Solana has become one of the most talked-about names in the crypto market in 2025, and for good reason. The price of SOL recently traded at $236.70 on September 12, 2025, and excitement is growing that it could push toward the $300 mark before the end of the year. The main reason for this optimism is the possibility of a spot exchange-traded fund (ETF) for Solana gaining approval. An ETF would allow traditional investors to gain exposure to Solana without having to buy and store the token themselves, which could attract billions of dollars in new investment. Analysts argue that if approval comes through, it could open the door to a major rally that extends well into 2026.

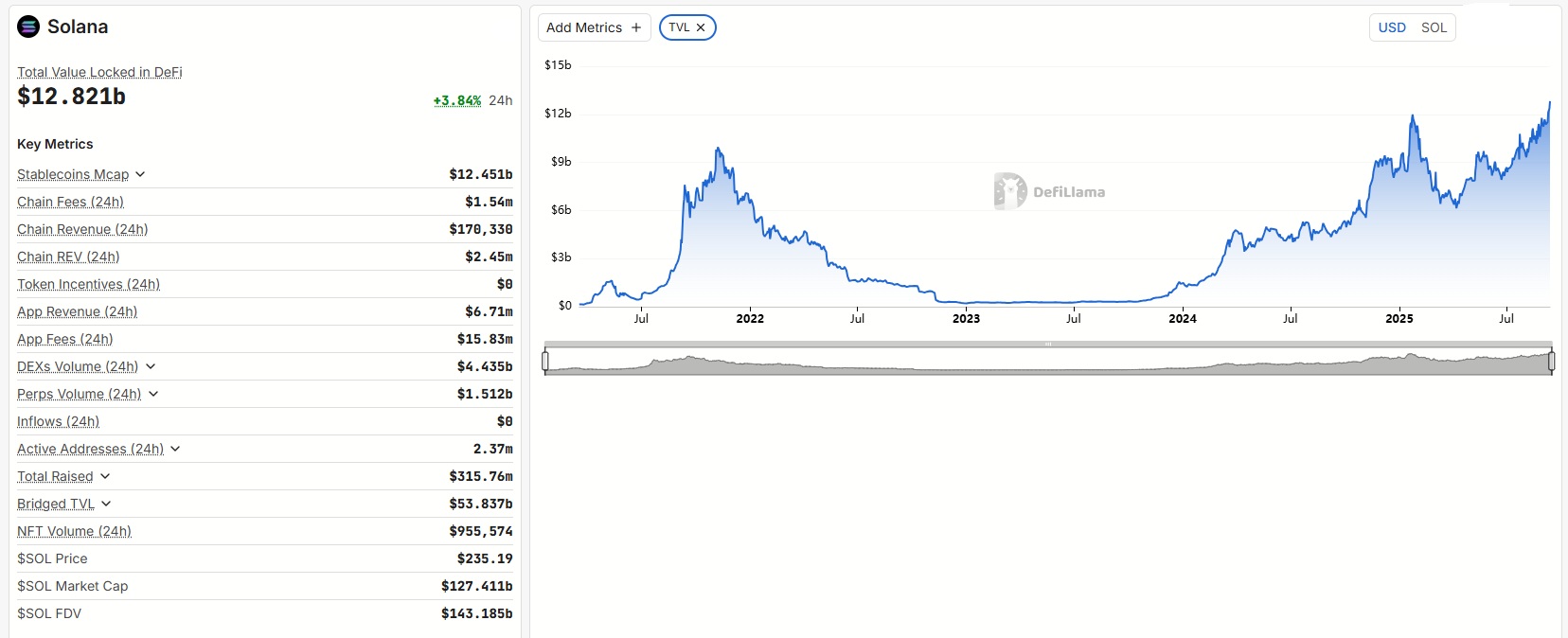

Several large asset managers, including VanEck, Grayscale, and Bitwise, have already filed for their own versions of a Solana ETF. Prediction markets such as Polymarket currently show odds of almost 100% for approval by October. This level of confidence has fueled strong institutional activity. On-chain data shows Solana’s futures market open interest climbing to $7.54 billion in just one day, a sign that professional traders are placing large bets on its future. At the same time, the value locked in Solana’s decentralized finance ecosystem has risen to $12.82 billion, the highest level since mid-2022. These numbers reflect both growing adoption and a steady return of investor confidence.

Experts following the ETF race suggest that while the U.S. Securities and Exchange Commission often delays decisions, such delays are procedural and not necessarily signs of rejection. Bloomberg analyst has noted that a final decision is expected no later than October 10. If approval comes through, some market observers expect Solana to follow a path similar to Bitcoin, which experienced explosive growth after its ETF launch in 2024. CEO of Galaxy Digital, Mike Novogratz says we’re entering the “season of Solana.”

🚨 JUST IN: "THE SEASON OF $SOL IS COMING" —@GalaxyHQ FOUNDER @Novogratz ON CNBC EARLIER TODAY#SOLANA ⚡️ pic.twitter.com/GOjpDTnIBK

— curb.sol (@CryptoCurb) September 11, 2025

Technical analysis also supports the bullish view. Solana’s weekly chart shows a bullish continuation pattern known as a bull flag, with projections pointing toward $335 if momentum continues. In addition, the pairing of SOL against Bitcoin has formed what is known as a golden cross, a signal often linked to long rallies in the past. Activity on the network is also climbing sharply, with daily active wallets rising nearly 40% to 2.7 million. This growth has been led by DeFi applications such as Raydium, which have reported triple-digit increases in unique users.

Corporate adoption is further fueling the rally story. Forward Industries recently announced a $1.65 billion purchase of Solana for its reserves, marking one of the largest treasury allocations in the history of crypto. This type of move is significant because it shows that large companies are beginning to treat Solana as more than just a speculative token. Instead, it is being seen as a strategic asset, alongside traditional holdings. Combined with regulatory changes in the U.S. that have eased restrictions on crypto trading and the appointment of a more crypto-friendly official at the SEC, optimism around Solana’s ETF prospects has grown stronger.

That said, risks are never far away in crypto markets. Solana’s price must still hold above $197 to maintain its bullish outlook, and a failure to break the resistance level around $225 could stall momentum. Traders also point out that highly leveraged bets in the futures market could backfire, leading to forced liquidations if the price dips too far. On a broader scale, if Bitcoin falls below key levels such as $90,000, altcoins like Solana would likely face pressure as well.

Why Solana Is Getting So Much Attention

Solana is being closely watched because of how well it performs compared to other blockchains. Unlike Ethereum, which is often criticized for higher costs, Solana is known for handling very large numbers of transactions at extremely low fees. The network processes more than 1.3 million transactions every day, showing how fast and efficient it is. Developers are also using Solana for much more than just finance. It has become a popular choice for gaming, NFTs, and creative campaigns such as “Solana Summer,” which have helped bring in new users and build community interest. This variety of uses makes the case for a Solana ETF stronger, as it highlights adoption beyond just financial products.

Supporters often compare Solana’s potential ETF approval to the success of Bitcoin’s ETF. After Bitcoin’s ETF launched, its price surged from $40,000 to $125,000 in less than a year. Many believe Solana could see a similar rise, with some predicting it could reach $500 by 2026 if overall market conditions remain positive. One factor that could help is the U.S. Federal Reserve lowering interest rates, which usually makes investors more willing to put money into assets like cryptocurrencies.

The key moment to watch is the October deadline for the decision on a Solana ETF. If approved, it could establish Solana as a strong competitor to Ethereum and an important option for institutional investors. If not, the network may need more time to prove itself. What stands out, however, is that Solana has already gained serious attention thanks to its technology, growing adoption, and the possibility of mainstream financial recognition. With the ETF decision ahead, Solana may be on the verge of one of the most important turning points in its history.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.