The crypto market recently experienced one of its most dramatic moments since the 2022 bear market. In late September 2025, funding rates for Bitcoin and other major cryptocurrencies plunged to their lowest levels in three years. Within days, over $19 billion in leveraged positions were wiped out, and more than 1.6 million traders faced liquidations. Prices dropped sharply, leading many to believe another long bear market was on the horizon. Yet, just as quickly as the market fell, it bounced back. By early October 2025, total crypto market capitalization had climbed back above $4 trillion, showing how unpredictable and resilient this market can be.

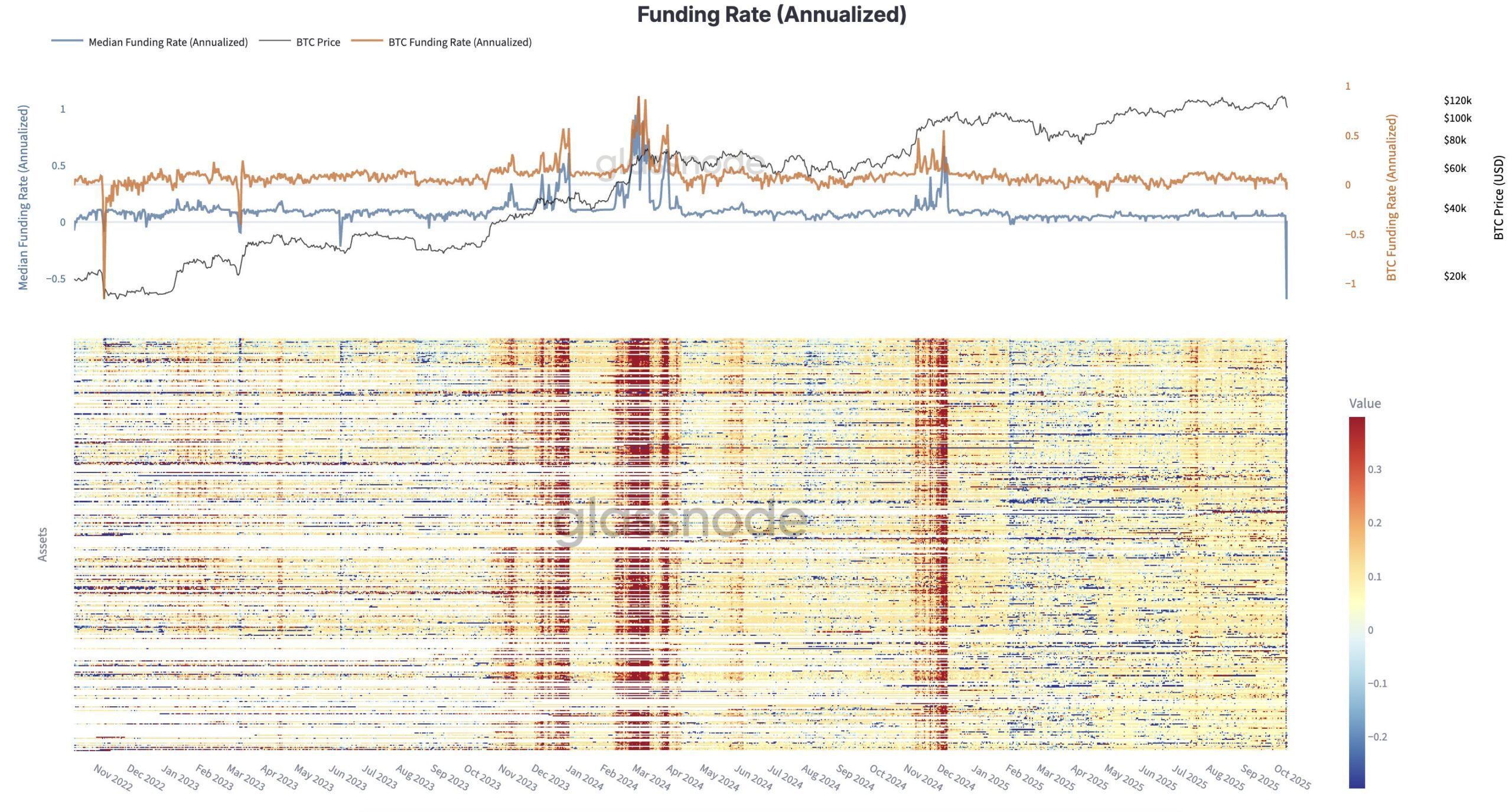

The chaos began when U.S. President Donald Trump announced new tariffs on China, triggering panic across global financial markets. Investors rushed to reduce risk, and heavily leveraged crypto traders were caught off guard. According to data from Glassnode and CoinGlass, funding rates across major exchanges fell into negative territory, meaning short sellers were paying to keep their positions open. This was a strong indication that most traders were betting on further price drops.

The result was swift, around $19 billion worth of long and short positions were liquidated in just 48 hours, wiping out months of speculative trading activity. Bitcoin briefly dropped below $105,000, and Ethereum slipped under $3,500. Some stablecoins, like Ethena USDe, even lost their dollar peg temporarily due to exchange disruptions.

However, over the following weekend, the market started to recover. Comments from Trump and Vice President JD Vance suggesting a willingness to negotiate with China reduced fears of a prolonged trade war. Confidence returned quickly, and by October 7, 2025, Bitcoin rebounded to around $115,000, with Ethereum climbing back above $4,100. Altcoins followed the trend, although most still traded below their pre-crash highs.

🚨 #Crypto Rebound Alert! 🚨 After Friday's $19B liquidation chaos, #BTC surges +3% to $115K+, #ETH & #SOL roaring back—market cap eyes $4T again! Trump's tariff threats shook us, but bulls are reloading. October's historically bullish—don't sleep on this dip buy! 💥📈 #Altseason pic.twitter.com/t5RVEW6J2t

— Jose Cordero (@JosCordero1) October 13, 2025

Funding Rates, Leverage, and Market Sentiment

To understand this turnaround, it helps to look at what funding rates and leverage mean. In crypto trading, funding rates are payments between traders that keep the price of futures contracts close to the real spot price. When funding rates go negative, it means traders are mostly shorting betting prices will fall. When they go positive, optimism is returning.

During this recent event, funding rates turned deeply negative levels not seen since the FTX collapse in 2022. Historically, such moments often mark the end of a market downtrend, as excessive leverage gets cleared out. This is why analysts called it a “leverage reset.”

Here’s a simplified view of the market indicators following the crash:

| Indicator | What It Means | Current Signal (as of Oct 2025) |

|---|---|---|

| Funding Rates | Cost of holding futures positions | Slightly negative — shows cautious optimism |

| Long/Short Ratio | Ratio of bullish vs bearish positions | 60% long / 40% short — indicates potential rebound |

| Market Cap | Total crypto valuation | $4 trillion — strong recovery from lows |

| Open Interest | Total value of futures contracts | Halved from $52B to $26B — suggests leverage reset |

| BTC Price Trend | Short-term market direction | Rebounded 10% after crash |

While such massive liquidations sound frightening, they often create healthier market conditions. Before the crash, many traders were using excessive leverage, borrowing large sums to bet on rising prices. This tends to inflate markets beyond sustainable levels. When these positions are wiped out, it removes weak hands and resets the market for more stable growth.

Experts describe this as “clearing the froth.” Hedge fund manager Richard Galvin noted that after the wipeout, crypto markets had a “surer footing,” as speculative excesses were removed. No major exchanges collapsed during the event, unlike in 2022 when the FTX failure caused widespread panic. This indicates that the overall market infrastructure has matured, with better risk management and liquidity systems in place.

The Road Ahead for Crypto is Bullish Rebound or Temporary Relief?

The big question now is whether this rebound marks the start of a new bull cycle or just a temporary recovery before another fall. On one hand, the data looks encouraging. A 54% bullish long/short ratio and a market cap recovery to $4 trillion suggest strong buying interest. If trade tensions continue to ease and Bitcoin maintains support above $110,000, analysts believe prices could push toward $150,000 by the end of 2025.

However, caution remains necessary. Global trade uncertainty, potential regulatory changes, and lingering volatility could still drag the market lower. If funding rates remain negative for too long or if another wave of leverage builds up, prices could retrace again. Some analysts warn that a failure to hold current support levels might send total crypto capitalization back to around $3.5 trillion.

Long-Term Outlook

Despite the volatility, many signs point toward growing maturity in the crypto sector. Institutional investors are more involved, infrastructure is more reliable, and regulatory clarity is slowly improving. If the market continues to expand without another major shock, a 2026 target of $6 trillion in total value is not impossible.

The events of September and October 2025 may ultimately be remembered as a pivotal reset, a painful but necessary correction that cleared out speculation and made room for sustainable growth. In short, the market fell hard but rose stronger, proving once again that in crypto, every crash carries the seed of the next comeback.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.