In recent years, cryptocurrencies have moved from niche speculation to mainstream finance. Now, Ripple’s latest step with BlackRock signals that XRP may be entering a new phase of utility and adoption. On September 23, Ripple announced a collaboration involving BlackRock’s $2 billion BUIDL fund and VanEck’s VBILL, two tokenized money market funds. This integration opens the door for institutional investors to connect with Ripple’s ecosystem, potentially boosting both utility and market confidence in XRP.

What the Partnership Means

JUST IN: BlackRock’s $BUIDL and VanEck’s $VBILL tokenized funds are now redeemable 24/7 through @Securitize with $RLUSD settlement on the $XRP Ledger coming soon🔜 pic.twitter.com/oguxsNONdv

— XRP Update (@XrpUdate) September 23, 2025

Through a platform called Securitize, investors in BlackRock’s BUIDL and VanEck’s VBILL can now swap their fund shares directly for Ripple’s U.S. dollar stablecoin, RLUSD, at a 1:1 ratio. This means traditional assets can be exchanged seamlessly for blockchain-based tokens without the delays of traditional settlement systems, which often take two days or more.

The service will initially operate on Ethereum, but Ripple has confirmed that it will soon expand to the XRP Ledger (XRPL). This expansion is important because it positions XRPL as a backbone for tokenized assets and cross-border liquidity, areas where Ripple already has significant traction. Ripple CEO Brad Garlinghouse highlighted that this collaboration brings “real utility” to decentralized finance (DeFi) by offering 24/7 liquidity options for institutions and retail users alike.

Technical Overview

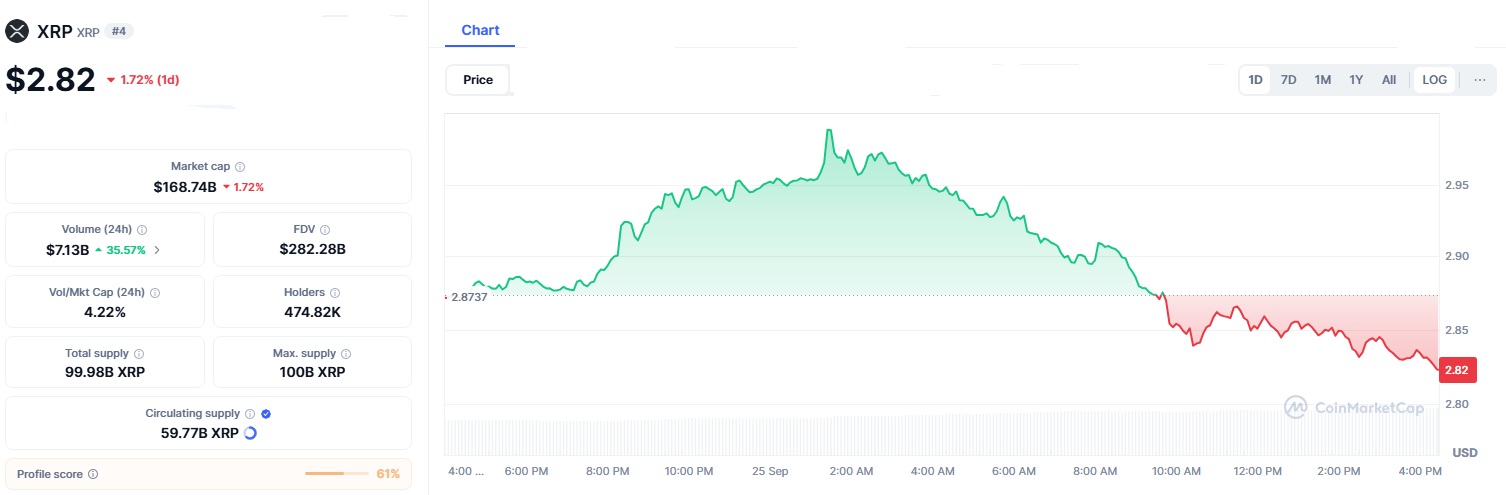

Following the announcement, XRP’s price recovered from a recent dip. After dropping as low as $2.70, it stabilized around $2.82, closely aligned with the 100-day Exponential Moving Average (EMA). Trading volumes rose modestly, suggesting that market participants are paying close attention to the new use case.

However, technical analysis shows mixed signals. XRP is currently moving within a descending triangle pattern, which often signals the risk of further downside if support levels are broken. If bearish momentum increases, XRP could retest the $2.50 support zone. On the other hand, breaking above resistance near $3.00 could pave the way toward $3.30 or higher if volume continues to increase.

| Indicator | Current Status | Implication |

|---|---|---|

| Price Range | $2.70 – $2.87 | Testing support near $2.70; resistance near $3 |

| 100-day EMA | ~$2.83 | Acting as current support |

| RSI (Relative Strength Index) | Neutral at 42 | Market is not yet overbought or oversold |

| MACD (Momentum Indicator) | Weak signals | No clear bullish momentum yet |

| RLUSD Market Cap | $700M+ | Institutional adoption accelerating |

Institutional and Retail Impact

This development has different implications for institutional and retail investors. For institutions, it provides an opportunity to access blockchain-based liquidity without leaving the safety of regulated money market funds. By converting shares of BUIDL or VBILL into RLUSD, funds can be mobilized instantly for lending, payments, or trading on decentralized platforms.

For retail holders of XRP, the news creates what analysts call a “halo effect.” If institutional money begins to flow into Ripple’s ecosystem, the demand for XRP as a bridge currency could rise. This may not cause immediate price surges but could strengthen the token’s position as a backbone of cross-border payments and tokenized finance.

Ripple’s partnership with BlackRock is part of a larger movement known as tokenization of real-world assets (RWA). Industry analysts predict that trillions of dollars in traditional assets such as bonds, funds, and real estate could be represented on blockchains over the next decade. By positioning RLUSD as a key settlement tool and XRPL as the infrastructure, Ripple is aiming to capture a meaningful share of this market.

The collaboration also reflects a growing shift in how large financial firms view blockchain. Instead of dismissing cryptocurrencies as speculative, institutions like BlackRock are experimenting with regulated on-chain solutions. This could influence competitors such as Fidelity and State Street to launch similar initiatives. For remittance markets, particularly in Asia and Latin America, the use of RLUSD and XRPL could cut transaction fees and settlement times, making cross-border transfers more efficient. Given that global remittances exceed $800 billion annually, this represents a significant opportunity.

Outlook

The short-term future of XRP depends on how the market reacts to both technical and macroeconomic conditions. If buyers push the price above $3, momentum could carry it toward $3.30 or even $3.50 in the coming months. However, if political and economic uncertainty in the U.S. weighs heavily on financial markets, XRP could struggle to hold its support levels. Longer-term, this integration strengthens the argument that XRP is more than just a speculative asset. By linking directly with tokenized funds managed by some of the largest firms in traditional finance, Ripple is moving closer to its goal of becoming a central player in global payments and liquidity management.

In summary, while short-term volatility remains a challenge, the Ripple BlackRock collaboration could mark the beginning of a more mature phase for XRP where adoption and utility take priority over speculation.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.