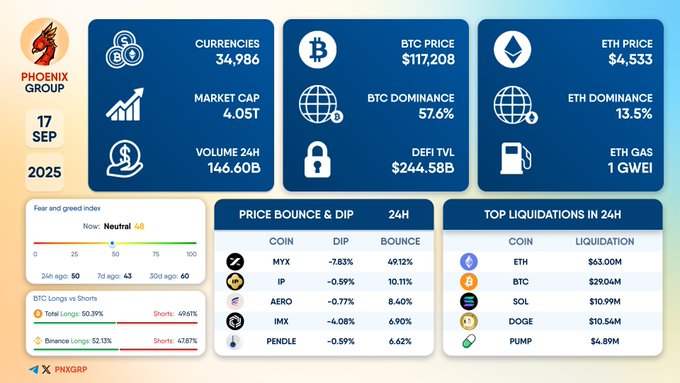

- Crypto market hit $4.05T cap with $146.6B trading volume on September 17, 2025.

- Bitcoin held 57.6% dominance at $117K, Ethereum at $4.5K with low 1 gwei gas fees.

- $118M in liquidations led by Ethereum and Bitcoin signaled high leverage activity.

The crypto market recorded mixed trends on September 17, 2025, as overall activity remained strong despite uneven results across major and mid-tier tokens. Total market capitalization reached $4.05 trillion, while daily trading volume stood at $146.6 billion across 34,986 tracked assets.

Daily Summary on September 17, 2025$MYX $IP $AERO $IMX $PENDLE $ETH $BTC $SOL $DOGE $PUMP#dailysummary #DeFi #Crypto pic.twitter.com/BR3hkbKv0x

— PHOENIX – Crypto News & Analytics (@pnxgrp) September 17, 2025

Bitcoin continued to dominate the crypto market, trading at $117,208 with a market share of 57.6%. Ethereum followed closely at $4,533, representing 13.5% of total capitalization. The decentralized finance (DeFi) sector also remained firm, with total value locked (TVL) reported at $244.58 billion. Transaction costs across Ethereum were stable, with gas fees at 1 gwei, enabling low-cost activity during the day. The figures pointed to steady network efficiency even with high trading volumes.

Market Sentiment and Futures Positioning

Sentiment indicators showed neutrality among investors. The Fear and Greed Index registered 48, only a minor change from 50 two days earlier. Futures data suggested a nearly even balance between long and short positions, with longs holding a slight majority at 50.93%.

On Binance, long contracts were more pronounced at 52.13%, while shorts accounted for 47.87%. The figures displayed measured positioning, with no immediate tilt toward extreme optimism or panic.

Source: Phoenix Group

Large intraday movements were visible in smaller assets. MYX fell by -7.83% before recovering with a strong 49.12% rebound. IP recorded a -5.09% decline followed by a 20.06% recovery. Additional tokens such as AERO, IMX, and Pendle saw moderate pullbacks and partial rebounds, reflecting continued price volatility outside the largest assets.

Liquidations Across the Crypto Market

Leveraged activity contributed to large liquidations. Ethereum accounted for the largest share at $63 million, followed by Bitcoin at $29.04 million. Solana saw $10.99 million in positions closed, while Dogecoin registered $10.54 million. Pump.fun completed the list of top liquidated assets with $4.89 million.

The crypto market displayed signs of consolidation as large assets held dominant positions and liquidation pressure concentrated on smaller projects. Stable readings on sentiment indicators reinforced the outlook of neutrality, while high leverage continued to drive volatility in selected tokens.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.