Dogecoin, the Shiba Inu-themed cryptocurrency that began as a joke in 2013, has entered a new phase of legitimacy with the launch of its first exchange-traded fund (ETF) in the United States. The Rex-Osprey DOGE ETF went live after a 75-day SEC review, marking the first-ever memecoin ETF. This launch allows investors to gain exposure to Dogecoin without holding the tokens directly, signaling growing acceptance of cryptocurrency in traditional finance.

The launch was smooth and regulatory-approved, providing a gateway for both retail and institutional investors. Grayscale has also filed an amended S-1 registration to convert its Dogecoin Trust into a spot ETF on NYSE Arca, potentially under the ticker GDOG. These developments have generated excitement in the market, but price movements indicate that investor sentiment remains cautious.

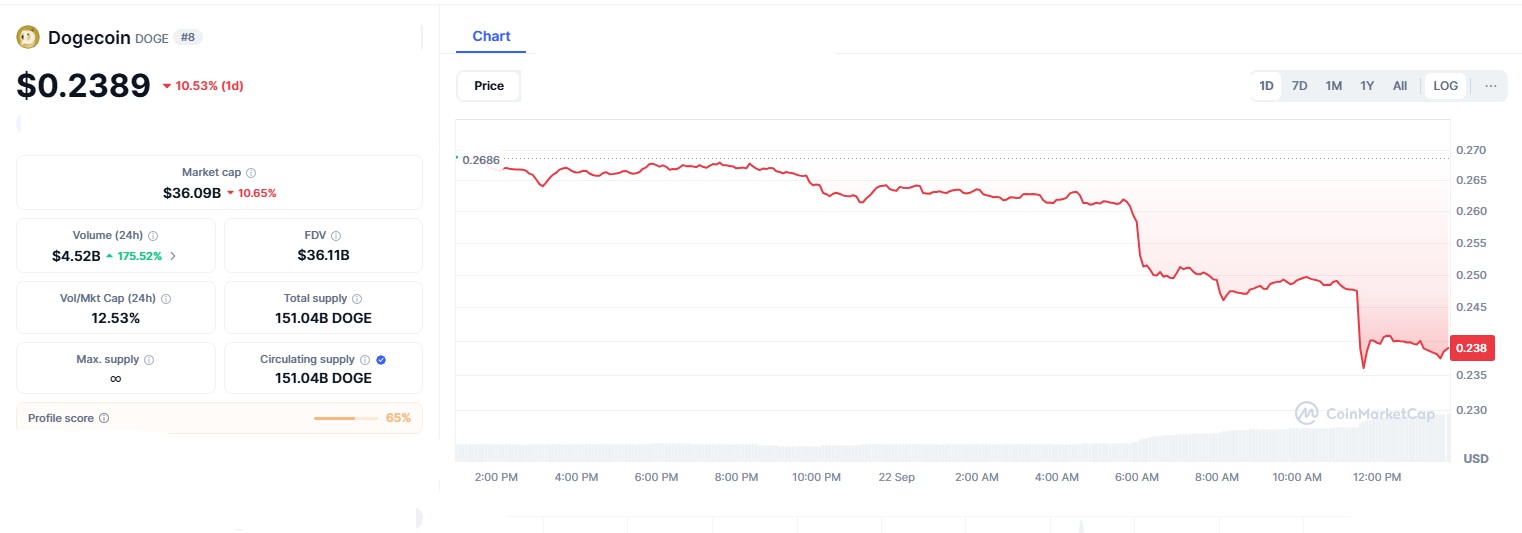

The Rex-Osprey DOGE ETF debuted on the Cboe exchange with a management fee of 1.5%. The first trading day saw Dogecoin’s price hover around $0.27, reflecting a modest increase of 0.75% over 24 hours. While the launch demonstrated investor interest, Dogecoin’s price chart shows a mix of signals, suggesting both potential gains and risks.

Large investors, commonly referred to as whales, have been accumulating significant amounts of DOGE. Recent on-chain data indicates that over 280 million DOGE have moved into the wallets of major holders. This accumulation suggests confidence in Dogecoin’s medium-term potential and adds upward pressure on the market. At the same time, technical indicators like the TD Sequential on the four-hour chart signal possible price increases toward resistance levels between $0.28 and $0.30, with a potential peak of $0.315 if buying momentum continues.

While the ETF launch provides optimism, some caution is warranted. Analysts have identified a potential death cross, which occurs when the 50-day moving average drops below the 200-day moving average. This pattern can indicate bearish trends in the short term. Current support levels are holding between $0.25 and $0.26. Should prices break below this range, a retest of $0.20 could occur, creating challenges for traders attempting to capitalize on the ETF’s momentum.

Transaction volumes and network activity suggest growing interest in Dogecoin, yet volatility remains high. Meme coins like DOGE are especially sensitive to market sentiment, media coverage, and investor psychology, making price swings common even after significant institutional developments.

Dogecoin’s ETF is significant beyond its price action. It represents a milestone in cryptocurrency acceptance within regulated financial markets. If DOGE ETFs gain traction, other memecoins could follow, potentially bringing additional liquidity and legitimacy to the sector. Developers may also feel pressure to improve Dogecoin’s network and ecosystem, ensuring it can support increased trading volumes and broader use cases.

Regulatory clarity plays a key role as well. SEC approval signals a willingness to integrate cryptocurrencies into traditional finance, encouraging further institutional participation. At the same time, broader macroeconomic factors, including inflation and Federal Reserve policies, will influence price trends and investor behavior. Short-term traders are watching the $0.26 support and $0.30 resistance levels. A sustained break above $0.30 could open the path to $0.38–$0.40, while a drop below $0.25 may test $0.20, especially if macroeconomic concerns increase. Longer-term projections suggest that Dogecoin could approach $0.50 to $1 in 2026 if adoption grows and regulatory conditions remain favorable.

| Indicator | Current Level | Implication |

|---|---|---|

| Support | $0.25–$0.26 | Holding this range may enable a breakout toward $0.30 |

| Resistance | $0.28–$0.30 | Breaking this could trigger further upside toward $0.315 |

| Death Cross | Potential | Could signal bearish trend if market pressure continues |

| Whale Activity | 280M DOGE accumulated | Indicates strong institutional or large-holder confidence |

Dogecoin’s ETF launch is both a moment of celebration and a test for the market. While the new ETF provides opportunities for broader investment and institutional involvement, technical risks remain. Traders and investors must monitor price charts, key support and resistance levels, and overall market conditions to navigate potential volatility. The ETF marks a step toward mainstream adoption for Dogecoin, but like all cryptocurrencies, it remains sensitive to broader market trends. The coming weeks will reveal whether this launch can sustain Dogecoin’s growth or if technical challenges will temper the excitement.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.