In mid-October 2025, ARK Invest, a company led by Cathie Wood and known for investing in fast-growing areas like electric vehicles and digital assets, bought an 11.5 percent stake in Solmate Infrastructure. This investment has caught the attention of both traditional and crypto markets, indicating a growing interest in Solana-based technology from big institutions. This stake, reported in a Schedule 13G filing, includes 6.5 million shares from a private investment in public equity (PIPE) round, plus an extra 780,000 shares bought later. This decision shows confidence in Solmate’s strategy as it aims to become a key player in infrastructure and treasury services within the Solana ecosystem.

Cathie Wood's @ARKInvest announces an 11.5% stake in Solmate.@CoinDesk reports👇https://t.co/E9Ot4YkWGh

— Solmate (@oursolmate) October 14, 2025

Solmate Infrastructure was formerly Brera Holdings, a company best known for its involvement in sports ventures. The firm has fully rebranded and shifted its focus to digital asset treasury services and Solana-related infrastructure. This pivot became more prominent after it secured $50 million worth of SOL tokens from the Solana Foundation at a 15 percent discount, signaling a long-term operational and governance partnership.

These tokens are being allocated to support bare-metal validator operations in Abu Dhabi under the “Solana By Design” initiative. The Solana Foundation will hold influence at the board level, with the option to nominate up to two directors. The initiative aims to expand Solana’s global footprint while tapping into the Gulf region’s appetite for digital asset infrastructure. Marco Santori, the CEO of Solmate, described the company’s mission as building a “new class of Solana infrastructure” in the United Arab Emirates. He characterized digital asset treasuries as “capital accumulation mechanisms,” emphasizing that validator networks can function like revenue engines rather than passive holdings. This framing aligns with the current wave of institutional crypto involvement, where treasury-backed infrastructure is viewed as a pathway to scalable growth rather than speculative accumulation.

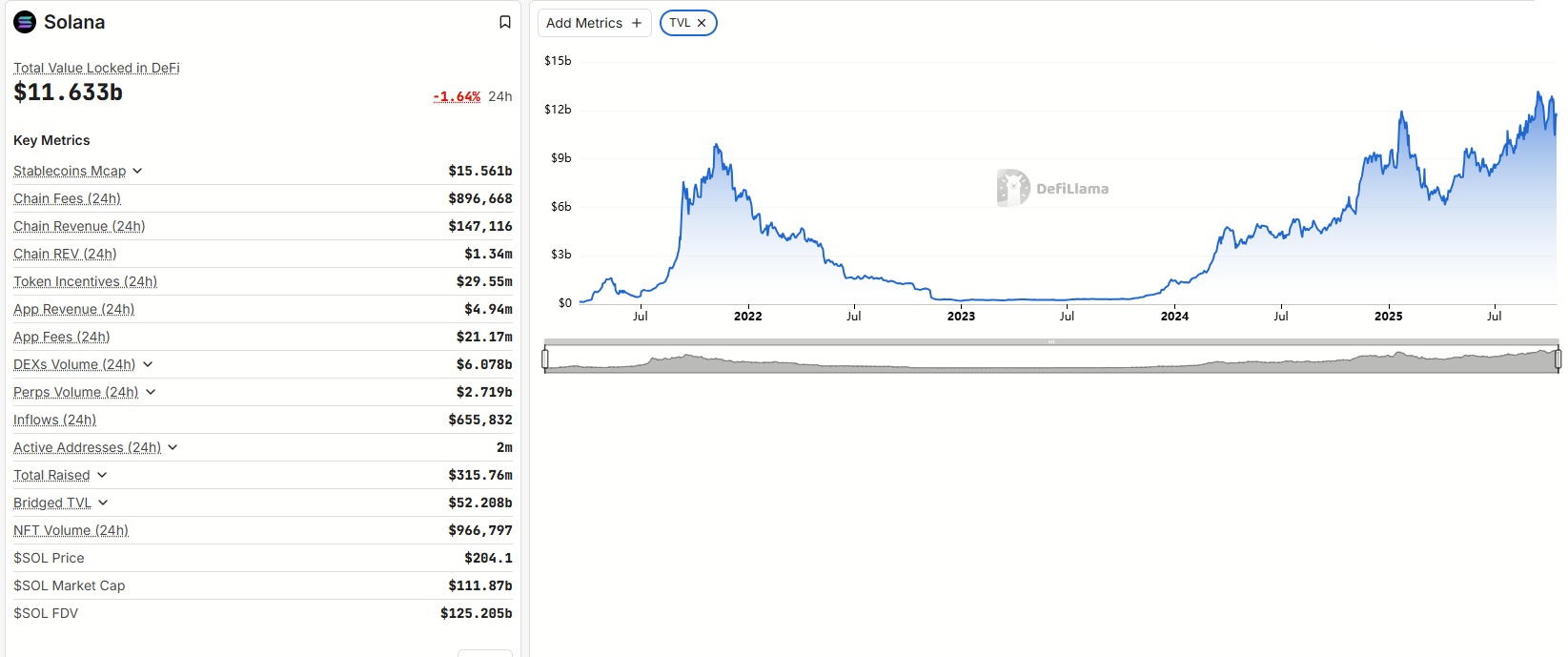

Following the news, Solana’s native token, SOL, traded around $197, with visible support at $193 and resistance near $206. The reaction was measured rather than explosive, reflecting cautious optimism rather than speculative frenzy. Solana’s broader total value locked (TVL) has surpassed $10 billion, reinforcing its relevance in decentralized finance, payments, gaming, and tokenization sectors.

ARK Invest has built a reputation for identifying early growth opportunities in disruptive technology. Its entry into a company tied closely to Solana adds institutional weight to Solana’s long-term narrative. Beyond token speculation, the investment points to treasury services, validator infrastructure, and region-specific expansions such as those in Abu Dhabi.

The move has generated mixed reactions. Supporters view ARK’s stake as a validation of Solana’s resilience and an endorsement of real-world blockchain infrastructure. They see Solmate as a bridge between enterprise capital and next-generation validator networks. The discounted token purchase and Gulf-region partnership are viewed as strong indicators of forward planning. Skeptical observers point to Solmate’s origins and question whether the transition from sports investments to blockchain infrastructure is sustainable. The change in direction, while bold, raises concerns about operational readiness and the ability to compete with established infrastructure providers.

If executed successfully, Solmate’s model could influence how other networks structure treasury operations and validator governance. The partnership with the Solana Foundation, combined with geographic expansion in Abu Dhabi, suggests a strategy that blends capital access, regulatory positioning, and future-proofing of validator resources. Solana developers and existing ecosystem participants could benefit from increased liquidity and institutional credibility. Enterprises looking toward tokenized assets and high-performance blockchains may view this as a reason to explore Solana more seriously.

Key Details at a Glance

| Area | Information |

|---|---|

| Investor | ARK Invest (led by Cathie Wood) |

| Stake Size | 11.5% of Solmate Infrastructure |

| Shares Acquired | 6.5M initial + 780K additional |

| Company Background | Formerly Brera Holdings; pivoted from sports to blockchain |

| SOL Token Deal | $50M in SOL at 15% discount via Solana Foundation |

| Infrastructure Focus | Validator operations in Abu Dhabi |

| Current SOL Price | ~$197, with support at $193 and resistance at $206 |

| Solana Ecosystem TVL | Over $10 billion |

| Board Influence | Solana Foundation may nominate up to two directors |

What Comes Next for Solana?

The future impact on Solana depends on several key factors. The validator operations in Abu Dhabi need to work efficiently, regulations have to stay stable, and Solmate must prove it can do more than just rebrand. If these elements stay strong, Solana’s infrastructure, backed by treasury support, could enhance its role in the digital economy. ARK’s recent investment suggests a growing interest from large institutions not just in tokens, but in the foundational technology that supports blockchain networks. It’s uncertain whether this will lead to Solana’s price increasing, possibly beyond $5, or if challenges could slow progress.

What’s clear is that infrastructure and treasury systems are becoming vital in the next stage of blockchain development, and Solana is positioning itself as a leader in this area.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.