- Mid-cap tokens led crypto market gains with COAI up 659.8% and Zcash up 142.2%.

- AI, privacy, and DeFi sectors drove strong investor momentum across digital assets.

- Broad-based rally signaled rising confidence ahead of Q4 in the crypto market.

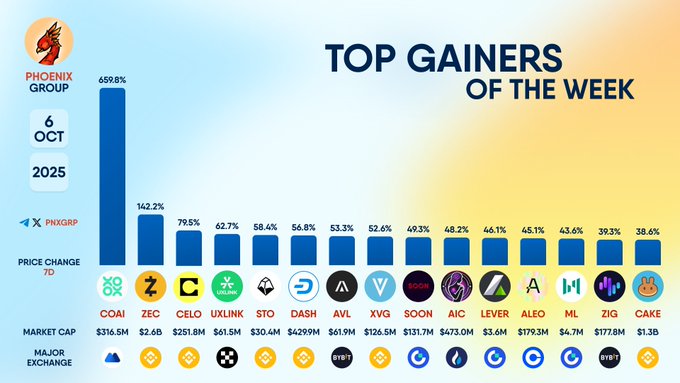

The crypto market recorded a strong rebound in the week ending October 6, 2025, as several mid-cap and utility-driven tokens outperformed major assets. According to data from Phoenix Group, the rally was dominated by COAI, Zcash (ZEC), and Celo (CELO), signaling renewed investor focus on decentralized AI, privacy-focused networks, and Layer 1 ecosystems.

COAI and Zcash Drive the Crypto Market Upswing

COAI led the weekly performance charts with an exceptional 659.8% surge, lifting its market capitalization to $316.5 million. The rise was linked to a spike in interest in AI-driven blockchain infrastructure, a sector that continues to attract global investor attention. Analysts noted that the project’s momentum represents one of the most large percentage increases within the crypto market in recent months.

TOP GAINERS OF THE WEEK

$COAI $ZEC $CELO $UXLINK $STO $DASH $AVL $XVG $SOON $AIC $LEVER $ALEO $ML $ZIG $CAKE pic.twitter.com/DaYT86drx6— PHOENIX – Crypto News & Analytics (@pnxgrp) October 6, 2025

Zcash (ZEC) followed as the second-best performer, climbing 142.2% over the week. The surge in Zcash’s value corresponded with renewed institutional focus on privacy-centric cryptocurrencies amid global regulatory scrutiny. Market analysts noted that privacy coins like ZEC often experience heightened interest during periods of compliance uncertainty, helping them gain traction within the crypto market.

Celo (CELO) secured the third position with a 79.5% gain, primarily driven by stablecoin integrations and the adoption of mobile DeFi in emerging markets. Its recent market developments strengthened its presence as one of the top-performing assets of the week, reflecting the sector’s expansion across practical blockchain use cases.

Broader Crypto Market Sees Gains Across Sectors

Momentum spread beyond the leading trio, with UXLINK (+62.7%), STO (+58.4%), and Dash (+56.3%) posting notable advances. These gains were fueled by increasing demand for interoperability and cross-chain functionality, areas gaining strategic attention within the crypto market.

Source: Phoenix Group

Further growth was observed in Avalanche (AVL) and Verge (XVG), both of which rose by over 50% amid increasing liquidity inflows from top exchanges, including Binance and Bybit. The strong trading volumes reflected enhanced confidence among traders re-entering the market after a prolonged consolidation phase.

Mid-Cap Tokens Sustain the Market Recovery

Mid-tier performers, including SOON (+49.3%), AIC (+48.2%), LeverFi (+46.1%), and Aleo (+43.6%), continued the positive momentum. Network upgrades, active staking programs, and higher engagement in decentralized finance platforms supported their growth.

Completing the list, Zignaly (ZIG) and PancakeSwap (CAKE) rose 39.3% and 38.6%, respectively. Both assets demonstrated steady accumulation patterns among traders diversifying exposure across decentralized and exchange-linked assets.

The crypto market report from Phoenix Group pointed to a broad-based upswing across AI, DeFi, privacy, and Layer 2 ecosystems. The data displayed growing investor confidence and sustained capital rotation into alternative digital assets as the market heads toward the year’s final quarter.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.