Solana (SOL) is showing signs of following a similar price pattern to Binance Coin (BNB), which recently hit a new all-time high. This comparison has drawn the attention of traders and investors who believe Solana could soon experience a major breakout. As of early October 2025, analysts are closely watching whether Solana can repeat BNB’s strong performance or if the token will face another round of resistance before moving higher.

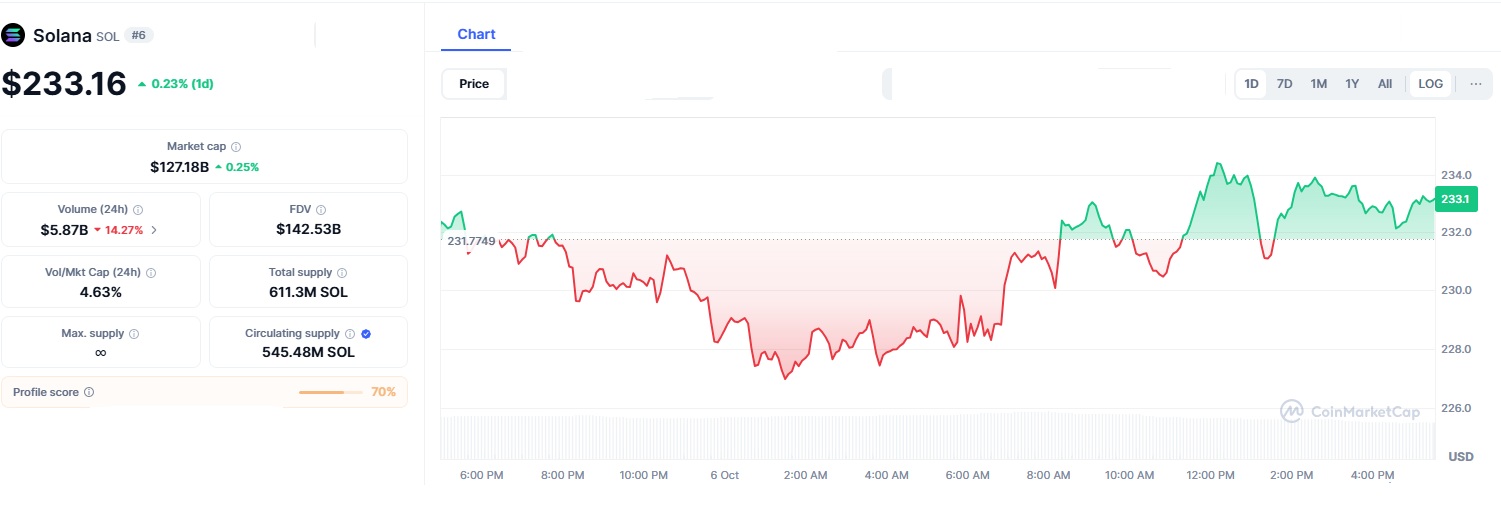

In September 2025, BNB climbed to a new all-time high above $1,000, rising nearly 18% in a week and more than 30% during the month. This growth was fueled by improved network activity, large-scale treasury buys, and strong market sentiment. Solana, known for its fast transactions and low fees, seems to be echoing this trend. On October 6, 2025, SOL traded around $233.16, with daily fluctuations between $226.95 and $236.78. The token recorded a 0.23% increase in 24 hours, supported by a trading volume of $5.87 billion and a market capitalization of $127.18 billion.

Although these movements might seem small, the pattern of steady growth and narrowing resistance levels hints that Solana could be preparing for a larger move possibly a 20% surge if market conditions align.

Solana’s Key Market Metrics (as of October 6, 2025)

| Metric | Value | Observation |

|---|---|---|

| Current Price | $233.16 | Stable, up nearly 1% in 24h |

| Daily Range | $226.95 – $236.78 | Key resistance near $236 |

| Market Capitalization | $126.46 billion | Among top 5 blockchains |

| 24-Hour Trading Volume | $5.87 billion | Reflects active trading |

| Monthly Performance | +9.5% | Strong recovery trend |

| Circulating Supply | 545.35 million SOL | Moderate inflation risk |

| Total Supply | 611.16 million SOL | Infinite max supply debated |

BNB’s recent rally marked the start of what some traders are calling “Altcoin Autumn,” where alternative cryptocurrencies outperform major assets like Bitcoin and Ethereum. Solana’s consistent gains over September up nearly 64% in some metrics have made it a standout among these altcoins. Analysts suggest that both BNB and Solana could outperform Ethereum in the short term due to their strong ecosystems and growing developer activity. Solana’s appeal lies in its speed, scalability, and active decentralized finance (DeFi) ecosystem, while BNB’s advantage comes from its deflationary token burns and exchange dominance.

However, there are still some concerns. Solana’s history of network outages and unlimited maximum supply raise questions about long-term stability and inflation. In contrast, BNB benefits from regular token burns, which reduce supply over time and can help support price growth.

Technically, Solana faces strong resistance near $236.78, which has capped several attempts to move higher. If it breaks through this level with strong trading volume, analysts believe SOL could quickly rise toward $280, representing roughly a 20% increase. However, if the price fails to hold above $230, a pullback toward $226 or even $200 could occur, especially if broader market sentiment weakens. The chart setup shows a clear consolidation zone, meaning the market is gathering strength for its next move. Whether that move is upward or downward depends heavily on trading volume, investor sentiment, and external market factors like BNB’s continued rally or shifts in liquidity across crypto markets.

What’s Next for Solana

The coming weeks could be crucial for Solana’s short-term direction. If trading volume increases and the token successfully breaks above $236, analysts predict a move toward $280 by mid-October 2025. A stronger breakout could even push it closer to the $300 mark before the end of the year. However, if resistance holds and sellers take control, the price might revisit the $226 level or even lower if broader market conditions worsen. In the bigger picture, Solana’s next phase depends on sustained network stability, developer growth, and investor confidence. As more capital flows into altcoins, the blockchain’s ability to maintain reliability and scale efficiently will determine whether this “echo” turns into a lasting rally.

Solana’s current market behavior mirrors BNB’s earlier surge, creating excitement about a potential 20% jump. But while short-term technicals look promising, long-term success depends on whether Solana can overcome its historical challenges and continue expanding its ecosystem. If resistance breaks, a climb toward $280 seems achievable. If not, the token could remain range-bound or slip to lower levels. Either way, Solana’s next few weeks may set the tone for how the rest of the crypto market behaves this season making it one of the most closely watched assets in the altcoin space.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.