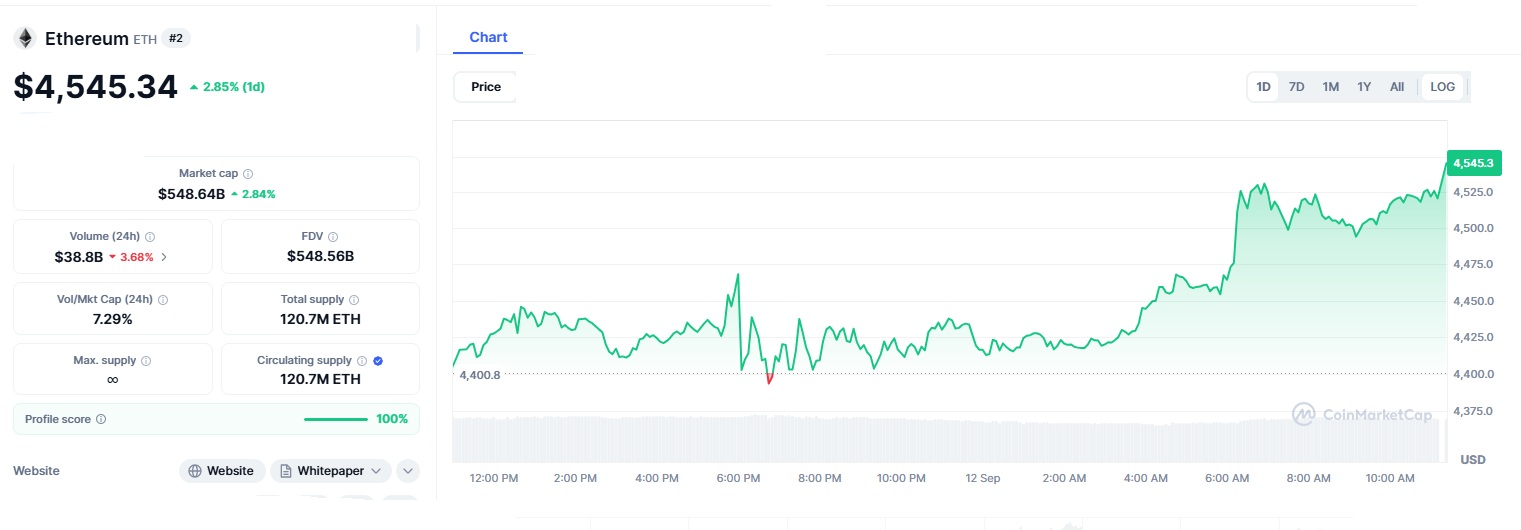

Ethereum, the world’s second-largest cryptocurrency by market value, has broken through a major price barrier at $4,400, sparking discussions about whether a long-term climb toward $9,000 is now possible. On September 12, 2025, Ethereum trading at $4,545, marking a 2.85% daily gain. The rise comes at a time when institutional investment is picking up, and upgrades to Ethereum’s network are strengthening its fundamentals. But questions remain about whether this momentum can last or if a pullback is near.

For weeks, Ethereum had been holding firm near the $4,300 level, forming what traders call a support base. Breaking above $4,400 suggests that buyers are gaining the upper hand. These inflows are often linked to large investors such as hedge funds and institutions positioning themselves for potential gains. On technical charts, Ethereum looks promising as well. Analysts highlight that the price broke above a downward trendline, while the relative strength index (RSI) sits at 59, signaling healthy buying momentum without showing signs of extreme overvaluation.

For weeks, Ethereum had been holding firm near the $4,300 level, forming what traders call a support base. Breaking above $4,400 suggests that buyers are gaining the upper hand. These inflows are often linked to large investors such as hedge funds and institutions positioning themselves for potential gains. On technical charts, Ethereum looks promising as well. Analysts highlight that the price broke above a downward trendline, while the relative strength index (RSI) sits at 59, signaling healthy buying momentum without showing signs of extreme overvaluation.

Recent market activity has fueled growing confidence around Ethereum’s future. One of the most notable developments came from BitMine, a large cryptocurrency-focused company, which purchased a significant amount of Ethereum. When large investors accumulate tokens like this, it reduces the available supply in the market. If demand stays steady or increases at the same time, prices often rise. This trend has led some to compare Ethereum’s current situation with Bitcoin’s rally back in 2020, when Bitcoin’s value soared to new all-time highs. Based on this comparison, some analysts believe Ethereum could reach anywhere between $8,000 and $10,000 by early 2026, as long as it can push through the major resistance levels that have held back its price so far.

However, the outlook is not entirely positive. While some institutions and funds are buying, others are choosing to cash out. Analytics Insight recently reported that $787 million was pulled out of Ethereum ETFs in just a single week. This shows how quickly market sentiment can shift, with some investors locking in profits instead of waiting for higher prices. On trading platforms such as Binance, strong selling interest is expected around the $4,000 level. If the price climbs to that range, it may struggle to move higher. On the downside, if Ethereum fails to hold above $4,387, analysts warn it could fall back toward $4,268 or even lower before finding support again.

These mixed signals are appearing at a time when the broader cryptocurrency industry is facing increased challenges. Regulators are putting pressure on decentralized finance platforms, which rely heavily on Ethereum’s network. To respond to these changes, Ethereum has been adapting to attract institutional investors. One example is the development of staking exchange-traded funds (ETFs). These financial products give traditional investors a way to earn staking rewards linked to Ethereum without having to buy and manage tokens directly. By offering easier access and more familiar structures, staking ETFs are designed to build trust among larger financial players who might otherwise hesitate to enter the crypto market.

Ethereum’s long-term growth is being guided by key technical changes. A major update called the Pectra upgrade is planned for early 2026 and is expected to improve scalability. This means the network will be able to process more transactions at once, lowering fees and making usage faster. Ethereum already leads the decentralized finance (DeFi) sector, handling around half of all decentralized exchange activity in August. The upgrade could strengthen this position, making the platform more efficient and appealing for new projects.

Staking is also affecting Ethereum’s supply. By September, about 35.6 million ETH, nearly 30% of the total, was locked in staking by more than 1 million validators. With fewer tokens available to sell on the market, this can create upward pressure on prices. However, the flow of money into and out of Ethereum ETFs remains an uncertain factor that could influence how the market develops.

Ethereum’s Path Toward $9,000 Faces Key Tests

Tom Lee asked Fundstrat’s Mark Newton for his technical take on Ethereum

Newton said "ETH could reach ~$5,500 in September and as high as $9,000 by early January." pic.twitter.com/GTb3uKfmP8

— Tom Lee Tracker (@TomLeeTracker) September 2, 2025

Ethereum’s chance of reaching $9,000 depends on several important factors. A major test is breaking above resistance at $4,600, which could signal the start of another rally. Broader economic conditions also matter, as interest rate cuts by the U.S. Federal Reserve may encourage more investment in assets like cryptocurrencies. Ethereum’s strong role in DeFi, NFTs, and growing institutional adoption, including HashKey’s $500 million digital fund, adds weight to its outlook.

Risks remain in the short term. If Ethereum drops below $4,387, leveraged positions could be liquidated, leading to sharp price declines. Volatility continues to be high, and while long-term fundamentals appear solid, setbacks are still possible.

Ethereum stands at a critical stage. Demand from institutions, upcoming upgrades, and reduced supply through staking provide reasons for optimism. However, the path to $9,000 is unlikely to be smooth. If ETF inflows, network improvements, and global economic support align, Ethereum could strengthen its position as a key asset in institutional portfolios.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.