Evernorth Holdings, a Ripple-backed institutional treasury company, is nearing a major landmark that is drawing the attention of both the crypto industry and traditional financial circles. With nearly $1 billion in XRP held in its reserves, Evernorth is positioning itself as one of the largest institutional holders of the asset. The rapid accumulation is reinforcing the view that XRP is gaining renewed relevance in institutional strategies, especially after years of regulatory uncertainty.

This development is more than a headline figure. It signals that large investors are beginning to treat XRP as a long-term digital financial tool rather than a speculative token. The trend points toward a broader shift in how institutions approach blockchain assets, prioritizing compliance, stability, and yield-driven opportunities.

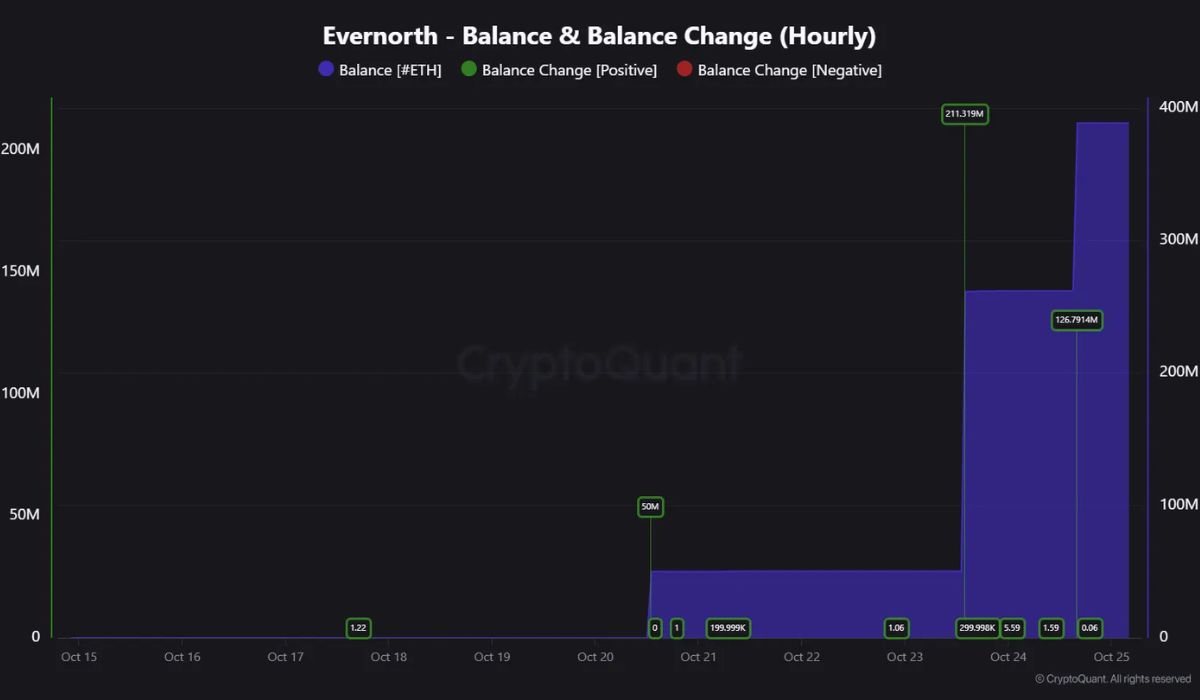

Data shared by Cryptoquant on October 27 reveals that Evernorth now holds 388,710,606 XRP, valued at approximately $993.6 million. This represents 95% of its target goal as the company works toward surpassing the full $1 billion mark. The pace of accumulation has been striking, supported by over $947 million in purchases and more than $46 million in unrealized profits generated within only a few days.

The company’s average purchase price sits around $2.44, which analysts believe may become an important price level for future XRP market behavior. With this strategy, Evernorth is treating XRP as a key asset within its institutional treasury model, not merely as a trading instrument.

🔥 Armada Acquisition Corp II is merging with Evernorth Holdings to create a $1B institutional XRP treasury — giving investors regulated, liquid XRP exposure.

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) October 29, 2025

💸 Ticker changes to $XRPN on NASDAQ Oct 30.

Evernorth’s mission: accumulate and grow XRP per share through… pic.twitter.com/ma51vbEoO0

Evernorth’s ambitions extend far beyond accumulating tokens. On October 20, the company announced plans to go public through a merger with Armada Acquisition Corp II. Once completed, the combined entity will trade on Nasdaq under the ticker XRPN, forming what is expected to be the largest institutional XRP treasury in the market. Proceeds from the public listing will be funneled into further XRP acquisitions and yield-focused strategies, including liquidity provisioning and DeFi-based opportunities. Unlike passive exchange-traded funds that simply track price movements, Evernorth aims to increase the amount of XRP per share through active management.

Ripple’s leadership has expressed strong support for the project. Executives such as Brad Garlinghouse, Chris Larsen, and Asheesh Birla have described Evernorth as a unique institutional pathway designed to expand XRP’s real-world use. Backing from SBI Holdings, Pantera Capital, Kraken, GSR, and Rippleworks has added further credibility to the initiative. Ripple CTO David Schwartz emphasized that Evernorth was created as a regulated and scalable structure capable of exploring XRP-based opportunities across capital markets and decentralized finance.

Evernorth’s growth reflects a wider movement toward regulated and professionally managed digital asset treasuries. Many institutions prefer this approach over self-custody because it reduces operational risk. The ability to earn predictable yields, access compliant lending markets, and use XRP in liquidity operations offers an added advantage. The rising demand also suggests growing confidence in XRP’s stability following earlier regulatory challenges. A well-capitalized treasury vehicle, supported by Ripple and established market participants, communicates a sense of maturity that appeals to risk-conscious investors.

At the same time, the scale of Evernorth’s involvement may influence wider market trends. Institutions often watch early movers closely, especially those that combine regulatory approval with advanced treasury management strategies. If Evernorth’s approach proves effective, it could lead to greater interest in institutional XRP products, similar to how early Bitcoin custodians reshaped the market.

Future Expectations from XRP

The approach toward the $1 billion milestone is shaping discussions about XRP’s future role in digital finance. Increased institutional participation can strengthen liquidity, improve market depth, and establish more predictable demand. For everyday users, this can translate into reduced volatility and greater confidence in the asset’s long-term outlook.

As Evernorth moves closer to its goal, the company may become a central player in shaping the next phase of XRP’s institutional adoption. Whether this marks the foundation of long-term stability or introduces new risks will depend on performance, regulatory clarity, and the broader digital asset environment. What is clear is that Evernorth’s rise reflects growing institutional belief in XRP’s role in the future of on-chain finance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.