Arthur Hayes, the co-founder of BitMEX and a well-known figure in the cryptocurrency industry, has made a surprising move that caught the attention of traders around the world. Hayes sold millions of dollars’ worth of Hyperliquid (HYPE) tokens and redirected part of the proceeds into AAVE, one of the largest and most established DeFi protocols. The decision has sparked debate about whether major investors, often referred to as “whales,” are beginning to retreat from risky tokens and move into safer, more reliable assets. The timing of this move is significant. Crypto markets in 2025 are slowly recovering from a long downturn, with established projects beginning to attract renewed confidence. Hayes’ portfolio reshuffle could reflect a larger trend in which big investors shift away from speculative tokens toward more sustainable platforms.

🚨 ARTHUR HAYES JUST BOUGHT 1,630 $AAVE FOR ABOUT $370,000.

— Kyle Chassé / DD🐸 (@kyle_chasse) September 23, 2025

👀👀👀 pic.twitter.com/3MhcCI7fbz

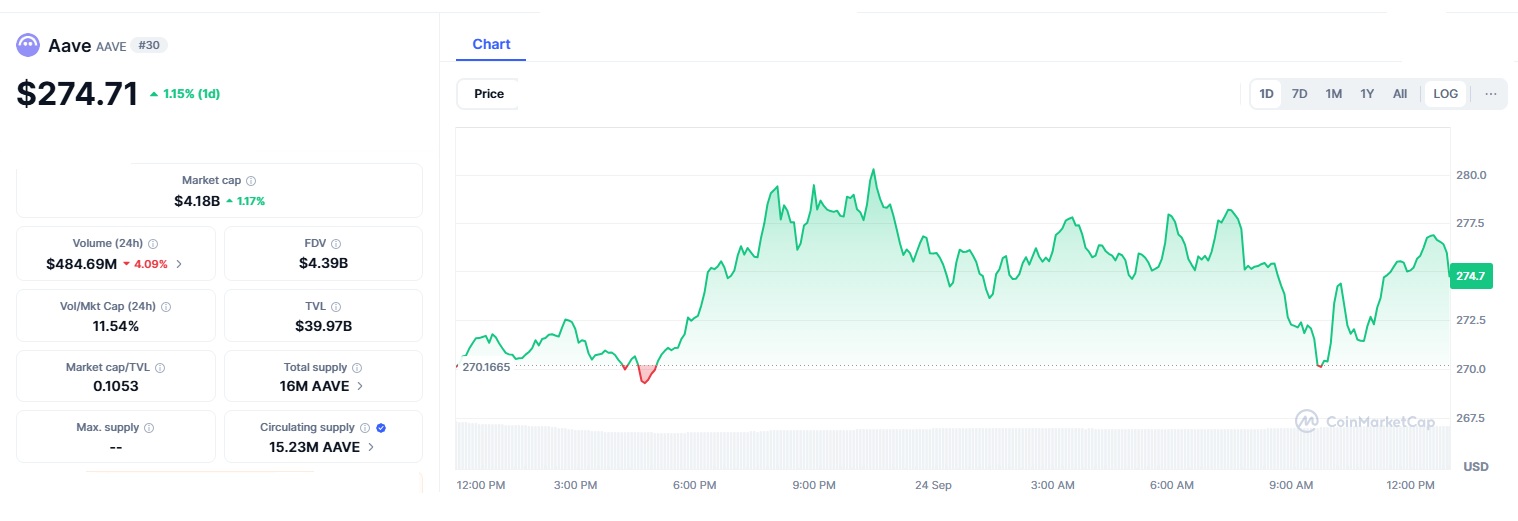

Over the weekend of September 23, 2025, Hayes sold 96,628 HYPE tokens, which were valued at approximately $5.1 million. Shortly after, he purchased 1,630 AAVE tokens, spending about $375,000 in USDC. The shift came as Hayes pointed to upcoming token unlocks in the Hyperliquid ecosystem. Token unlocks often add large amounts of supply to the market, which can put downward pressure on prices. Previously, Hayes had been very supportive of HYPE, predicting massive growth and even suggesting the token could rival Binance in scale. His sudden exit therefore surprised many observers and raised questions about whether his earlier enthusiasm encouraged others to invest before he sold his position.

The difference in the two tokens is striking. HYPE is a relatively new project with limited history and high volatility. AAVE, by contrast, is one of the most trusted names in decentralized finance. It is a lending and borrowing protocol that has maintained strong market presence since 2017. According to DeFiLlama, AAVE currently holds over $39 billion in total value locked (TVL), a measure of how much capital is being used within the protocol.

The market responded quickly. Following Hayes’ move, AAVE rose by about 3% to trade near $275, while HYPE fell almost 4% to $47.41. The sell-off in HYPE was worsened by competition from Binance’s ASTER token, which drew some liquidity away from Hyperliquid.

Key Figures at a Glance

| Token | Hayes’ Action | Value of Trade | Price Impact | TVL / Market Strength |

|---|---|---|---|---|

| HYPE | Sold 96,628 tokens | ~$5.1M | -3.9% (to $47.41) | Facing unlocks, high volatility |

| AAVE | Bought 1,630 tokens | ~$375K | +3% (to ~$275) | $39B TVL, top DeFi protocol |

This transaction highlights a tension within the crypto market. Many traders chase fast-moving, high-reward tokens like HYPE, but these assets can fall just as quickly as they rise. By contrast, established DeFi protocols like AAVE are considered “blue chips” because they have proven stability, real-world utility, and large user bases. Hayes’ decision could suggest that whales are looking to reduce risk by favoring established platforms over newer, untested tokens. This trend would be important for the market as a whole. If more large investors follow this path, capital could flow into blue-chip projects, boosting their strength and reducing overall market volatility.

Hayes’ move reflects a broader reality in crypto markets, whales have significant influence. When a figure with Hayes’ track record reallocates millions, it often shifts market sentiment, encouraging others to reconsider their own positions. For retail traders, these moves can be both opportunities and risks. Prices in blue-chip tokens like AAVE may rise, while smaller tokens may face heavy selling pressure. For DeFi as a whole, this pivot highlights a shift toward sustainability.

Short and Long-Term Outlook for AAVE and HYPE

In the near future, AAVE might see benefits from Hayes’ recent actions, with the possibility of reaching higher prices if more investors join in. On the other hand, HYPE is dealing with challenges due to the release of new tokens, which increases selling, and growing competition in the DeFi space. In the long run, Hayes’ shift might be part of a larger trend where big investors move towards more established DeFi platforms. If this pattern continues, the next wave of growth in the crypto world could be driven by well-established projects rather than newer, experimental tokens.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.