HEMI, a new Bitcoin-based project, has taken the crypto community by storm. In just one week, the token gained more than 250%, largely driven by its listing on Binance and a surprise airdrop program for Binance Coin (BNB) holders. The rise has created excitement across the industry, but it has also raised questions about whether this growth is sustainable or just another short-lived market pump.

At its core, HEMI is not a meme coin or a hype-only project. It is designed as a modular Bitcoin programmability layer created by Jeff Garzik, one of the earliest contributors to Bitcoin. HEMI runs on the Hemi Virtual Machine (hVM), which combines Bitcoin’s strong security with Ethereum’s ability to run smart contracts. This approach allows developers to build decentralized finance (DeFi) applications on top of Bitcoin, something the original Bitcoin blockchain was not designed to handle.

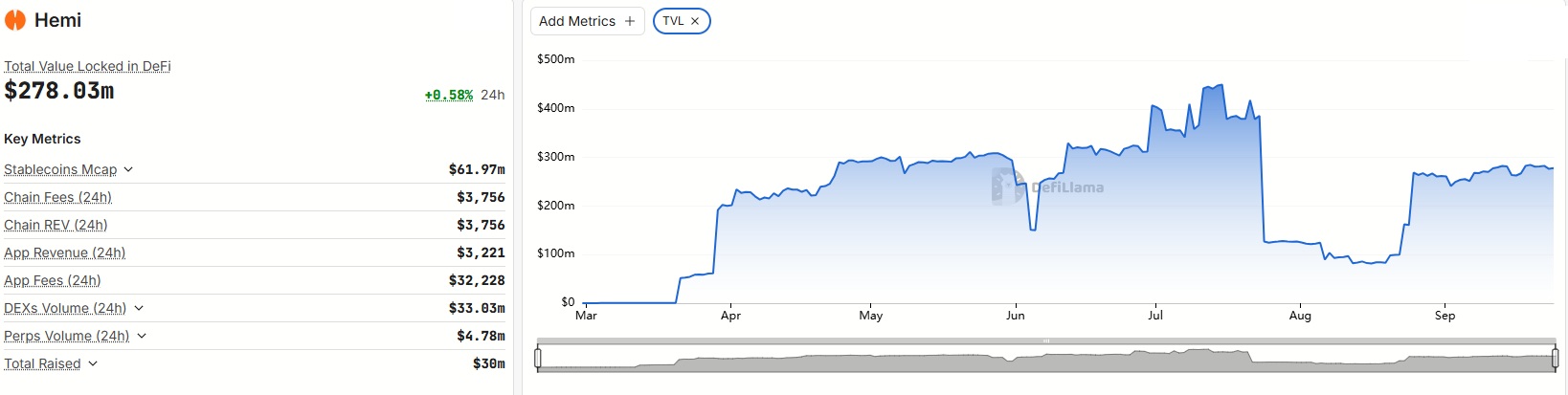

To understand the scale of HEMI’s sudden rise, the key data is summarized below:

| Metric | Value (September 2025) | Notes |

|---|---|---|

| Price Peak | $0.183 | Current price ~$0.178 |

| Weekly Growth | +250% | Including +52% in one day |

| Fully Diluted Valuation (FDV) | $1.7 billion | At price peak |

| Binance Listing Date | September 23, 2025 | Trading pairs with USDT, USDC, BNB, FDUSD, TRY |

| Airdrop Supply | 100 million HEMI (1% of total) | Distributed to BNB holders |

| Total Value Locked (TVL) | $278 million DeFi | Second largest among Bitcoin sidechains |

The listing on Binance, combined with the retroactive airdrop to BNB holders, was the turning point. Binance gave HEMI a “Seed Tag,” indicating that the token carries high volatility but strong growth potential. The airdrop was particularly important. HEMI became the 43rd project to be included in Binance’s HODLer Airdrop Program. This meant that users who staked BNB through Simple Earn or On-Chain Yields between September 17 and 19 received free HEMI tokens distributed through Binance’s HODLer portal. For many traders, this felt like a surprise reward for loyalty.

Why HEMI Stands Out

HEMI’s technology aims to solve a challenge that has followed Bitcoin for years, programmability. While Bitcoin is the most secure blockchain, it does not natively support smart contracts. Ethereum filled that gap, which is why most DeFi activity has taken place there. HEMI bridges this divide by embedding a Bitcoin node inside an Ethereum Virtual Machine (EVM). This allows developers to build applications that benefit from both Bitcoin’s security and Ethereum’s flexibility. Partnerships with Binance Perpetuals, Alpha, Booster, and Binance Wallet have also strengthened its position.

The response from the crypto community has been mixed. Many traders and BNB holders were thrilled with the unexpected airdrop and celebrated HEMI’s rapid rise. Online discussions compared the rally to a “lottery win,” especially for those who happened to be staking BNB during the airdrop window. Others, however, expressed caution. Some forum posts warned that a 250% surge in just a few days could be unsustainable, and with Binance marking the token as highly volatile, there is always a risk of a sharp correction. Skeptics pointed out that many tokens have enjoyed strong initial gains after listings, only to fall back once the excitement cooled.

HEMI’s launch highlights a few broader trends in the cryptocurrency space. First, Bitcoin-based layers and sidechains are gaining attention as developers look for ways to unlock new use cases for the world’s largest blockchain. Second, exchanges like Binance continue to play a crucial role in determining which projects gain mass exposure. Finally, retroactive rewards and airdrops are becoming powerful tools for building loyalty among token holders. If HEMI can maintain user interest, attract more developers, and grow its ecosystem, it may become one of the leading projects bringing DeFi functionality to Bitcoin. However, if the surge is mainly driven by short-term speculation, prices could fall just as quickly as they rose.

In the short term, HEMI may continue to experience volatility as traders take profits and new participants enter the market. Analysts suggest the token could test higher levels if developer activity expands and new DeFi applications launch on the hVM. Long term, its success depends on whether it can deliver real, lasting utility and avoid being remembered as just another temporary listing pump.

HEMI’s story is still being written, but the sudden combination of a Binance listing, retroactive rewards, and innovative technology has made it one of the most talked-about tokens of late 2025. The next few months will reveal whether this is the beginning of a new chapter for Bitcoin-based DeFi or simply another reminder of how quickly fortunes can rise and fall in the crypto markets.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.