The crypto market faced heavy selling pressure on September 25, 2025, as concerns about a potential U.S. government shutdown rippled through global financial markets. Bitcoin (BTC), Ethereum (ETH), and XRP all recorded notable declines, highlighting how political uncertainty in Washington can directly influence digital assets.

Ethereum Leads the Decline

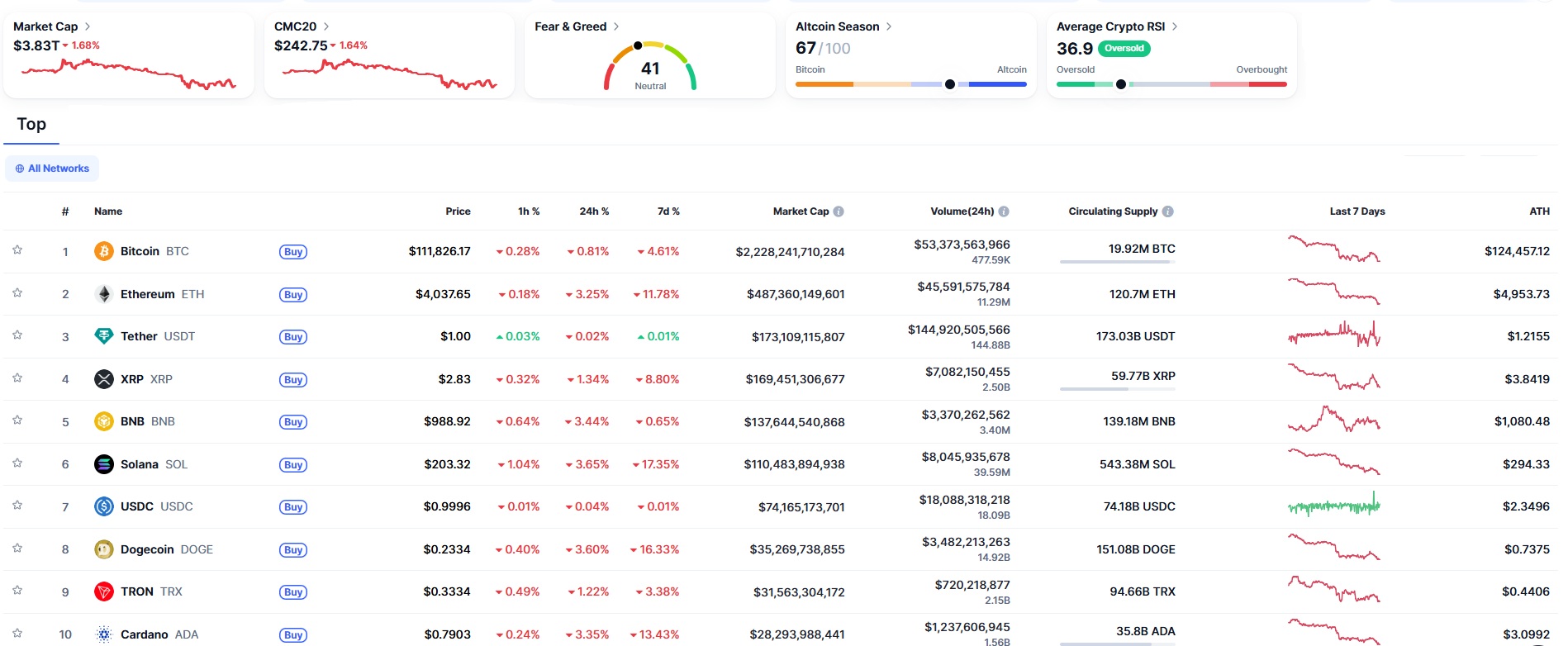

Ethereum was at the center of the market downturn, falling more than 3% and coming close to the $4,000 level, which it had not tested since early August. Bitcoin, the largest cryptocurrency, dropped over 1% and slipped below $112,000, while XRP declined between 2.6% and 3%. The sell-off reflected not only technical pressures but also fears about the U.S. government’s ability to fund its operations. With federal finances under strain, Congress is debating whether to pass a short-term spending bill or a full set of annual appropriations. Without an agreement, the government could shut down on October 1, 2025.

Political Gridlock and Market Stress

🚨 U.S Government will trigger the biggest CRASH

— Aralez 🐕 (@0xAralez) September 24, 2025

U.S Shutdown on Oct 1 – market will " drown in blood "

After studying SECRET GOV files, I was shocked

Here’s how U.S. Shutdown will impact crypto and what’s next👇🧵 pic.twitter.com/d30RoRHZxp

The likelihood of a shutdown has been rising. On prediction markets such as Polymarket, traders now place the odds at 63% by October 1 and 77% by the end of the year. President Donald Trump’s warnings about potential chaos added to investor unease.

The uncertainty has already caused ripple effects across financial markets:

- Over $631 million in crypto positions were liquidated within 24 hours.

- Total losses from leveraged positions reached $1.61 billion.

- U.S. Treasury yields are climbing as China sells billions of dollars’ worth of bonds.

- The Federal Reserve’s recent 25 basis point interest rate cut from September 17 feels overshadowed by political risks.

This combination of high leverage, political instability, and cautious institutional sentiment created a perfect storm for crypto markets.

Historical Context

This is not the first time a U.S. government shutdown has shaken crypto markets. During the 2018–2019 shutdown, regulatory actions stalled, legislation was delayed, and the Securities and Exchange Commission (SEC) operated at limited capacity. A similar scenario in 2025 could slow down the approval of ETFs, new crypto regulations, and other initiatives currently under discussion.

At the same time, the Federal Reserve is signaling that two more interest rate cuts are possible before year-end. If combined with lower inflation data such as the PCE inflation report due tomorrow markets may recover some stability in the coming weeks.

Community discussions reveal mixed emotions. Some traders see the decline as a natural correction caused by external politics, not blockchain fundamentals. Ethereum at $4,000 is viewed by optimists as an opportunity, especially given strong inflows into ETH ETFs earlier this year. Bitcoin, despite its slip, remains up over 150% year-to-date, showing resilience even during turbulence. XRP’s situation is more complex. The token is still tied to Ripple’s long-running legal battles with the SEC. While shutdowns could delay regulatory enforcement, they also introduce uncertainty for investors waiting for clarity.

Key Market Levels

Analysts are closely monitoring support and resistance levels across major cryptocurrencies.

| Asset | Current Range | Key Support | Key Resistance | Outlook |

|---|---|---|---|---|

| Bitcoin | ~$112,000 | $110,000 | $115,000 | Possible safe-haven rally if shutdown extends |

| Ethereum | ~$4,050 | $4,000 | $4,500 | PCE data could trigger recovery toward $4,500 |

| XRP | ~$2.65–$2.70 | $2.50 | $2.80 | Dependent on regulatory clarity and market sentiment |

Outlook

Short-term volatility is likely to continue until clarity emerges in Washington. If Congress fails to reach a deal by October 1, markets may experience further turbulence. However, past cycles suggest that crypto assets often rebound strongly once political uncertainty is resolved. For longer-term investors, the dip highlights both the risks and opportunities of a maturing crypto market. Despite setbacks, Bitcoin and Ethereum continue to show strength compared to earlier cycles, while XRP’s trajectory remains tied to regulatory outcomes.

The coming weeks will determine whether this episode becomes a temporary correction or a more prolonged downturn. Either way, the events of late September 2025 reinforce an important lesson, cryptocurrency markets are not isolated from global politics and economic policy.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.