- Over $653M in token unlocks could boost crypto market liquidity this week.

- SUI, GRASS, and EIGEN lead high-value unlocks, raising short-term volatility risks.

- Major assets like SOL, WLD, and TRUMP face moderate unlocks with limited supply impact.

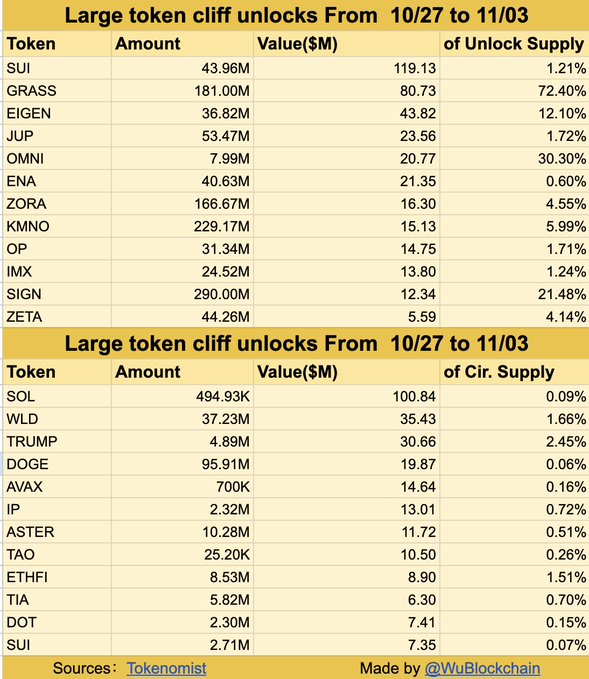

More than $653 million worth of cryptocurrencies are scheduled for release into circulation this week, as data from Tokenomist and Wu Blockchain shows that over 20 digital assets will undergo major unlocks between October 27 and November 3.

These events, commonly referred to as “cliff unlocks,” represent the expiration of vesting periods, allowing previously locked tokens to enter the market. Analysts note that such unlocks can temporarily alter supply dynamics and influence short-term volatility.

Among the largest unlocks as highlighted in our previous report, Sui (SUI) is set to release 43.96 million tokens, valued at approximately $119.13 million, making it the most substantial single event of the week. Close behind, Grass (GRASS) will see 181 million tokens unlocked, worth $80.73 million, representing 72.4% of its locked supply.

Source: X

EigenLayer (EIGEN) follows with an estimated $43.82 million in unlocked tokens, while Jupiter (JUP) is expected to release $23.56 million. Other projects in this category include Zora (ZORA) with $16.3 million, Kumo (KMNO) at $15.13 million, and Immutable X (IMX) at $13.8 million.

A separate large-scale unlock involves SIGN, which will free 290 million tokens valued at $12.34 million, equivalent to 21.48% of its circulating supply. Analysts tracking these events have suggested that smaller-cap projects with high unlock ratios may experience short-term price fluctuations due to increased token availability.

Blue-Chip Assets Record Moderate Token Unlocks

While most attention centers on emerging projects, established assets will also experience moderate unlocks during the same period. Solana (SOL) leads with $100.84 million in scheduled releases, followed by Worldcoin (WLD) at $35.43 million and TrumpCoin (TRUMP) with $30.66 million, which accounts for approximately 2.45% of its circulating supply.

Additional unlocks include Dogecoin (DOGE) at $19.87 million and Avalanche (AVAX) with $14.64 million, while Polkadot (DOT) and Celestia (TIA) remain among the lower-value releases.

Although token unlocks do not always lead to immediate price changes, the scale and supply percentage of each event often determine its effect. According to data reviewed by Tokenomist, unlocks exceeding 10% of a project’s total circulating supply, such as GRASS, EIGEN, and SIGN, may contribute to short-term market adjustments as liquidity expands.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.